Ranked #30 on the 2012 Fortune 500 list of the largest U.S. Corporations, and a leader in financial services segments internationally, INTL FCStone Inc. has identified errors in the reconciliation of its subsidiary INTL FCStone Markets, LLC's accounting records to its back office system. This was according to a company press release and recent regulatory filings made by the company yesterday, as it anticipates these errors will cause it to file its annual report for 2013 potentially late in advance of the December 31,2013 deadline.

Forex Magnates reached out to numerous offices and divisions within the corporate structure and spoke with several key staff who refused to comment on the matter, as the internal audits underway are ongoing in order to help reconcile and determine the extent of any further effects, but was eventually able to speak to the company's CEO during an exclusive call.

During the phone interview in an effort to help set the records straight concerning the recent dive in its stock price, INTL FCStone Inc. CEO, Sean M. O'Connor said to Forex Magnates' reporters that these errors which potentially overstated income by $6.4 million (mln) were related to it subsidiary's swaps dealer business which at the time wasn't a regulated market segment, and how the differences as noted in the press release may only affect less than 2% of the reported revenues and how the firm is all about transparency and took action to remedy these relatively small inconsistencies as soon as they were discovered, and added how he was neither trying to make light of them.

FCStone CEO Agrees Market's Price Doesn't Reflect Book Value Adjustment

Mr. O'Connor, who has held the role of Chief Executive since he joined in 2002, further opined that the $6.4 mln adjustment (or decrease) in the company's book value didn't reflect in the recent stock price which dropped by as much as 10.5% or over $40 mln of book value since yesterday, and believes the market may have overreacted to related media reports. Mr. O'Connor was unable to provide further details to what was already in the official regulatory filings and press release, but reiterated the firm's strong position as described in its most recent annual report.

Shares of the company stock traded 3x normal volume today and a chart of last week shows the drop in INTL’s price on Tuesday and compared to the NASD (Nasdaq) overall index according to Google finance:

Nasdaq: INTL Chart, Source: Google Finance

All About Transparency, Management are Major Shareholders

Members of the management team are significant shareholders of the company and have their interests aligned with those of shareholders as described by the company. The reconciling error may have overstated net trading gains of $10.2 mln, and subsequent net income by $6.4 mln for previously reported fiscal year periods, among other items noted in the explanation the company made in related regulatory filings, and according to a corporate press release issued on the company’s corporate website dated December 17, 2013.

Fast Facts (according to information on FCStone's website)

- Ranked #39 on the 2013 Fortune 500 list of largest U.S. Corporations

- Executive management has significant ownership

- More than 10,000 customers in more than 100 countries through a network of 30 offices around the world

- 1,074 employees

- Traded more than 29 million contracts in the 12 months ended September 30, 2010

- Traded $47 billion in physical metals for the 12 months ended September 30, 2010

Market Segments and Business Lines (according to company fact sheet):

- Risk Management Advisory Services

- Futures Brokerage and Clearing

- OTC and Structured Products

- Physical Trading in Select Commodities

- LME Metals Trading

- Global Payments and Treasury Services

- Investment Banking and Advisory Services

- Equity Market-Making

- Foreign Exchange

- Market Information

- Asset Management

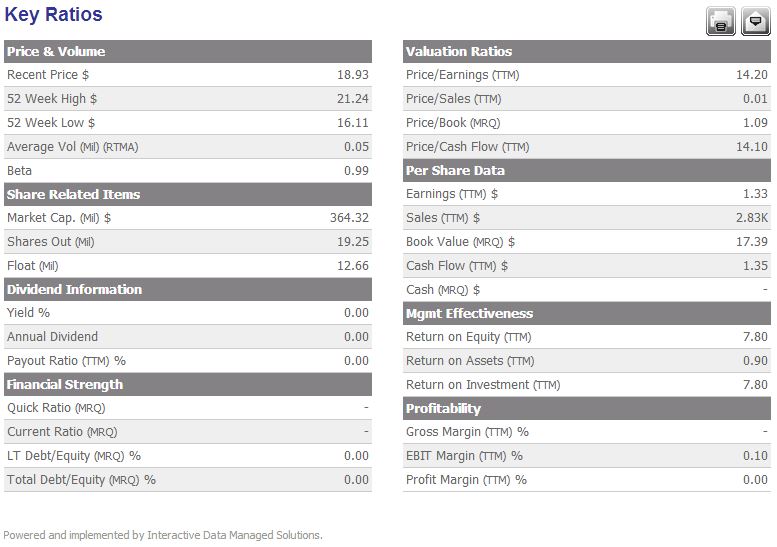

A copy of key ratios can be seen here, as per information updated on the investor relations section of the INTL FCStone website:

