One of the biggest Swiss brokerages catering to foreign exchange and CFDs traders, Dukascopy Bank, has shared exclusively with Finance Magnates its unaudited full year results for 2015. Being one of the heavyweight players in the industry, Dukascopy Bank has announced a year of record profits.

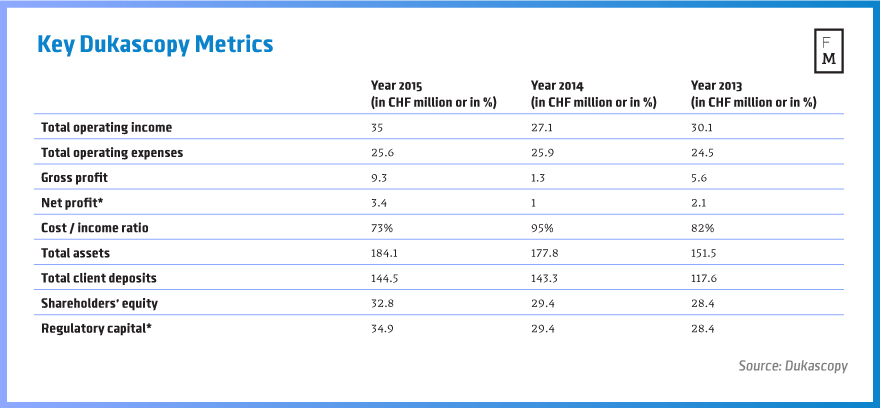

The company’s total operating income for the year was CHF 35 million ($35.9 million), which is higher by 29 per cent when compared to 2014, when the company experienced a decline in revenues. Reversing the trend was a success for the relatively new management of the company after a corporate restructuring that took place in the middle of 2014 that saw Veronica Duka become the new CEO of Dukascopy Bank.

For the full year, the brokerage registered an average monthly trading volume of $55.8 billion per month.

Despite much lower FX Volatility , growth continued at a steady pace in the second half of the year. As Finance Magnates previously reported, the company has recorded a total operating income of CHF 16.6 million (US$17.0 million) for the first half of 2015.

Dukascopy full year results for the past three years, figures for 2015 are unaudited, Source: Dukascopy Bank

Looking ahead to 2016, and considering the company’s new Japanese business which the firm acquired from Alpari UK, Dukascopy Bank’s revenues could grow further this calendar year, especially if the massive volatility in the Japanese yen FX pairs persists.

While the broker’s income continued growing, the total operating expenses at Dukascopy have been successfully contained with the company actually cutting the amount when compared to 2014 to CHF25.6 million ($26 million), or lower by 1 per cent.

Looking at the bottom line, the results are nothing short of impressive as the profitability of the company has risen over 6 times when compared to the previous year to a record high of CHF 9.3 million ($9.5 million).

The company’s net profit was CHF 3.4 million ($3.5 million), after an adjustment for additional reserves, which Dukascopy Bank has put aside for a rainy day. The brokerage has boosted its “Reserves for General Banking Risks” with CHF 2.8 million, CHF 2.1 million of which will reinforce its capital base. Without the adjustment, the net profit for 2015 would have reached CHF 5.5 million ($5.6 million).

The firm’s cost to income ratio has dropped to 73.3 per cent in 2015, which compared to 95.4 per cent for 2014. The company’s total assets are now worth CHF184.1 million ($188.5 million), which is an increase of 3.5 per cent.

Curiously, total client deposits were little changed at CHF 144.5 million ($148 million) with the increase being fairly marginal when compared to 2014, coming in at less than 1 per cent. Looking at the figures, the increased revenues of Dukascopy could be partly explained with the higher margin that brokerages make on CFDs products, a product to the development of which Dukascopy has dedicated a lot of resources since 2014.

The shareholders’ equity was CHF 32.8 million, compared to CHF 29.4 million in 2014, an increase of 11.5 per cent. After the additional reserves committed to Dukascopy’s “Reserves for General Banking Risks”, the company’s regulatory capital has been boosted by about 18 per cent, to CHF 34.9 million.

Looking at the volatility in the European financial system, the move has proven to be more than prudent, as Deutsche Bank jitters have spread across the financial sector of the euro area.

Dukascopy will very soon start providing, instant payment services through smartphones

Commenting on the results, the CFO of Dukascopy Bank Laurent Bellieres stated: “Last year has been the best year ever in Dukascopy Bank’s history. It has also been exceptional because of the setting up of Dukascopy Japan in Tokyo after the acquisition of Alpari Japan.”

Further elaborating on the company’s new endeavors, Bellieres explained: “Our European subsidiary, Dukascopy Payments has obtained a Transfer and E-Money license and will very soon start providing instant payment services through smartphones. Dukascopy Group is therefore well positioned to pursue its expansion in terms of products and international presence.”

Bellieres stated to Finance Magnates that the services of Dukascopy Payments are currently being tested in live mode internally by the employees of Dukascopy Bank.