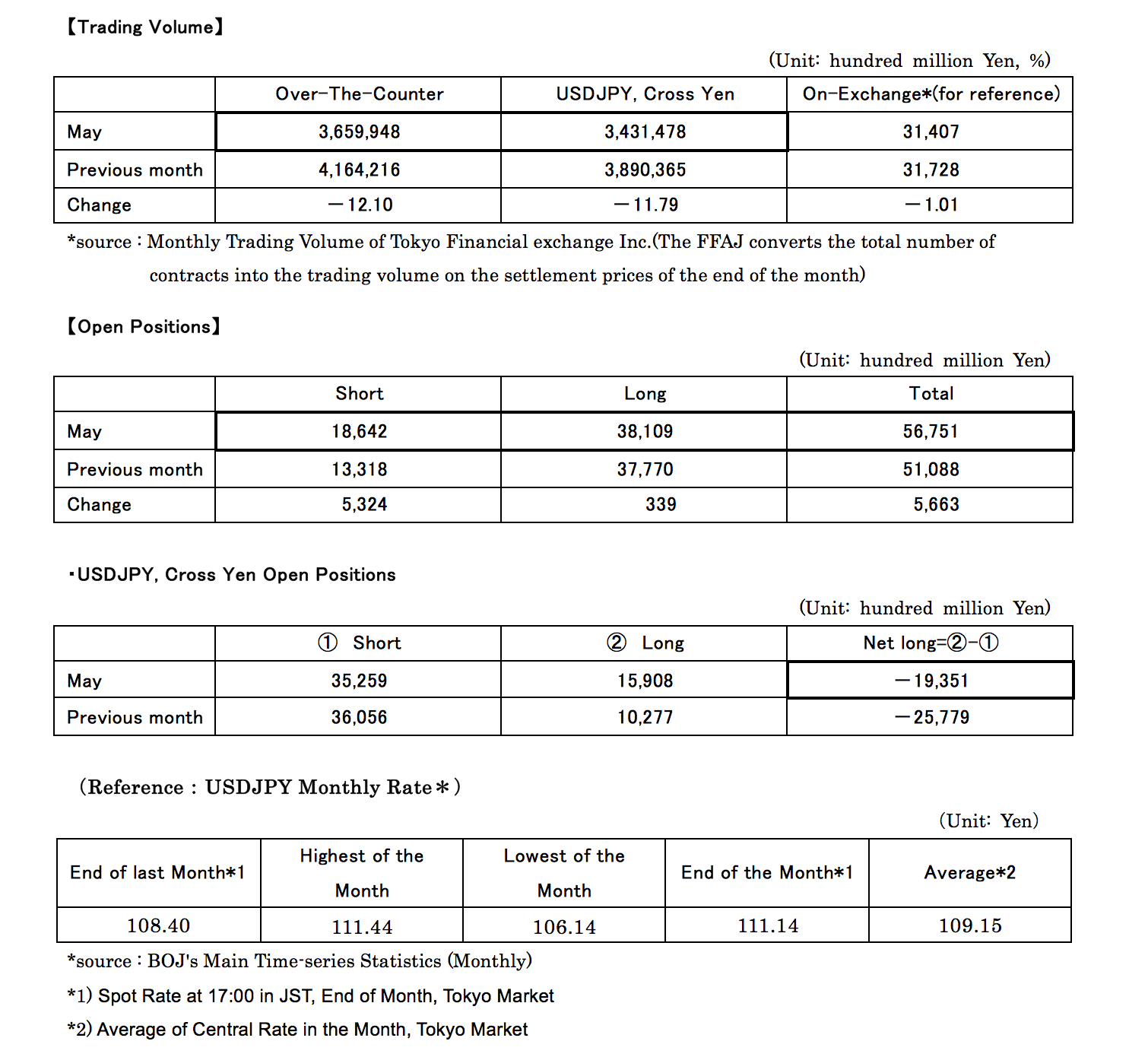

The Financial Futures Association of Japan (FFAJ) today released its monthly statistics bulletin for over-the-counter (OTC) retail FX margin trading for May 2016, consisting of volumes reported from among 52 member firms for the month, and showing a decrease of 12% from ¥416 trillion in April.

