Cresco FX, the Malta-based brokerage regulated as Cresco Capital Markets (Malta)Ltd with the Maltese Financial Supervisory Authority (MFSA) as a category II dealer, has today shared exclusively with Forex Magnates its planned announcement of a synergy with Hotspot FX which it added on its MetaTrader 4 (MT4) ) licensed platform.

The firms clients will now be able to access Hotspot, via MT4, with Cresco FX matching client's trades as an agency, based on its regulator license in Malta.

The line separating retail and institutional trade sizes has become blurred in recent years, with larger traders - at times - taking smaller size trades, and small traders taking larger positions, due in part to the use of algorithms, leverage, a higher frequency of trading, and the emergence of intra-day traders - along the more traditional buy-and-hold longer term investors.

Forex Magnates asked Derek Mayne, Managing Director of Cresco FX: What drove you to choose to integrate Hotspot into MT4, and please elaborate on how you think this could help your clients and Cresco overall?

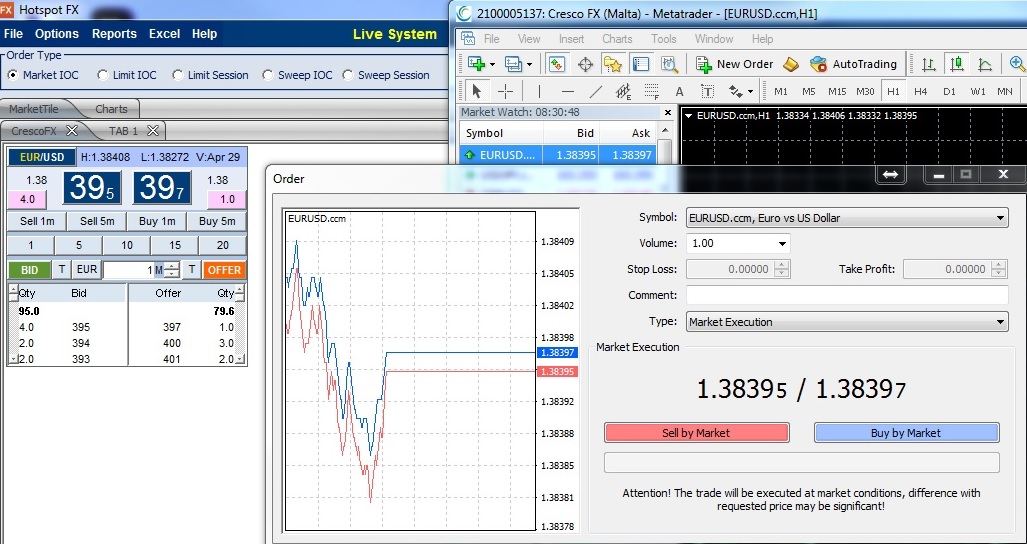

“We have several clients that were trading institutional size orders over MT4 so it seemed like a natural progression. Prospective clients always ask about price and are looking for low spreads but only some ask about the size of the inside band which is really what affects their fills. We expect this to improve the trading results for our clients which will in turn lower their cost of trading and increase their overall returns,” replied Mr. Mayne during the exclusive interview, and who later provided the following screenshot displaying the addition:

Screen Shot of MT4 Platform from Cresco with Hotspot Pricing [Source: Cresco FX]

Hotspot FX on MetaTrader4

MetaTrader4 is a staple platform for many retail fx brokerages and retail traders, although less so in the institutional space where proprietary software can be developed in-house, or the technology is non-application specific.

However, MT4 has been gaining recognition as money managers have used its multi-account-manager capabilities to manage funds of multiple investors simultaneously even if they are not per say institutional money managers, their transaction sizes would certainly approach institutional levels.

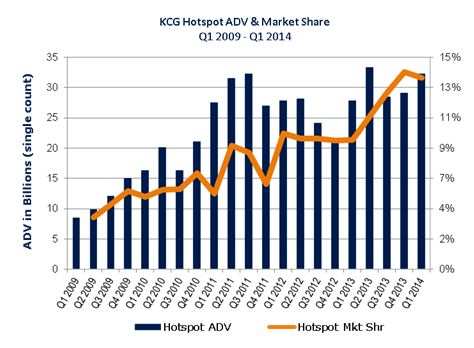

At the same time HotspotFx, part of KCG Americas, is a major ECN platform venue that executes trillions of dollars worth of Foreign Exchange transactions per year, alongside other major single-dealer and multi-bank platforms and inter-dealer brokers, by aggregating Liquidity from underlying interbank dealers, and pooling it within its ECN structure for execution.

Prime Brokerage, and Prime of Prime (PoP) Re-sellers

Typically, since anyone looking trade with Hotspot would need a Prime Broker (PB), the process to obtain a PB for a normal retail size trader would be close to impossible, unless a Prime of Prime Broker (PoPB) re-seller was able to facilitate its PB relationship on the traders behalf.

While this process could be cumbersome, and requires receiving an appropriate ID, and become part of a collaterilized group that is able to trade at platform like Hotspots', what Cresco has done by adding Hotspot to MT4, is that it removes that step as clients open with Cresco directly and it matches their trades with Hotspot on the back-end.

Source: HotSpot

Mr. Mayne explained to Forex Magnates reporters that Cresco can offer a tailored solution to its clients, with either last-look (which could provide better prices but potentially fleeting rates) as well as no-last-look, which could ensure the trade gets executed although less ticks could occur as they would need to be executable. The firm is focused on catering to professional clients, and ECPs, although its licenses allows it to accept retail clients as well, although its pricing structure is most competitive when traders reach higher volume levels to obtain the largest commission break.

Prime XM Bridge and Outsourced Solutions Powering White Labels

In addition, the bridge provider for Cresco FX that helped connect Hotspot to its MT4 platform was Prime XM, and as part of its agreements with certain vendors, such as Prime XM, Cresco can resell their solutions as its own, and has already secured several white-label clients that are already on board, according to Mr. Mayne.

Cresco FX will continue to put forth best efforts in order to satisfy our customers. We are currently developing products and services that will serve clients from retail right through to large institutions.

During the conversation the subject of sales and marketing came to mind, with regards to how the business growth has been driven, and it appears that the company is mostly following a traditional approach to sales with word-of-mouth referrals, and phone and in-person meetings, as opposed to online advertising and internet marketing or mass emailing.

Mr. Mayne concluded with regards to where it's focus in terms of target audience, "Cresco FX will continue to put forth best efforts in order to satisfy our customers. We are currently developing products and services that will serve clients from retail right through to large institutions. "

Forex Magnates also asked Cresco FX: As a boutique brokerage and re-seller of certain services, such as PB or LP solutions, how has the white-labeling side of your operations performed, and do you expect that will be complemented with this latest addition?

The firms COO Peter Laursen responded to Forex Magnates, "We expect this to boost our WL operations as we've streamlined access to Hotspot liquidity. Our existing and future WL partners will have access to this with low barriers to entry."