Saxo Bank has announced that it is launching a brand new order execution model for its clients that are trading foreign exchange and contracts for difference (CFDs). The changes are to affect a multitude of offerings that the Danish multi-asset brokerage is delivering to its clients, including FX Spot, FX Forwards and CFDs on Indices and CFDs on Futures.

The new order driven model is allowing clients of the bank to fully customize their orders to better achieve their goals – whether those include strict adhering to pricing or to volumes of the transaction. The order driven model is undergoing a testing phase by Saxo’s team and will be live later this year in November.

With the change in order execution method, clients will get a chance for price improvement on every single trade

Clients will be delivered pricing based on Saxo’s own Liquidity if they so choose or additional liquidity available on a Direct Market Access (DMA) basis in the broader market via bank and non-bank liquidity providers as well as ECNs.

Kurt vom Scheidt, Global Head of Foreign Exchange of Saxo Bank

Saxo Bank’s order driven model is at the center of the Danish multi-asset brokerage’s commitment to deliver best execution to its customers. To elaborate on the details of the offering and the enhancements to clients’ ability to control their trading orders, Finance Magnates has exclusively spoken with the Global Head of Foreign Exchange of Saxo Bank, Kurt vom Scheidt.

What has been the main reasoning for the changes to an order driven model?

The change in the order execution method comes in context of previous and future steps on our journey to provide better service to, and to help foster better profitability of, our clients. During Brexit we were one of the first companies that increased margin requirements for our clients, a move that netted them over €200 million in profits. Earlier this year, we also made sure that stop orders to sell were triggered not on the bid price, but rather on the offer.

It is normal for spreads to widen, even without the mid-price moving significantly, every day at the end of the NY trading day as well as around daily economic announcements. With the lack of a single traded reference point in OTC spot FX, as it exists in many listed product markets, we don’t think that clients should be stopped out prematurely just because the bid price moves down and the offer price moves higher. Saxo Bank has no incentive to stop out its clients; our objective is to facilitate their trading in ways our clients are profitable, so our interests are aligned with theirs. If they are making money, then they are more likely to be clients of ours for the long-term and active in many products to diversify their portfolio risk.

What are the specific changes that are going to be introduced?

We are going to be publishing a more transparent order handling procedure, allowing clients to better understand specifics like differences in bid/offer trigger and execution price levels. We will be packaging all this into our global rollout in November.

With the change in order execution method, clients will get a chance for price improvement on every single trade that they make thanks to the new order-centric system. Market orders will be filled at the price upon receipt, whilst limit orders will be filled at prices no worse than the maximum tolerance specified on each order by each individual client.

If for some unexpected latency reason an order comes back to us later than it is supposed to, we are going to give the client a fair fill and we will publish more execution stats beyond our quarterly Historic Stop-Order Fill statistics so everyone has visibility. Heightening trust amongst FX market participants is key to its long term sustainability and growth. From large banks that are getting substantial fines, to some brokers in the industry, we have unfortunately seen some issues over the past years that need to be addressed professionally, and Saxo Bank takes it’s role in the overall process of market reform very seriously and feels responsible to lead by example.

How are clients going to be able to fully control their orders?

Being able to give clients the benefit of price improvement on every trade is something that we are very proud of, along with giving clients total control and enhanced flexibility with their orders. Traders can choose what is more important to them on each transaction – getting a specified price level or getting increased certainty of a full amount fill. We believe this choice should lie in the hands of each client since we recognize that all clients are not equal, nor are the needs of any one client always constant over time.

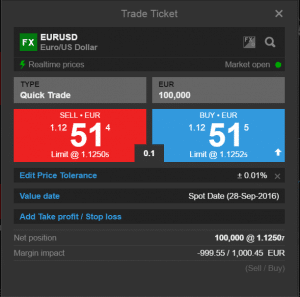

New Order Trade Ticket with Price Tolerance enabled, Source: Saxo Bank

Alongside existing resting orders, there will be two methods of quick trade for FX spot and forwards – market order and limit order, both of which will have a duration of IOC (Immediate or Cancel) that will give the client a fill at the best possible rate upon the receipt of the order within the maximum tolerance that is specified. If Saxo has insufficient liquidity ourselves for clients that have chosen Saxo liquidity, the order will be routed to market automatically, also to be filled as an IOC. We have connections to numerous banks and non-banks as well as connections to all the primary and secondary ECNs – EBS, Reuters, Hotspot, Currenex, etc. Since the ECNs operate using limit orders, we felt that shifting from quote driven to order driven execution is the right direction to go as that allows Saxo Bank to meet our goal of broadening the liquidity that our clients have real-time access to.

If the tolerance level is surpassed an order will not be filled in its entirety, but may be filled partially if possible. Partial fills on foreign exchange orders is something that Saxo Bank hasn’t done in the past. Partial fills really demonstrate their value to clients in situations where a client has a take profit limit order placed. For example, on a TP to buy, rather than needing to wait for the market price to be offered at that level in the full amount of the order, Saxo will now automatically and iteratively fill those limit orders in partial amounts, which can occur sooner, given that spreads are always wider in larger notional sizes than in smaller, which will help clients realize their gains before a “V” shaped market formation would otherwise decrease their unrealized P&L.