Russian Finam is hardly a new entrant to the brokerage world. The firm is one of the largest retail brokers in Russia, and offers asset management, investment funds, and brokerage services for clients. Focused on Russian stocks and bonds, the brokerage has recently been expanding its offerings to include access to foreign stock exchanges. In addition, they launched FinamFX, a CySEC regulated forex broker, as well as a copy trading product, presented under the Finam brand.

A new endeavor for Finam is the launch of social trading network WhoTrades. The launch last year, was part of the rebranding of FinamFX, where the trading name of the license was changed from Finam Limited to WhoTrades. The new initiative combines Finam’s forex brokerage along with its auto trading services as a rebranded social network. WhoTrades is still in its infancy, but the firm is aiming to become a multi-asset provider of social trading. As a result, WhoTrades has connected with leading exchanges such as Germany’s XETRA, the NYSE Euronext, and Eurex. In addition to their CySec regulation, they became a registered firm in the US with the SEC and CFTC to offer services to US clients as well as enabling foreign customers to trade on US markets. The company is targeting a global audience, however, its main focus is on Russian speakers as an extension of its Finam brokerage services, with its FinamFX.ru site.

Learning more about WhoTrades, Forex Magnates spoke to Arthur Shponko, Open API Division Manager, to uncover facts about the social network, Finam’s entrance to the forex market, and client interest in copy trading. Responsible for the company’s open API division, which includes algo trading, third party products and software development, Shponko explained that they have received demand from developers looking to provide their products for customers, as well as clients desiring asset management and trade robot services. Based on the need, Finam built its copy trading product to enable an efficient platform for customers to connect with money managers. The service worked with Finam approving managers for the platform, and splitting customer commissions with them.

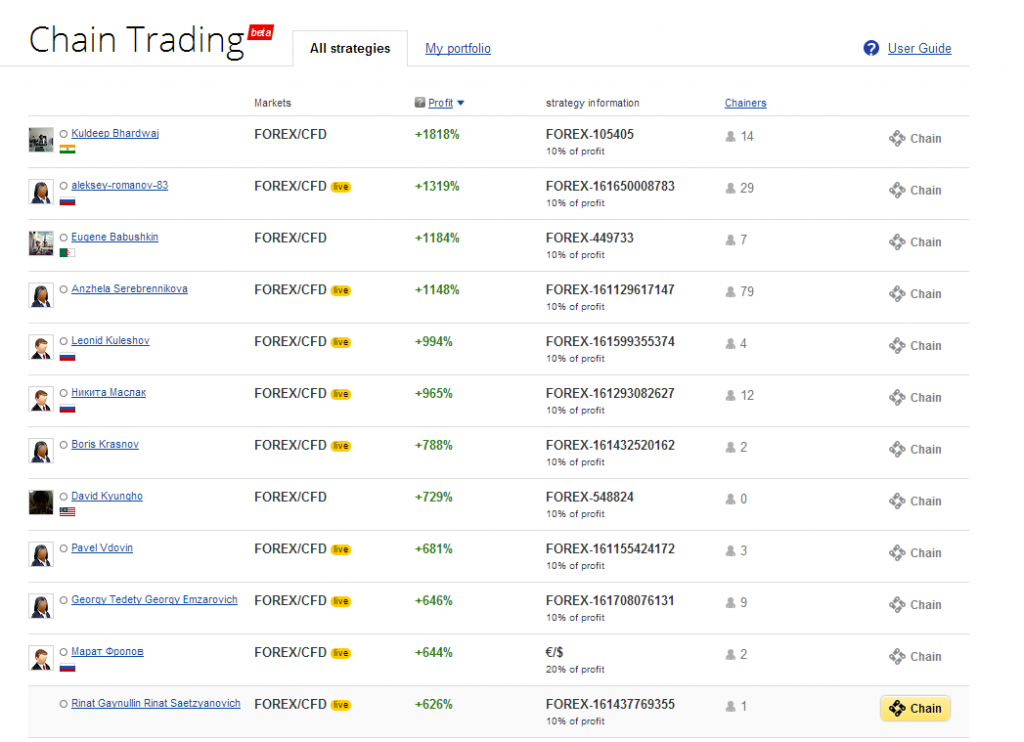

What Finam found, was that there are very few good managers in the market. As a result, when creating Who Trades, they decided to mix both a social network and trading signals together to provide greater diversity of auto trading. Therefore, the network provides traders the ability to follow and copy other members. In addition, WhoTrades is working with approved partners that offer trading signals for traders to copy. Shponko explained that there are three parts of the partnership. Partners are listed on the website with the description of their products, marketed on WhoTrades, and given access to presenting webinars.

Among initial partners is Faunus Analytics . Written about in the past, Faunus Analytics has been having success in integrating its trading signals for forex and binary options brokers this year. Shponko explained that in Faunus’s case, Finam was attracted to their mathematical prediction methods. He added that “Russian money managers haven’t been performing well recently. We wanted to boost the division by adding robot traders”. Therefore, the addition of Faunus is aimed at diversifying WhoTrades' managers to both algorithmic and discretionary traders.

In relation to Faunus, Pavel Bykov, Chief Development Officer at the firm explained to Forex Magnates that their interest in partnering with Finam was based on the broker being “the largest Russian retail broker and one of the largest financial institutions in terms of asset management and brokerage services.“ He added that there were synergies between their own products and Finam’s plans going forward with WhoTrades. In relation to what they will be offering, Bykov stated that they will be offering algorithmic based signals and are currently working on integrating their existing products for Finam’s multi asset trading client base. Upon fully integrating, Faunus plans to offer “the possibility to copy trades directly, potentially watch them updated live online or customize the strategy using personal robot” within the WhoTrades platform.

Social Trading and Russia

Within the FX industry, social and autotrading has proven to be one of the fastest pockets of growth. The sector includes well positioned firms such as eToro, Tradency, and Zulutrade, as well as a multitude of autotrade solutions built around the Metatrader platform like EAs and PAMM accounts. Russia has been no exception to the global interest, with local brokers citing high rates of usage for PAMM and similar types of accounts. In addition, Zulutrade has proved to be popular in the country, with the country being one the networks most important markets.

Commenting on the role of social trading in Russia, as signal trading and PAMMs dominate the landscape of autotrading, Bykov stated that the “phenomenon of social trading is not limited to geographical means, and is popular in Russia as well.” However, he added that “it is necessary to mention, that there is still huge a amount of people who prefer to subscribe to successful PAMM accounts with verified track record, instead of carefully picking good from day to day traders and following them strictly.” But, he believed there is potential for the combining of social along with algorithmic trading together. On this note, with a diversity of money managers and social traders, WhoTrades is aiming to cater to both users seeking PAMM style money management as well as those interested in true social trading.