Key Ratios of INTL published as of Dec 18, 2013

An excerpt of the reason stated for the late filing on form NT 10K (12b -25) filed with the SEC yesterday by INTL FC Stone said:

FCStone Inc. (the “Company”) identified errors in the reconciliation of the Company’s subsidiary INTL FCStone Markets, LLC’s accounting records to its back office system, which has resulted in a delay in finalizing the Company’s consolidated financial statements required to be included in the Company’s Form 10-K. As a result, the Company is evaluating the effect these errors may have on previously filed consolidated financial statements covering the Company’s interim periods for the fiscal year ended September 30, 2013 as well as the previously filed audited and interim consolidated financial statements for the Company’s fiscal years ended September 30, 2012 and 2011.

The Company believes these errors may reflect an overstatement of revenues in trading gains, net in prior fiscal periods of up to $10.2 million and correspondingly an overstatement of net income of up to approximately $6.4 million. The errors do not relate to any customer-owned collateral. The Company has not yet determined whether the errors will have a material impact on the Company’s previously reported consolidated financial information, and therefore the Audit Committee cannot yet conclude that such consolidated financial statements and the information derived therefrom should no longer be relied upon. If, upon further review, the Audit Committee determines that any previously issued consolidated financial statement should no longer be relied upon because of the errors, the Company will file a Current Report on Form 8-K disclosing the Audit Committee’s determination.

The Company is continuing its review processes, including the effect on previously filed consolidated financial statements covering the Company’s interim periods for the fiscal year ended September 30, 2013 as well as the previously filed audited and interim consolidated financial statements for the Company’s fiscal years ended September 30, 2012 and 2011. The time frame for completing this review is not currently known and no assurances can be given that the Company will be successful in completing the filing of the Annual Report on Form 10-K for the fiscal year ended September 30, 2013 by December 31, 2013.

Management continues to assess the Company’s disclosure controls and procedures and internal control over financial reporting for current and prior periods. Management does not expect to reach a final conclusion on the effectiveness of the Company’s internal control over financial reporting and disclosure controls and procedures until completion of the review process.

Potentially Impacted Metrics:

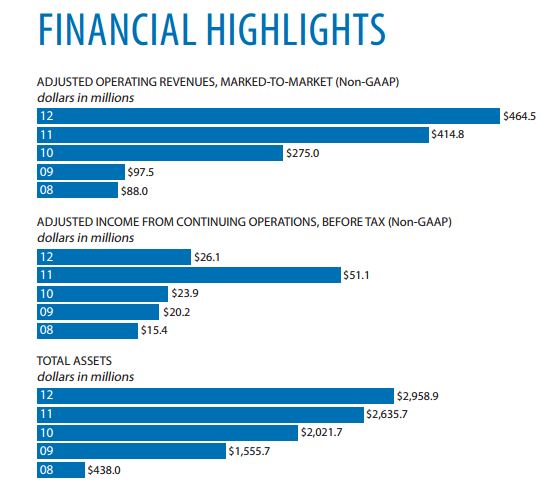

While the extent of effects were noted as yet being undetermined due to the ongoing nature of the firms audit committee still looking into the matter, the financial highlights from the INTL FCStone 2012 annual report show how the adjusted operating revenues since 2008 have more than quintupled, even if adjusting for a $10 mln overstatement of operating revenues in the last few years as a result of the estimated difference disclosed in the filing.

A similar drop in the company's stock price had occurred surrounding the time when the CFTC imposed a $1.5 mln penalty, as previously covered by Forex Magnates, and which only took nearly 1 month for the stock price to recover.

Source: INTL FCStone 2012 Annual Report, excerpt of financial highlights

Foreign Exchange Segments

One of its many market segments, FCStone also operates through its subsidiaries a significant Forex business that provides treasury, global payment and foreign exchange services to financial institutions, multi-national corporations, government organizations and charitable organizations and assists commercial customers with the execution of foreign exchange hedging strategies.

The company transacts in over 130 currencies and specializes in smaller, more difficult emerging markets where there is limited Liquidity , and executes trades based on the foreign currency flows inherent in the Company’s existing business activities.

FCStone primarily acts as a principal in buying and selling foreign currencies on a spot basis. The Company derives revenue from the difference between the purchase and sale prices (spreads). The Company also provides spot foreign currency trading for eligible contract participants and high net worth retail customers and operates a proprietary foreign exchange desk which arbitrages the futures and cash markets. Note, that the news today does not relate to the firm's Forex or FCM business (as noted above it related solely to its Swap Dealer Business and related to metrics from that business during a time when the Swap markets had not yet been regulated).