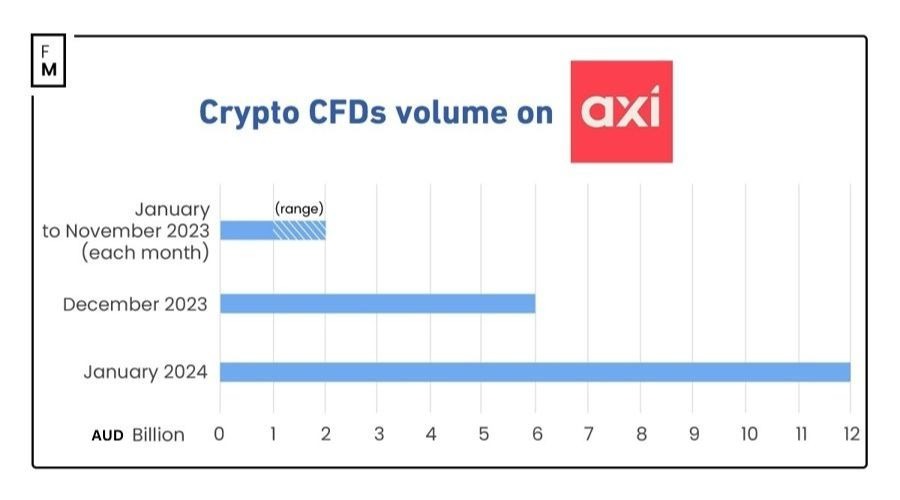

The demand for cryptocurrencies among active traders is soaring , with crypto contracts for differences (CFDs) at the retail broker Axi nearly doubling to reach almost AU$12 billion in January, according to information obtained by Finance Magnates. The brokerage processed about 70,000 crypto trades every week.

Throughout most of 2023, Axi handled crypto volumes ranging between AU$1 billion and AU$2 billion. However, last December the volumes surged dramatically to rise up to AU$6 billion.

ETF Effect?

The rise in crypto volumes on Axi echoed the sentiment towards the anticipation and thereafter, the approval of spot Bitcoin exchange-traded funds (ETFs) in the US.

The price of Bitcoin remained highly volatile in the last couple of months. Before the approval of 11 spot Bitcoin ETFs by the US regulator, the fiat value of the cryptocurrency touched US$48,000. However, that rally could have been more sustainable, as the Bitcoin price dropped shortly after the official approval of the ETFs.

The initial net inflows into Bitcoin ETFs fell short of many analysts' expectations. On top of that, Grayscale’s Bitcoin ETF, which was converted from a closed fund, experienced a massive outflow. However, gradually, investors began showing interest in these instruments, as evidenced by the inflows into these ETFs.

The Rising Demand for Crypto CFDs

The Australia-headquartered broker exclusively offers crypto CFDs featuring “30 of the most popular cryptocurrencies,” including Bitcoin, Ethereum, Litecoin, Ripple, and Bitcoin Cash. These are derivative instruments that allow traders to take either long or short positions with the underlying digital assets.

Axi provides crypto CFDs under two of its entities, one regulated in Australia and the other incorporated and authorized by the regulator in St Vincent and the Grenadines. While the Aussie broker offers leverage of up to 2:1 to its clients, the offshore unit offers significantly higher leverage, reaching up to 200:1 leverage, as seen on the Axi website. The low leverage under the Australian unit is a result of limitations introduced by the country’s financial services regulator in 2021.

The UK-regulated arm of Axi does not offer cryptocurrency CFDs, as regulated brokers in the UK are prohibited from offering such leveraged crypto instruments to retail traders. Axi also holds licenses in New Zealand and Dubai.

Only a Fraction of Crypto Traders Trade CFDs

Although the demand for crypto CFDs on Axi has doubled month-over-month, this figure remains a fraction when compared to the trading volumes on dedicated crypto spot and derivative exchanges. For instance, Binance processed US$39.8 billion in crypto derivatives and $14.3 billion in spot volumes in the last 24 hours. Within the same one-day period, Bybit and OKX also managed US$13.6 billion and US$15.4 billion in crypto derivatives, respectively.

While several retail brokers offer cryptocurrency CFDs in various jurisdictions, only a few disclose volumes and other metrics associated with these instruments. Last October, the offshore broker Titan FX revealed it handled US$2 billion in crypto CFDs volume in a single day.

Saxo Bank, headquartered in Denmark, began offering crypto CFDs in 2021 in certain Asia-Pacific countries and generated US$2.5 billion in turnover from digital assets in the first six months. However, the Danish broker did not publicly update those numbers further.