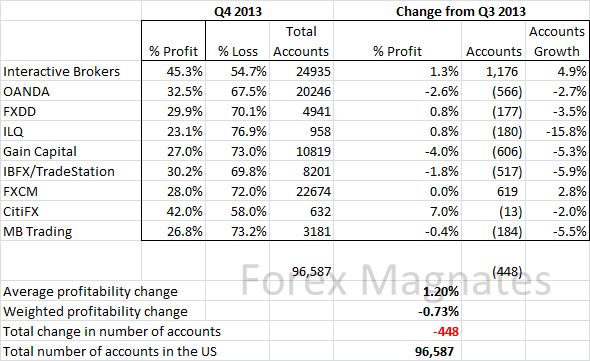

NFA member brokers have reported their Q4 2013 retail account numbers and profitability figures. During the quarter, 33.6% of US retail account holders registered profits, while 66.4% were in the red. The 33.6% figure compared negatively to 33.4% in Q3 2013. Also falling was the total number of US retail Forex accounts, which declined by 448 customers to 96,587 clients who placed trades during the quarter. The decline in profitability occurred as volumes and Volatility were also below Q3 levels.

(Correction: Chart has been updated as it previously showed CitiFX profitability declining 7% instead of rising.)

Q4 2013 US Retail Forex Profitability Report

With individual brokers, once again, InteractiveBrokers(IB) has taken the top spot in terms of both number of accounts and most profitable customers, with 45.3% of clients in the black, easily edging in second place is CitiFX. IB also expanded its lead on FXCM as the US’s largest retail forex broker by number of accounts. During the quarter, IB added 1,176 accounts for a total of 24,935 customers, versus a 22,674 total at FXCM. Speaking of FXCM, the broker added 619 accounts during the quarter. The growth was most likely the result of the company’s assumption of Alpari’s US retail account base which took place at the end of September, with the majority of customers only beginning to place trades with FXCM in Q4. For reference, Alpari had 2013 accounts on record at the end of Q2 (Q3 results were unavailable from the broker).

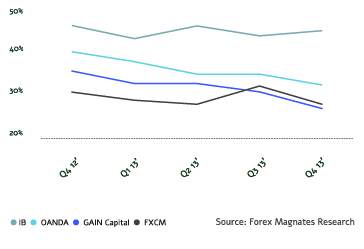

Among other brokers, one of the most interesting ones is the performance being seen at OANDA. Typically among brokers with the most profitable customers, OANDA’s client performance has been steadily declining this year. Although ranked number three when compared to its peers, the broker’s 32.5% account profitability number has fallen from the 40.5% figure that was reported in Q4 2013 (see below). At the end of 2012, OANDA changed its trading conditions as it moved from fixed to dynamic spreads. Feedback from clients was mixed, with many customers complaining on OANDA’s trading forums of excessive slippage and stops getting triggered incorrectly. Responding to questions about the changes to Forex Magnates in early 2013, Courtney Gibson, Vice President of Trading at Oanda, stated to us that spreads are on average tighter as he said, “OANDA’s average spreads have decreased significantly on a time-weighted basis since we introduced the new algorithm.” Regardless of whether average spreads are indeed lower, the account profitability figures reflect that clients have been performing poorer since the trading changes took place.

Top US Retail Forex Broker Quarterly Profitability

Also of note is GAIN Capital. For the most part, GAIN’s FOREX.com US retail customers have been in the middle of the pack in terms of profitability. However, during 2013, performance has been on the decline, culminating in Q4’s data of only 27% of traders achieving profits during the quarter. The company’s US business has also experienced contraction between Q1 to Q4. Following a boost of account growth due to GAIN Capital acquiring GFT’s US customer base in Q1, at 10,819 accounts, client numbers are back towards their Q4 2012 pre-GFT level.

Previous Reports: Q3 2013, Q2 2013, Q1 2013, Q4 2012, Q3 2012, Q2 2012, Q1 2012