Yesterday I talked about Market Making brokers today I’ll discuss STP and ECN brokers.

Forex Broker, which is not a Market Maker, is either a Straight Through Processing Broker (STP) or an Electronic Communications Network Broker (ECN). These types of brokers are typically (and sometimes erroneously) called Non Dealing Desk brokers.

ECN Brokers:

ECN Broker is a broker per-se, one who gives you a direct access to display your order in the market. This broker’s income comes from a certain mark-up on the spread displayed to you: for instance if the current actual spread on a EURUSD pair is 0.2 pips, this broker might display you a 0.5 pips spread making 0.3 pips on every trade you make.

There are several ECN brokers out there with Swiss Dukascopy being one of the most recognized with the ECN execution model.

For a retail trader ECN execution is often beyond reach: due to its inter-banking nature, traders are typically required to trade very large lots and minimum deposit requirements are somewhere from $50,000 to $100,000. FXOpen recently tried to cover this gap by offering a MT4 ECN platform, not very successfully or transparently in my opinion.

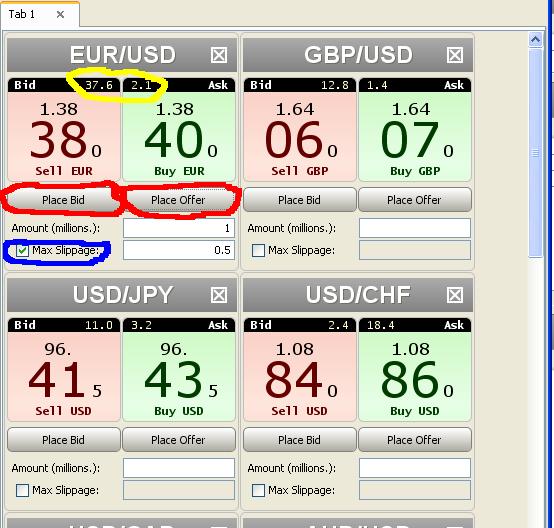

STP Brokers: STP Broker is a type of a Market Making broker. This broker, most of the time, displays its own quotes (which are correlated to the actual inter-banking quotes). Now here is the real complexity: sometimes this broker routes your orders to the market (acts as an STP broker) but sometimes it doesn’t (acts as a Market Maker). For instance, successful traders or successful trading algorithms will be automatically routed to the market while small or losing clients will not. This way the broker profits twice: once by clients’ losses and another by not losing money to successful traders (of course this never works 100% but it does most of the time). This way the STP broker’s commission comes from two sources: unsuccessful clients’ losses and commission arbitrage on routed orders – when you trade at 2 pips with this broker for example, it routes your orders to another broker or the inter-banking market thus making 1 pip without assuming any risk. This model is also responsible for all the re-quotes and order rejections. When you open a large order the broker routes it to the market, but the prices there might have already changed (the market does move very fast sometimes) – so the broker is faced with two options: either rejecting the order asking for you to adjust prices or completing the order by taking the risk that it might end up a successful trade meaning the broker will have to pay you from its pockets (Nostro). So how do you as a trader distinguish between a MM, STP or ECN broker? Well, it’s easy to recognize an ECN broker: the minimal capital requirements and the ability to see not only the bid and ask prices but also the amounts on either side of the price (Depth Levels) is the most notable ECN feature. Can you tell the difference between MM and STP? Probably not. It’s very hard to distinguish between these two and most of the time the brokers use a Hybrid Model anyway. As I mentioned in the first part: most of US and UK regulated brokers will not ‘trade against you’ in the way that will make you lose money, not because they are moral but because this might cause problems with their license.