Polish brokerage XTB went public in May of last year. The company marked one of the most successful initial public offerings (IPOs) in Poland for 2016. After a shakeup at the top executive level of the brokerage, the company selected Omar Arnaout as its new CEO earlier this year.

[gptAdvertisement]

XTB’s stock traded at around PLN 12 when the firm debuted on the Warsaw Stock Exchange, valued at almost $350 million on the first day of trading. Since it became public, the company's value declined materially to trade around PLN 8.5 at the time of writing. The firm’s market cap is around $250 million as of today, providing a challenge for the new CEO of the firm to reassure investors in the future of XTB.

Certainly the retail market will consolidate in the coming years

Mr Arnaout kindly agreed to respond to some important questions for the Forex and CFDs brokerage industry and shared some specifics about the challenges his firm is facing.

Regulatory Challenges

Does XTB plan to keep operating in Turkey despite the rigid new regulations?

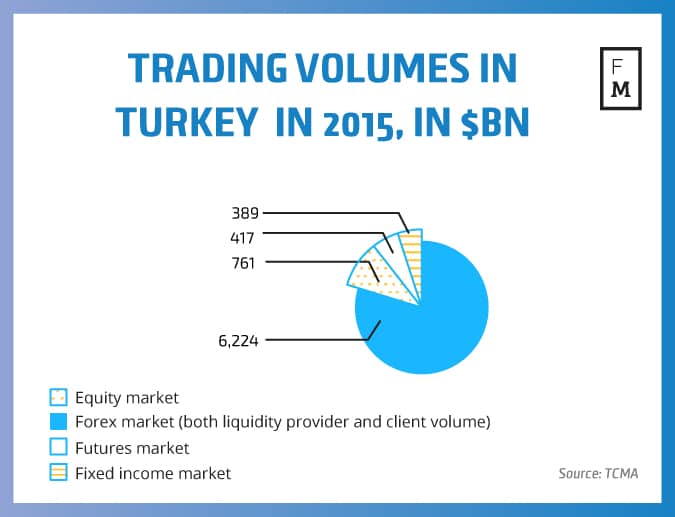

At this moment, unlike many other brokers operating in Turkey, we plan to maintain our branch. We are aware, however, that the current state of the CFD market may change dramatically. Due to the leverage reduction to 1:10 and the increase in minimum deposits to around $13,500, the customer profile will change from standard retail investors to significantly larger ones.

What is also important is the focus on cost optimization. In our own experience, we know that local customers have been used to lower leverage over the past few years and are keen on national regulation. As a result, we forecast that the largest customers will still be looking for Turkish companies that allow leveraged markets trading, and the consolidation of the industry may be used by us where we will probably be able to focus on more wealthy traders.

The results of each of our branches are analyzed on a regular basis. Although at this point we are not considering leaving the Turkish market, if the results of the assessment show constant and strong declines, this step certainly will have to be considered.

Staying on the topic of market consolidation, does XTB see a threat in this area, or is it likely to be an advantage in the future?

Certainly the retail market will consolidate in the coming years, as we have seen recently in Poland. In general, this process is beneficial for us, because we are one of the largest brokerage houses on a European or even a global scale.

Such an arrangement, exacerbated by sharpening regulatory changes, which have become more visible recently, also offers opportunities to take over other companies. Particularly large entities that attempted to debut on the stock exchanges, however, eventually withdrew from the process.

As an FCA licensed broker, what do you think about the regulator’s proposed leverage cap? How is it going to affect your UK business?

Due to the fact that we are a big brokerage house, we have a lot of flexibility in this area. As a curiosity I can tell you that despite current consultations on tightening local regulatory requirements in Great Britain, customers from all over the world want to set up accounts in the UK office. They know perfectly well that the FCA is a demanding market watchdog with an established reputation and well-developed instruments that help control the retail market.

The leverage itself - even with a 1:50 limitation - should not introduce such drastic changes or a potential collapse in the UK FX/CFD market. This is illustrated by the Turkish example mentioned earlier. Before the current modifications, the leverage was 1:25, and customers were using our services anyway - everything is a matter of habit.

Staying in the regulatory field - the UK ombudsman and many of its European peers are thinking about limiting or banning the retail FX/CFD industry. Could this be the end of the market for individual investors?

The regulatory changes themselves within the most popular jurisdictions are not a bad thing. However, this does not allow us to completely solve the problem that we are constantly struggling with. As long as investor money goes to exotic countries where fund protection is practically invisible, we cannot talk about the proper protection of the retail trader.

We are monitoring the situation in the US market, but I do not think that Dodd-Frank can get repealed in the near future

As for the chances of closing markets for small investors in the near future, we do not expect this situation in the coming years. However, if such a threat appears, we will certainly be able to adapt smoothly to the changes focusing on institutional investors. Again, the great advantage here is the size of our business and activities in many diversified markets.

Therefore, we will not be the ones that suffer the most - the biggest harm will fall on the many retail customers who will be cut off from trading opportunities by regulators wishing to protect them. Their actions should rather be focused on limiting the effect of ‘customer migration’ from one country to another.

At a time when Europe is tightening its regulations, the United States debates a possible loosening or even a complete cancellation of the Dodd-Frank Act. Would XTB, like other brokers, consider entering the US market if this happens?

Of course we are monitoring the situation in the US market, but I do not think that such changes will occur in the near future. We have a number of significant priorities in other markets, so we are not taking that option into account for the moment.

