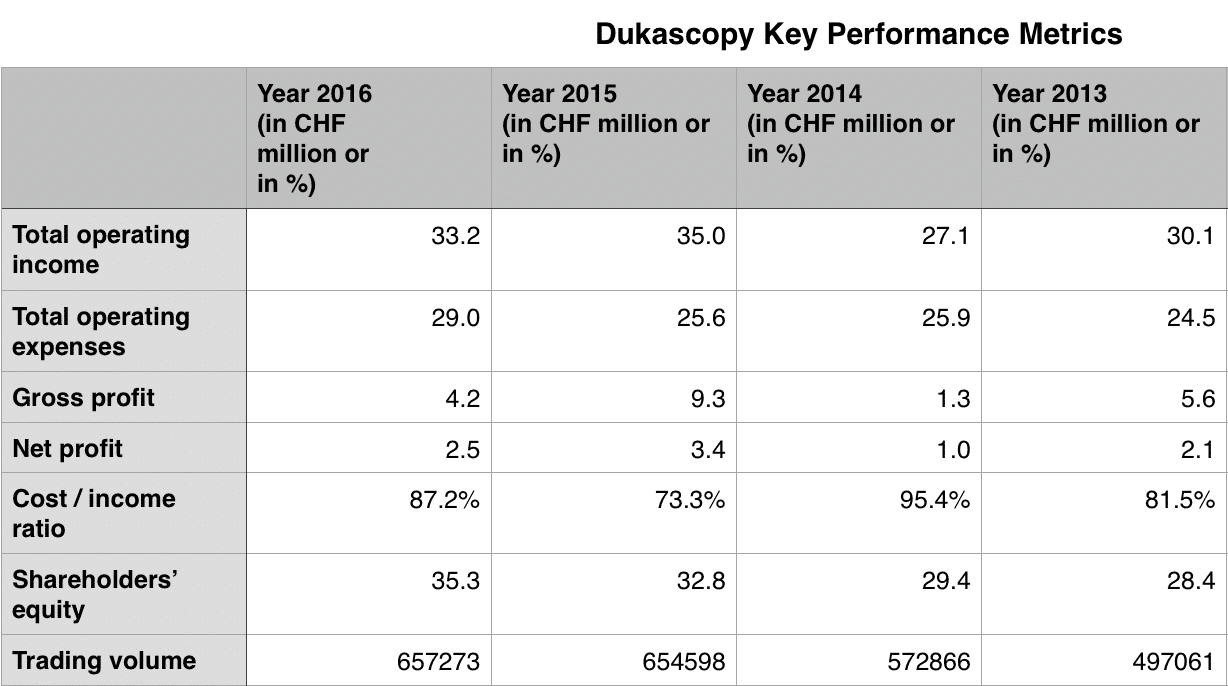

Swiss bank Dukascopy which is one of the top Forex and CFDs brokers in the country, shared the company’s unaudited results for 2016 with Finance Magnates. The posts a new record for trading volumes and marks the second best year for operating income after 2015.

[gptAdvertisement]

Dukascopy’s total operating income for last year amounted to CHF 33.2 million ($33.4 million at current exchange rates). The figure is 5 percent lower when compared to 2015, when the company reported a massive spike in revenues and profits in the aftermath of the SNB crisis.

Dukascopy key 2016 metrics, unaudited. Source: Dukascopy Bank

The Swiss bank also reports an increase in trading volumes, reaching a record of CHF 657.3 billion for the full year. The number is only marginally higher when compared to 2015. The relatively calm FX markets throughout the year were only disturbed by short outbursts of Volatility around key risk events.

Rising Costs Due to Increased Investment

Dukascopy’s operating expenses increased 13 percent to CHF 29 million ($29.2 million) throughout the year. The rise in costs negatively affected the company’s bottom line. The firm’s net profit for 2016 decreased by 26 percent to CHF 2.5 million ($2.5 million), as gross profits declined 54 percent to CHF 4.2 million ($4.2 million).

The company’s CFO, Laurent Bellieres, elaborated on the results in a comment to Finance Magnates: “The increase in operating expenses has negatively affected net profits but was an important investment for the future. Currently, Dukascopy Bank massively extends its range of financial instruments, specifically by adding a large number of CFDs on blue chips across major markets.”

“Also, Dukascopy Bank made its proprietary messenger "Dukascopy Connect" a back-bone for instant and very low cost retail banking. Dukascopy Connect allows identifying clients within minutes via video, providing support via chat, doing instant and free of charge transfers via smartphones. Our Bank will continue to extend its online retail banking services and will make Dukascopy Connect available to financial institutions as a freeware,” Bellieres explains.