Earlier this morning, the UK’s Financial Conduct Authority, which is the chief financial regulator of foreign exchange and contracts for difference (CFDs) brokerages and spread betting providers in the country, issued a consolation paper to companies from the industry.

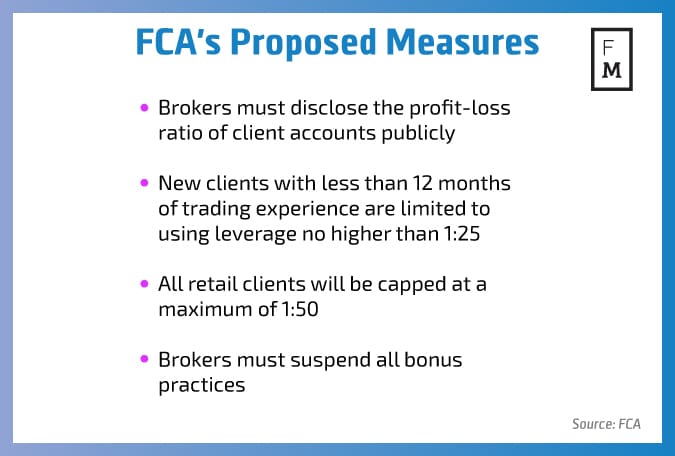

The watchdog outlined some proposed changes to the regulatory framework that governs the conduct of rolling spot forex, CFDs and spread betting providers. The FCA has given companies from the industry until the 7th of March 2017 to submit their comments to the regulator on the proposed changes that are aiming to better protect retail traders.

Amongst those, there is a proposed leverage cap at 1:50, mandatory reporting of the percentage of profitable traders, and last but not least, the introduction of a binary options regulatory framework by the financial regulator.

A number of publicly traded companies have been affected by the regulator’s move with CMC Markets, IG Group and Plus500 being the most affected in today’s trade on the London Stock Exchange.

Industry Response

CMC Markets has issued an official announcement highlighting that the company shares a common desire with the FCA “to see a uniform application of the highest standards of conduct across the industry”.

With the UK regulator identifying substantial risks to inexperienced retail investors, where the FCA is mandating a cap on leverage at 1:25, the continuation of a business model that relies on a high churn of clients with a high loss rate us unsustainable.

“CMC has consistently focused on higher-value experienced premium clients who understand the markets and products they are trading. Furthermore, an integral part of CMC’s “client first” proposition over the last five years is ongoing client education about markets, products and associated risks. CMC’s business model and ongoing strategy is focused on generating revenue from client trading costs and therefore believes in establishing long-term client relationships,” the company elaborated in its statement.

I am not sure this is really a Black Swan event , but maybe a dark grey one!

Tom Higgins, CEO, Gold-i

Gold-i’s CEO Tom Higgins doesn’t seem surprised by the announcement: “This is something I have predicted for a while and it all started with the culling of Binary Options, which are the ultimate example of selling highly risky products to people who do not know what they are doing. Highly leveraged FX & CFDs with bonus upon bonus is a very similar offering. It encourages clients to trade more and more and is much more akin to a casino or a Ponzi scheme than trading a financial product.”

“I think this is good for the industry as a whole as the ultimate customer must always be looked after. They are not usually professionals and need education and controls to stop them “blowing up” in a matter of weeks,” Mr Higgins elaborated.

He continued: “This does mean that the B-book only broker with massive leverages and 1000’s of clients that churn weekly will either die or evolve into something better. Luckily there are technology providers like Gold-i who already have all the technology they need to make this leap into a risk-managed and controlled world. I am not sure this is really a black swan event , but maybe a dark grey one!”

IG Group stated in an official communique via the London Stock Exchange that a robust and proportionate regulatory oversight of the CFD sector in the UK and Europe is supported by the firm.

The company’s statement also notes that “the FCA’s proposals do not appear to directly apply to firms operating from outside the UK offering CFDs and binaries to clients in the UK on a cross-border services passport from another EU member state.”

Ron Finberg, Cappitech

Cappitech’s Business Development Manager Ron Finberg commented with an optimistic note: “I believe that the Forex/CFDs industry will be able to adjust to the leverage restrictions. Both the US and Japan have long had leverage restrictions and individual traders are among the most active in the world.”

“More than bonuses and margin, a bigger blow would be an increase of minimum capital requirements. In terms of the US, it’s the $20 million minimum that drove out the brokers and destroyed the market. On a side note, I find it interesting that the FCA also mentioned that it was in the process of evaluating financial regulation for binary options,” Mr Finberg stated.

Plus500’s shares tanked the most in the aftermath of the London Stock Exchange open, as the firm highlighted in an official announcement that it expects material operational and financial impact on the UK regulated subsidiary of the firm, which represents approximately 20% of the group’s revenues.

Ramy Soliman, CEO of Stater Global Markets

The CEO of Stater Global Markets, Ramy Soliman, thinks that the FCA is doing the right thing.

“The larger well capitalized players that operate prudent business models with strong Risk Management and good education programs will be adversely affected in the short term but in the longer term these firms will ultimately increase their market share in a more consolidated space. For the smaller retail firms that warehouse client risk, a natural consequence may be more externalization of their flows as they may not have enough capital or the correct business model to both market to new clients and manage risk books,” he said.

Soliman also highlighted that if Japan is any indication, reduced leverage doesn’t necessarily mean reduced volumes but it does mean a reduced number of well capitalised, well run participants to service an increasingly sophisticated retail client base.

ThinkMarkets’s CEO Nauman Anees elaborated: “We welcome the FCA's initiative to strengthen its oversight and supervision of the CFD market, we trust their skill, expertise and insight will bring a meaningful and useful decision for the wider market.”