For the three-month period that ended March 31st 2016, the Financial Futures Authority of Japan (FFAJ) today published its Q4 report showing increased trading volumes in financial futures including from retail FX and over the counter (OTC) trading contracts, compared to the prior quarter for reporting member firms in Japan.

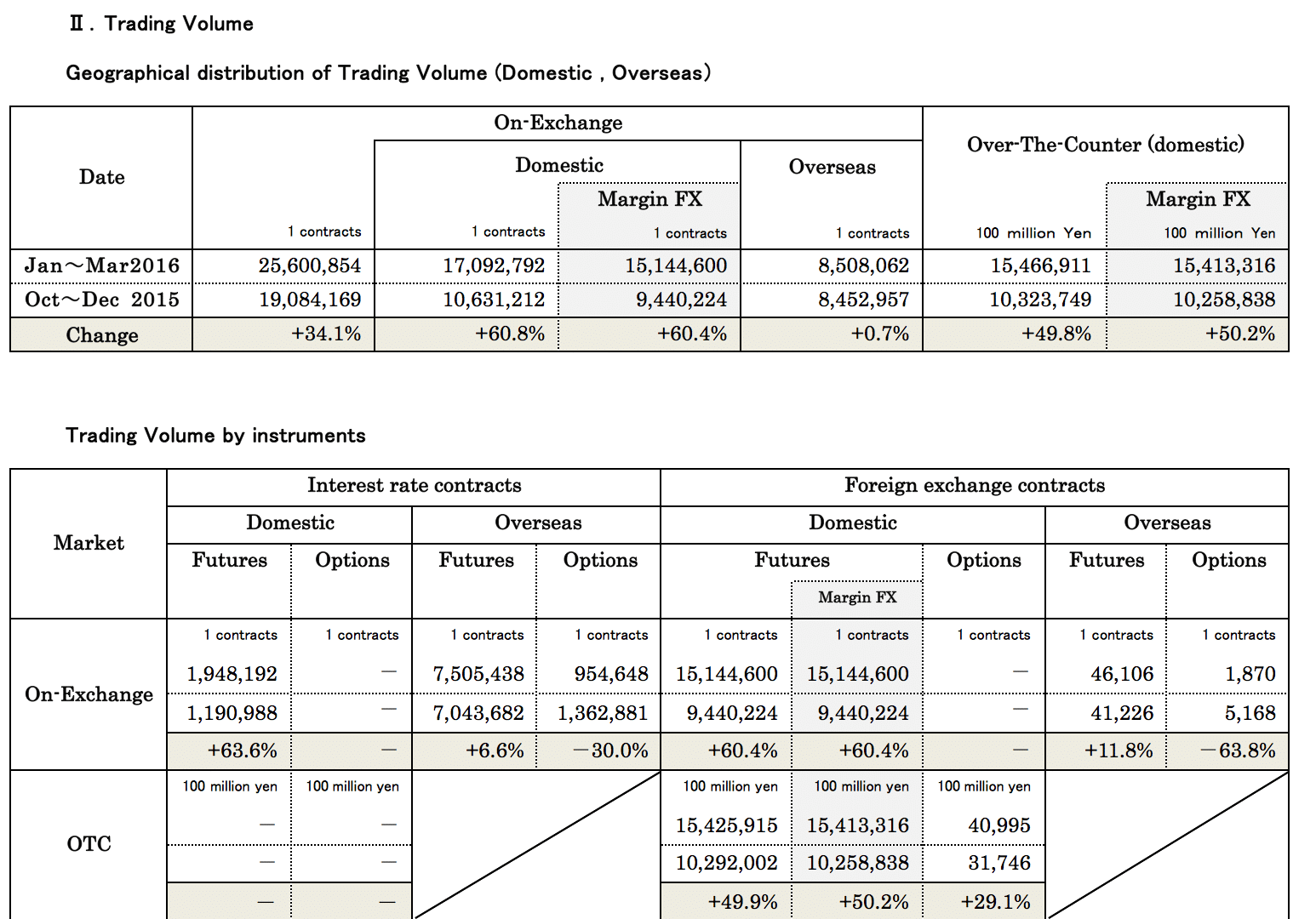

Total trading volumes on-Exchange rose to 25.6 million contracts for the Q4 period through the end of March that was reported by the FFAJ for its members and this total was higher by nearly 6 million contracts from the 19.08 million contracts reported in its prior Q3 quarter.

The new world of Online Trading , fintech and marketing – register now for the Finance Magnates Tel Aviv Conference, June 29th 2016.

On-exchange and retail FX

The majority of the quarter-over-quarter increases for on-exchange volumes were driven by more than 60% gains in both domestic and retail FX margin trading, whereas the overseas segment was little-changed at 8.5 million contracts.

In addition, the over-the-counter OTC domestic volumes published by FFAJ for its reporting members totaled over ¥15.46 trillion during Q4, higher by nearly 50%, including margin FX OTC volumes which rose similarly to ¥15.41 trillion up from ¥10.25 trillion reported in the prior quarter.

During the start of 2016 the Japanese currency wreaked havoc in the foreign exchange markets thanks to intervention from the Bank of Japan, yet the currency strengthened further towards the end of the quarter and added renewed pressure on the country's central bank.

Q4 ending March 31st 2016

This increase during its Q4 report shows a reversal of the prior decline in volumes compared to FFAJ's Q3 period ending December 31st which declined from Q2 totals, as detailed by Finance Magnates in a related post.

Earlier this month, FFAJ released its binary options trading report that showed a third month of declines in volumes during April, despite the growth seen in foreign exchange trading during the first three months of 2016.

FX gains during start of 2016

Mostly broad increases were seen across all reported segments by FFAJ except overseas interest rate and foreign exchange options which declined 30% and 63.8% respectively compared to Q3.

Domestic on-exchange volumes jumped to 17.09 million contracts in Q4, up from 10.63 million reported in the prior quarter, and margin FX increased similarly from 9.44 million to 15.14 million contracts over the same period. In addition, compared to Q3 the total number of member firms declined by 3 to 142, while the number of reporting firms increased by 1 to 125.

FFAJ Q4 Report for the Period Ending March 31st 2016.