2013 annual reports have been filed for both FxPro and eToro’s UK units. Those expecting to view in-depth analysis of the broker’s 2013 results will be a bit disappointed as the reports are specific to eToro and FxPro’s UK corporations, which are subsidiaries to the global group located in Cyprus. But, with both firms shifting their focus on increasing their UK presence, the 2013 annual reports as well as 2014 updates included by the broker do shed light on what may be ready to take place in the future.

eToro – Foundation Building

With eToro, the current filed report is less about 2013 and more about 2014. In fact, during 2013, the broker reported no revenues in its UK unit as it had no sales operations, but was only involved with building the foundation of the London-based office. What the company did do was receive authorization in May 2013 from the FCA, and appoint a UK-based director, Paul Chrimes, earlier this year.

Funding the creation of the unit has been the issuance of shares to the parent eToro Group Limited, which netted the UK office $1M in 2013, and another $1.7M in three separate sales during 2014. eToro UK ended 2013 with about $830,000 in cash and after the 2014 infusion, as well as taking into account expenses, is estimated to be holding over $2M in cash, of which around $700,000 is Tier 1 Capital to meet minimum regulatory capital requirements from the FCA.

Forex Magnates has reported several times that among privately held brokers, eToro is near the top of the list as firms expected to pursue an IPO. While the company won’t comment directly about their IPO plans, sources have disclosed to Forex Magnates that eToro has been holding meetings with underwriters and consultants about the process. Also pointing to a possible IPO is that as a venture funded firm, the company has reached the point in its lifecycle that investors typically will be pressing for a Liquidity event.

In terms of holding them back, our opinion is that eToro may be waiting for final approvals from the FCA in regards to classifying their social trading operations, if further asset management licensees are required to meet the regulator’s classification of copy trading. In this regard it is worth pointing out that despite becoming authorized from the FCA in May of last year, they have still yet to launch their UK brokering and client onboarding operations. As a result, the UK unit continues to be financed by its parent group through the issuance of new shares.

FxPro – Small but Growing UK Operations

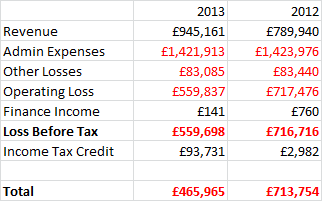

In comparison to their global operations, FxPro’s UK unit ended 2013 with strong volume growth, but it was still only a drop in the bucket of their overall trading activity. Revenue grew 20% to £945,161 on total volumes traded on $49B, 206% above the same period in 2012. According to FxPro, the 206% volume growth only translated to a 20% top line revenue increase due to what they called “revenue from recharge of expenses was terminated in 2012." Without the recharge of commissions, revenues would have risen approximately 77%. The revenue numbers point to the UK unit collecting around $65 per million traded, with the rest realized by the global unit.

On the bottom line, FxPro UK experienced a £465,965 loss compared to a loss of £713,754 in 2012. The smaller loss was due to keeping administrative expenses in-line at just above £1.4M but realizing an increase in revenues.

FxPro UK 2012 and 2013 Financials

Unlike eToro, FxPro didn’t provide any additional updates for 2014. What we do know is that FxPro UK is the default portal for much of their European marketing. However, like eToro, FxPro’s copy trading product, SuperTrader, isn’t available to customers onboarded with the FCA UK unit.