We promised our readers yesterday that we would bring you IronFX's response to the serious revelations in our exclusive report yesterday about a harsh CySEC audit and why the watchdog hasn’t suspended the firm. Today the broker answered our call and tried to explain its view of the matter.

To unlock the Asian market, register now to the iFX EXPO in Hong Kong. [gptAdvertisement]

Regarding to the most important issue, the "$176m Client Money Hole", IronFX says in essence that the report's $176 million figure includes bonuses and not just deposits. Beyond this the company thinks that the audit report fails to represent the full picture of the situation, and it says it is taking steps to rectify the matter - presumably meaning in court or with the regulator itself.

IronFX issued the following statement to Finance Magnates:

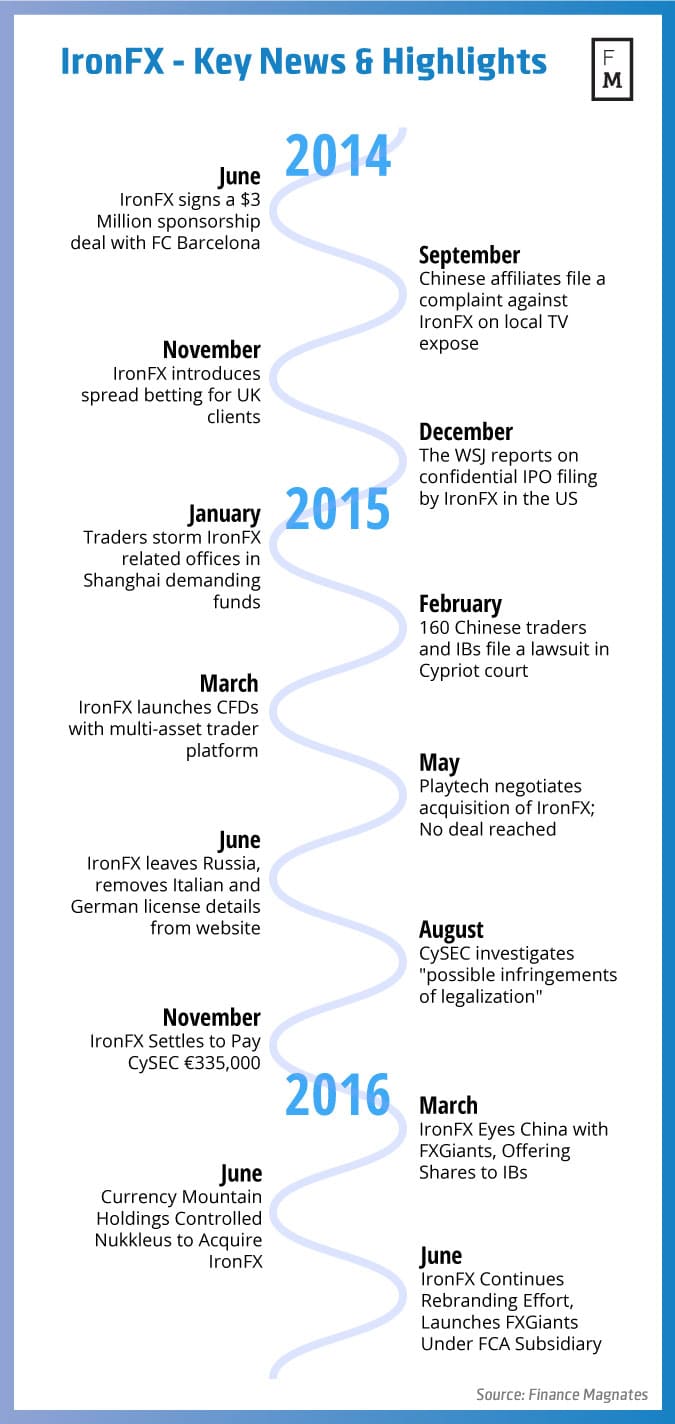

"The Company was investigated by the Cyprus Securities and Exchange Commission (CySEC ) in 2015 following a number of customer complaints. The findings of the investigation that led to a €335,000 settlement were made publicly available on the Commissions website on November 27, 2015.

With regards to the erroneous reference of the $176m amount mentioned in the Auditor General’s report the Company would like to emphasize that it did not relate to client money but to client equity that included non-withdrawable bonuses and is therefore misinterpreted in the Auditor General’s report. The said report includes selective data and fails to present the full facts of the investigation and the final findings of the Commission as they were presented in the settlement that was reached in November 2015. The Company is taking all necessary steps to rectify this misrepresentation.

The Company would also like to reiterate that all actions taken with regards to the treatment of the abusive traders are well documented and are in line with the various legal opinions it obtained and are further supported by its Terms & Conditions which are binding on both the Company and its clients.

Finally, the Company would like to draw your attention to the official statement of the CySEC Chairman published December 27, 2016. The Chairman explains among others, the Auditor General’s failure to present the CySEC’s position on all matters raised by his office and fully present the facts and results of the Commission’s investigation by including selective information in its report, thereby misrepresenting the facts."