In the last three years we have been dealing with a broad consolidation in EURUSD

It is worth pointing out, however, that the US supervisory committees have actually tried to protect consumers from access to leveraged products, e.g. by introducing changes in the local market. Unlike the European Union, traders from local jurisdictions cannot legally use the services of external brokers.

Personally, I would like regulators to not tighten the screw on honest and well-regulated brokers, but to deal more seriously with the problem of unethical operators that cheat customers and that for many years have negatively affected the industry, leading to a bad impression in the media.

If you had to choose between a market where the regulations are most favorable for conducting business or one which provides access to a potentially larger customer base, which one would you select?

At present the regulatory environment is changing dynamically, with recent examples in Turkey and Belgium. Therefore, I would choose the first and second option. Although it can be initially costly, it allows for greater flexibility and a faster response to all legislative updates prepared by supervisory committees.

If XTB were a broker with only one branch, e.g. in Turkey, then after the recent increase in capital requirements for retail traders we would be near bankruptcy at this point. In this industry you cannot afford to depend on only one regulator, even if this involves higher costs.

Moving Ahead in Low Market Volatility

Analysis of XTB’s financial results from recent periods shows a decline in significant revenue indicators. On the other hand, however, we are seeing an increase in client accounts. What are the implications of this?

I have to admit that there are a lot of factors influencing our business, some of which we simply cannot control. Let's take for example the so-called market volatility, which is often misunderstood. It is not completely absent, because we are constantly observing it. However, the visible and clear market trends are the most important part here.

Just take a look at historical EUR / USD prices - in the last three years we have been dealing with a broad consolidation. Previously, the market was only going in one direction - downward. Unfortunately, we cannot influence the lack of clear trends, which may have a negative impact on financial performance.

Jakub Zabłocki, XTB owner and managing director of X Open Hub, XTB's institutional arm

On our side, however, we can do much to increase the number of accounts - primarily active ones - and the number of deposits. Our statistics clearly show that XTB is making very good progress in this area, but at the same time they point out that investors are waiting for the right trade opportunities.

The FX/CFD retail trading industry can be compared to a charging battery. We are still waiting for the moment when it will finally start working to its full potential. With raising the number of active accounts by 30-40%, which is one of my real goals for the next quarters, I will calmly look at the company's future earnings despite the current turmoil.

Could you elaborate on your medium and long term goals as CEO of XTB?

As I mentioned, I would like to focus on increasing the number of accounts opened monthly at XTB. It is not just about encouraging customers to deposit funds, but also about maintaining our clients relationships, so they decide to stay and invest with XTB for as long as possible. This is one of the reasons we are strongly focusing on providing our clients with the highest quality educational and analytical resources.

It is also very important to optimize overall costs. Some of the changes we have made in this area have been implemented in the UK and in several other countries - modified marketing systems help us in a very detailed way to analyze market trends and determine what really works and what turns out to be ineffective. Our team reacts very quickly - within one week or even a day, we are able to change marketing materials many times to get the most out of them. Thanks to that, we are constantly gaining crucial knowledge, reducing unnecessary costs.

What did you learn from the listing on the WSE and would you recommend other FX brokers to take the same path? As we know, XTB's stock has shed over 26% of its price since the IPO last May - did you expect this performance?

We certainly do not regret our stock debut and it was a good decision. As for the fall in stock price, I would not look for serious problems here, and it is highly connected with the situation on financial markets. Instead of valuing the stock itself, we should focus on other important advantages of our IPO - we build trust in the brand and the broker. What's more, it is a huge help with potential future acquisitions of other brokerage houses.

XTB's stock performance since IPO to date

Being in the position of fourth largest broker in the world bring listed on the stock market certainly makes a great impression both in business talks and in conversations with our customers. Especially when we take into account the mature markets of Western Europe.

Does the company have plans to acquire other brokers in the near future?

We are constantly monitoring what is happening on the market. I do not want to reveal too many details, but on the technical side we are preparing for such a possibility. We want to make sure that by deciding on a real takeover, we will be able to retain the highest percentage of generated revenues while maximizing cost optimization.

Such operations require not only the appropriate technology, but also human resources backing. As I said, without going into the specifics, we are actively exploring the market trying to find the best investment opportunities in this area. The process should intensify in the second half of this year.

Technological Evolution

What main technological trends do you identify in the global FX industry? Artificial intelligence, robo-advisors, social trading, or maybe something completely different?

XTB keeps track of all the innovations and changes that are taking place on the market. Thanks to developing our proprietary xStation platform, we already see a strong increase in the popularity of mobile based trading.

We are also trying to beat the popularity of MetaTrader products. In some countries, this goal has already been achieved. Investors have become accustomed to MetaTrader, using the experience of a huge community, a wide base of free indicators and EAs. But to be completely honest, I do not see an advantage over our platform and I believe that the xStation platform is simply a more modern tool for trading.

As for the use of artificial intelligence, social trading and robo-advisors in retail trading, we naturally cannot fall behind. However, our customers' opinions and our own experience show that ‘traditional’, independent trading is still much more popular. At first glance it all looks great, but people are trading for emotions - they certainly do not like the losses, but want to decide on their own.

So far, XTB has no plans to go in that direction. However, we have a large team of IT professionals - more than 100 people. So in a very short time we would be able to create competitive high quality solutions. Of course, if these trends and innovations start to gain real popularity among retail investors we will definitely explore the niche further.