The founder, chairman, and CEO of Interactive Brokers, Thomas Peterffy, is about to make history. The brokerage house he founded in 1977 is becoming the inaugural listing on the IEX Exchange .

The move to delist Interactive Brokers from NASDAQ and list it on IEX could mark the beginning of a new era. Since its inception in 2013, IEX has earned a reputation as the first anti-high-frequency trading venue as trading on the exchange is executed via a specially designed routing mechanism that prevents front-running

IEX came to fame in 2014, when financial writer Michael Lewis made the trading venue and its co-founder Brad Katsuyama the focus of his book about high-frequency trading ‘Flash Boys.’

Interactive Brokers meanwhile, is widely acclaimed as one of the most reputable brokers in the world. The firm was the first discount brokerage company to open access to the markets for smaller investors.

Peterffy, who amassed a fortune of $22.5 billion, has been among the revolutionaries in the industry and his latest move represents a major commitment to continue innovating.

Mr. Peterffy was kind enough to share some exclusive details on Interactive Brokers' listing on IEX with Finance Magnates.

'It’s All About Education'

Asked about the main reason for the move made by Interactive Brokers, the company’s CEO explained: “Trading volumes on the IEX are growing and they are providing better Execution prices for their customers. The unique order types IEX has are at the core of our decision to move our listing there.”

Peterffy also shared that he wanted the company’s shareholders to receive the benefit of better execution prices.

“We have been routing orders to the IEX for some time now. If the exchange succeeds this would only benefit our customers," he said. "We do not accept payment for customers’ orders and since their execution prices are better when compared to other exchanges, we would like to execute more flow there. The owners of our shares will also benefit.”

Asked if he thinks that a movement against high-frequency traders can succeed, Peterffy shared: “It’s all about education. If people are aware that there is a venue where their orders can get executed at better rates, they will naturally move their business to that venue.”

“HFT’s are buying order flow from many brokerages, which are keen to maintain the status quo. As long as end-customers are aware of the existence of a marketplace where their orders can get better fills, the market will change and the business of HFTs will decline.”

The proprietary order types which IEX offers its clients are at the core of the exchange’s success.

Interactive Brokers itself has a SmartRouting system that automatically searches for the best price and routes trades there. Clients can override these recommendations if they want their trades executed at a specific exchange.

Continuing HFT Debate

By joining IEX, Interactive Brokers is setting itself up against major competitors, including zero-commission trading app Robinhood.

A recent SEC filing by the mobile app-centric intermediary confirmed some rumors that Robinhood had been selling flow to HFT firms for prices which might be much higher than its competition.

In an article on Seeking Alpha, analyst Logan Kane pointed out that Robinhood has been compensated on a per dollar and not per share basis as its peers.

According to Kane's article, public filings reveal that brokers like TD Ameritrade and E*TRADE get about $22 per $1,000,000 traded. Robinhood, on the other hand, gets paid about $260 from the same leaders in the HFT space, like Citadel, Virtu, and Two Sigma.

A debate which has been around since the launch of Robinhood is now heating up. Is the company really that interested in providing a zero-commission service to its clients?

In any case, the listing of Interactive Brokers on IEX could mark a new era for the brokerage industry and the broader stock market overall. Provided that the share prices of Interactive Brokers remain well bid, the company's move could be followed by many others soon.

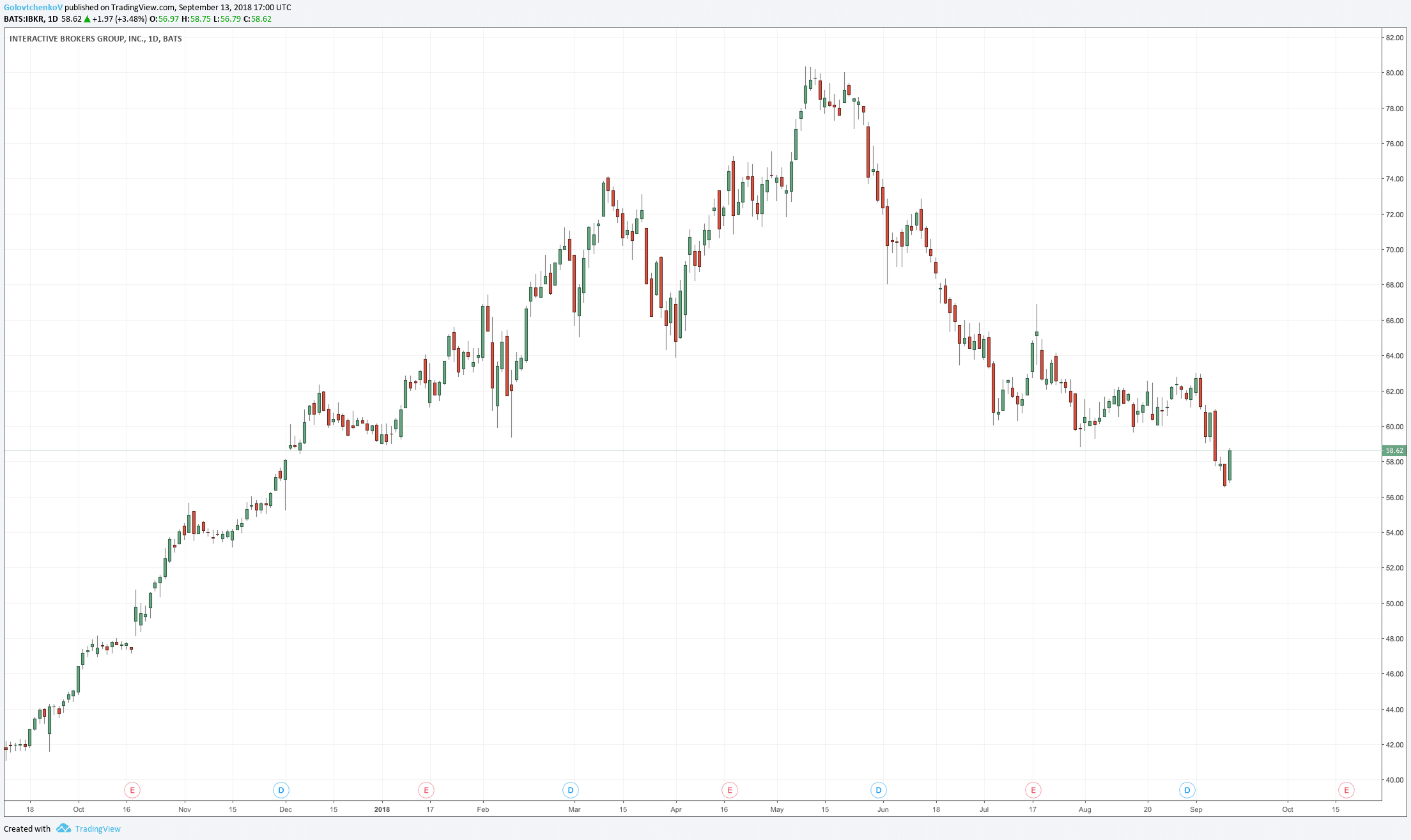

In Thursday's trading, the share price of the company reversed Wednesday's decline and is currently priced three percent higher.

Interactive Brokers daily price cart, Source: TradingView