Finance Magnates has learned that IronFX is launching a new subsidiary targeting the Chinese market after the reputation of its brand was affected by months of disputes about withdrawal requests with some clients. As Finance Magnates reported several weeks ago, FXGiants is the new brand which IronFX will use.

According to publicly available documents filed with the Australian Securities and Investments Commission (ASIC ), IronFX Global has changed its name to GVS (AU) PTY.

IronFX becomes GVS (AU) PTY LTD

The directors of the new company are well known to readers familiar with IronFX, since they match the top executives representing the interests of IronFX Global headquartered in Cyprus. The document lists the CEO Markos Kashiouris and Director Petros Economides as directors.

IronFX is launching a new subsidiary targeting the Chinese market after the reputation of its brand was affected by months of failure to honor withdrawal requests

The Cyprus headquartered brokerage made headlines in China in 2014 after a large number of its clients asserted that the company was withholding their winnings. At the same time, IronFX Global claimed that some of its clients had abused the firm’s bonus promotions.

With the dispute ongoing, a number of legal cases have been filed against the company in Cyprus, and CySEC settled with the firm for €350,000 late last year. A number of clients spread all over the world continue claiming that IronFX has wrongly accused them of abusing the company’s promotions.

While the heat is still on and with numerous clients of IronFX actively campaigning on social media and forums that the firm is withholding their winnings and/or deposits unlawfully, IronFX continues an ongoing restructuring of its operations after some speculative media reports circulated that the firm was getting close to listing.

IronFX Australia new ownership and rebranding

According to ASIC documentation the new subsidiary under which IronFX is launching its new brand GVS (AU) PTY changed its name on the 21st of January 2016. All 1,500,000 ordinary shares of the newly named company are held by an offshore British Virgin Islands company named GVS Limited.

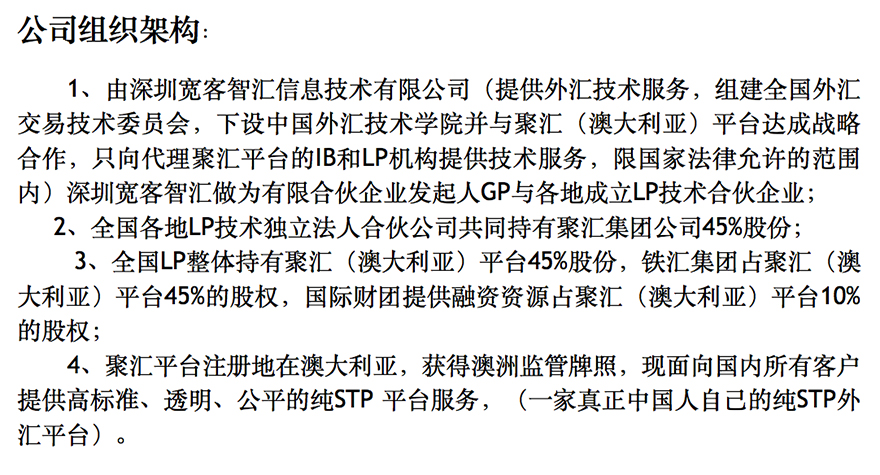

Sources with knowledge of the matter confided to Finance Magnates that the new venture FXGiants is allegedly owned only partially by IronFX Global. According to the information, about 45 per cent of the BVI registered company belongs to a set of Chinese introducing brokers, with another 45 per cent owned by IronFX Global, and 10 per cent in the hands of a third party which is providing financing resources.

Offering to Chinese IBs

According to the information, about 45 per cent of the BVI registered company belongs to a set of Chinese introducing brokers

In terms of the business structure, the new venture allows IronFX to fulfill its vested interest in Chinese introducing brokers. After the Cypriot brokerage was unable to meet its Obligations in the past, the new model was set up in order to ensure that the interests of both IronFX and the introducing brokers are aligned. As some Chinese IBs still have a pending legal dispute with IronFX, offering shares of the new enterprise could be understood to be a means to pay back funds.

Sources with knowledge of the matter say that while the headquarters of FXGiants are located in Australia, the firm’s marketing department and customer service management offices are going to be located in Cyprus. The company will also allegedly have an operational center in China, where the customer support of FXGiants is to be located.

IronFX in China

Back in September 2014, dozens of Chinese traders flocked to the offices of the company and claiming withdrawal delayed. The company denies the allegations.

By design, the new offering which IronFX and its partners are claiming to bring to the market is based on Straight Through Processing (STP) of client orders.

Meanwhile, ASIC has been actively discouraging the use of offshore entities when it comes to the ownership of regulated firms in Australia. Commenting on a previous occasion when the watchdog suspended the license of an OTC (over-the-counter) brokerage whose real owners were not properly disclosed, ASIC Commissioner Cathie Armour waved a red flag.

Any entity that is unable to comply with Australian licensing obligations risks having its license suspended or cancelled

“We would have concerns if new entrants to this market were trying to inappropriately bypass ASIC’s stringent AFS License application processes. Regulatory obligations on AFS licensees continue to apply after the change of control. Any entity that is unable to comply with Australian licensing obligations risks having its license suspended or cancelled,” Armour said.

Finance Magnates reporters reached out to IronFX representatives for comment, however at the time of the publication have not received any response.