Exness, a multi-asset brokerage, has exclusively shared its trading volume numbers for 2020 with Finance Magnates, showing solid growth in the demand for its services.

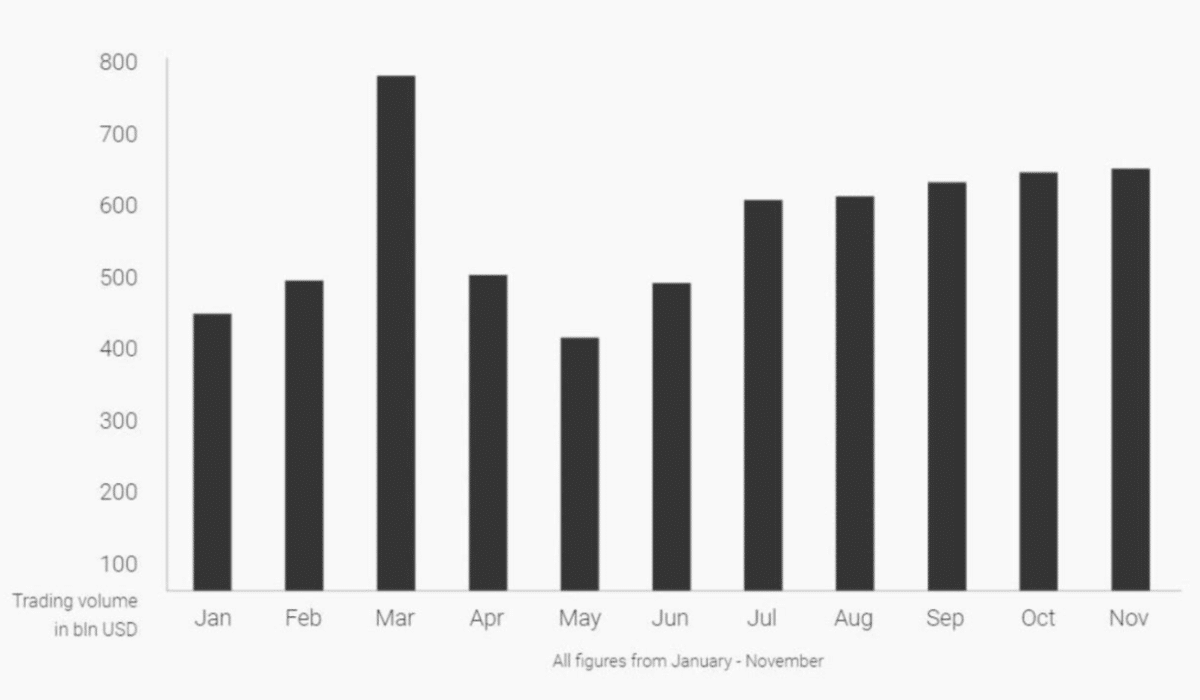

In the first 11 months of this year, the total trading volume on the platform came in at $6,110.8 billion, setting a record for itself.

The company pointed out the increasing demand in the trading market during the market volatility induced by the economic lockdown to curb Coronavirus and gained heavily from that. Indeed, the trading volume on Exness hit $785 billion in March, setting a monthly record.

“[Exness] was able to capitalize on the volatile market situation and saw its highest-ever trading volumes,” the company stated.

Headquartered in Cyprus, Exness has operations across the globe and provides services to both retail and professional clients. It offers trading services with Forex pairs, stocks and indices, CFDs, Cryptocurrencies , and also commodities.

Additionally, it has added new financial instruments to its offerings, including the popular stocks of Tesla, Amazon, Apple and Netflix.

The Pandemic Turned out to Be Positive for Brokers

The excellent growth in the trading volumes was pushed by increasing client activities. The number of active traders on Exness doubled this year to 143,560, compared to 2019’s figure of 72,721.

Moreover, the brokerage detailed that it closed at 315,585,372 orders so far this year, and handled withdrawals of $593 million and $100 million from clients and partners, respectively.

Apart from the booming business, Exness pledged €1 million as a part of its corporate social responsibilities to fight COVID-19. Furthermore, it dominated another $1.5 million to pandemic relief in developing countries.

“Taking a look behind the scenes and not just on a client level, Exness also responded to the pandemic by finding the right solutions to create a work from home model that would support its employees and guarantee uninterrupted performance during the crisis,” the broker added.