The Financial Futures Authority of Japan (FFAJ) today published its Q3 report on financial futures transactions including from retail FX and over the counter (OTC) contracts, for the quarter ending December 31st 2015, showing mostly lower trading volumes in key FX segments.

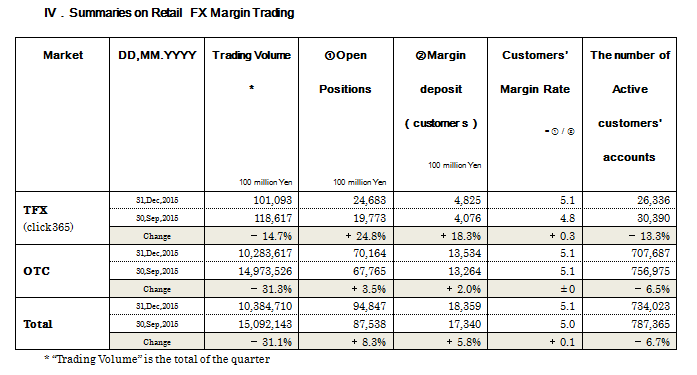

According to data compiled by the FFAJ from its members for Q3, OTC margin FX volumes fell by 31.3% to 10,283,617 (100m yen), whereas on-Exchange retail FX margin trading was 17.8% lower at 11,491,386 (100m yen) over the same period when compared to the prior quarter.

After including December totals that helped to bring down the trading volumes reported by its regulated members, the year-to-date totals were still higher year-over-year (YoY) despite a dampened Q3.

The lower volumes in Q3 also mirrored the drop in the total number of active customer accounts which fell from 6.7% from 787,365 in Q2 to 734,023 reported for Q3 ending December 31st, according to the retail FX trading report summary.

Concurrently, the higher total trading volumes year-to-date (YTD) from April (the start of FFAJ's fiscal year) are higher across domestic segments in both OTC and on-exchange margin FX contracts, at 12.7% and 25.3% higher respectively. This brings the YTD from April to nearly 40 trillion yen (39,519,449 at 100m).

source: FFAJ

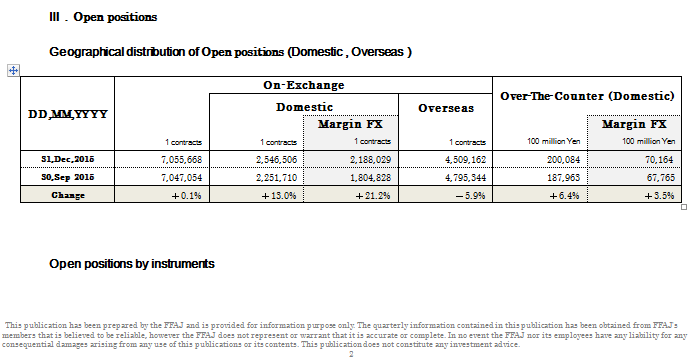

In addition, open interest during Q3 grew as traders maintained and increased their positions, despite decreasing trading frequency and volumes. Q3 also saw options volumes grow slightly from reporting members – for the overseas segment - as traders sought Volatility bets across foreign exchange and interest rate option chains.

Currency weakness also affected other transactions reported by members according to the FFAJ, helping to bring volumes lower both on-exchange and off-exchange during Q3. Interest rate related transactions grew during Q3 by the small amount of 0.7% at 19.07m contracts over Q2’s figures.

The number of members stood at 145, yet the number of firms that reported data in December was lower by 3 when compared to the previous quarter ending September 30th, across domestic and overseas members in both OTC and on-exchange products.

Source: FFAJ