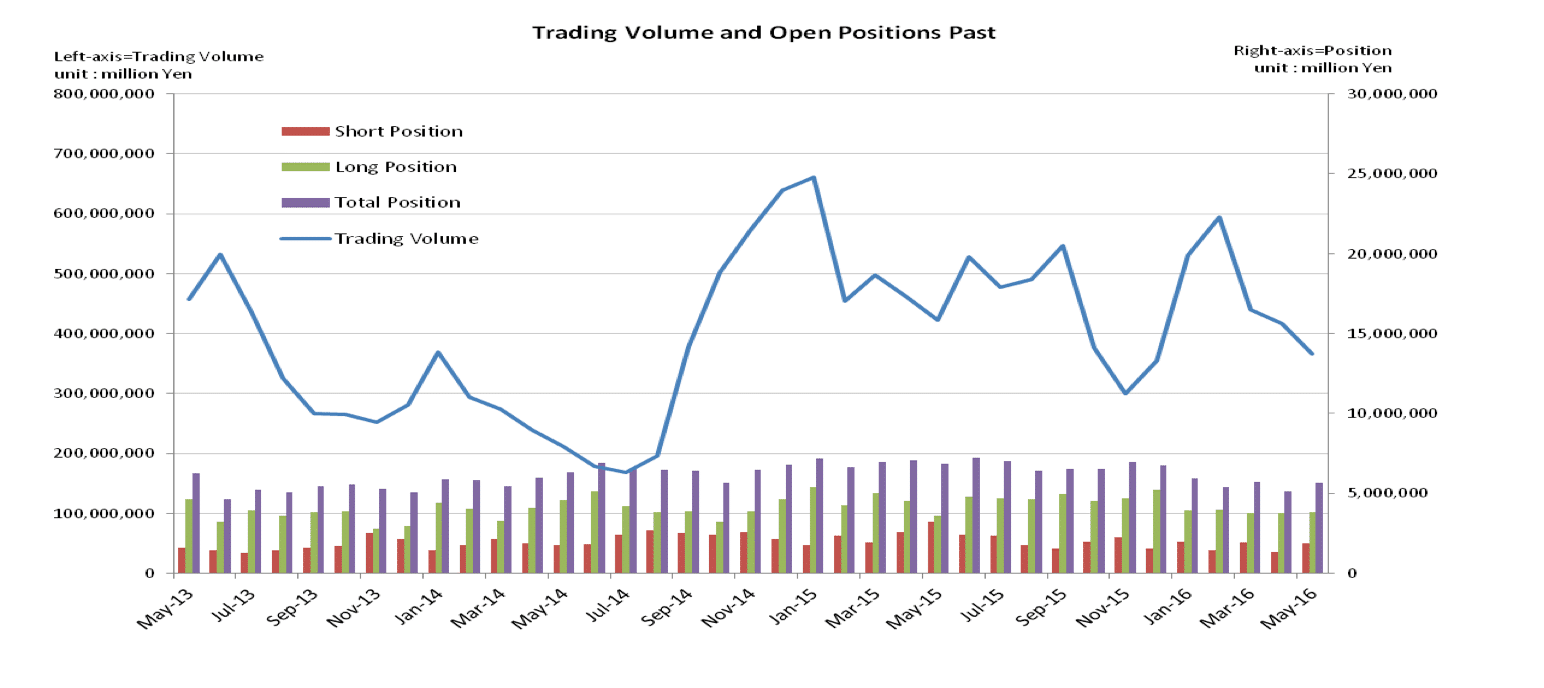

Combined trading volumes reached nearly ¥366 trillion in May (roughly $3.35 trillion), falling below the ¥400 trillion mark for the first time in five months, as noted by the FFAJ in its report, and driven by a decrease in USD/JPY Volatility which affected trading volumes in the country’s most popular traded pair - and helped drag down volumes by ¥50 trillion from April.

The new world of Online Trading , fintech and marketing – register now for the Finance Magnates Tel Aviv Conference, June 29th 2016.

Source: FFAJ May 2016

May volumes fell 12% from April

Of the ¥365 trillion total volumes in May, USD/JPY consisted of ¥261 trillion, lower from the ¥294 trillion that it represented from April's total of ¥416 trillion, yet represented a 71% share in May versus 70% in April, despite the lower overall turnover.

Despite the ¥50 trillion decrease in turnover volume in May, the number of open positions (i.e. open interest) including both buy and sell positions rose during the month, when compared to April.

Open short sell positions amounted to ¥1.864 trillion through the end of the month, whereas long buy positions were more than double at ¥3.810 trillion through the end of May, and making for a combined ¥5.67 trillion in open interest. Earlier today Finance Magnates reported on the FFAJ's binary options results for May from among 7 reporting members, and the news follows after the association releasing its Q1 2016 volume totals for Japan.

Source: FFAJ May 2016