This article was written by Marcus Taylor who is the Chief Marketing Officer of TradeSocio.

99% of Brokers Are Undifferentiated in Their Marketing.

Not convinced? Pick a broker at random. Overlay their logo onto another broker's homepage. Design clashes aside, you’ll see how most brokers’ messaging, taglines, and USPs are largely interchangeable.

To make matters worse, most brokers have more-or-less the same strategy on how to acquire traders:

- Buy traffic from Google Adwords

- Engage in media buying

- Attract IBs

- Sponsor a sports team

- Exhibit at tradeshows

This lack of marketing creativity is the root cause of several rising problems in the FX industry. Increasing churn and Acquisition costs, for example, are both rooted in a lack of differentiation.

Marcus Taylor, TradeSocio, CMO

In this article I’m going to explore five powerful techniques for escaping this hyper-competitive landscape and pursue a more creative, growth-oriented, marketing strategy for your brokerage.

1) Acquire Traders Where the Competition Is Not

Earlier this year, I spoke at IFXexpo on how to acquire activated traders for as little as $18.

To put this into perspective, most brokers happily pay $400+ CPAs to acquire a single active trader. Yet, there are ways to acquire these same traders for one twentieth of the cost.

How is this possible? Because most brokers market to traders through the same channels - which inflates the cost of marketing on those channels. When you zig where others are zagging, you can find marketing channels that are not hyper-inflated.

Most marketers in the FX industry currently spend their paid acquisition marketing dollars with Google Adwords and various media buying companies. As such, those channels are so hyper-inflated that CPCs are in excess of $100 for certain keywords.

On the other hand, most FX marketers aren’t using Twitter ads, Facebook ads, or content discovery networks like Taboola and Outbrain. There are even content delivery networks specifically aimed at the financial markets, such as Dianomi - and yet very few FX companies know about them.

From my own personal experiments, these channels (Facebook ads in particular) are a significantly more cost effective way to acquire traders.

2) Plot Your USPs on a Strategy Canvas

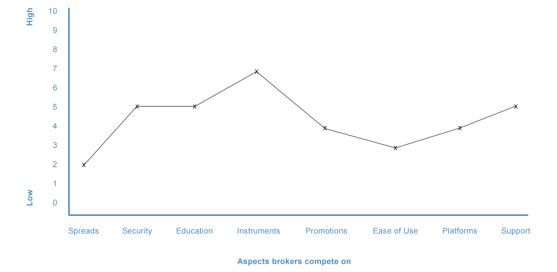

Generally speaking, there are around eight factors that FX brokers tend to compete on from a marketing perspective, which you can see plotted along the X axis of the ‘strategy canvas’, a concept created by the authors of the book ‘Blue Ocean Strategy’, below.

If you take a typical broker and score them from high to low on each point, you’ll likely see a pattern like this:

In other words, most brokers do most things reasonably well. Nothing exceptional, nothing awful.

The problem with this strategy is that it doesn’t align with how people search for products. When searching for an airline, you don’t look for a flight that does an okay job at everything; Okay-ish food, reasonable comfort, and above-average staff.

You look for the cheapest flight. Or the most comfortable flight. Or the shortest flight.

The same is true for traders searching for a broker. Traders search for the most affordable broker, the easiest broker to use, the safest broker etc. Given that some factors are contradictory (e.g. it’s hard to be the simplest broker to use, and also have the largest variety of platforms), it’s important to have a clear-cut definition of what your broker is and isn’t.

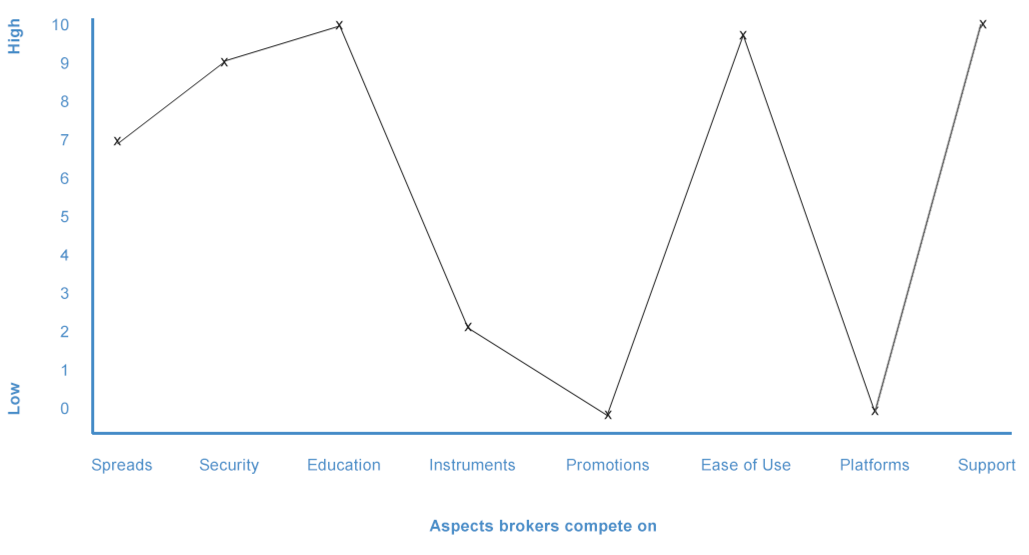

By plotting where your broker sits on each of these points, you can visualise what needs to be changed to make your brokerage stand out. If, for example, you wanted to create a brokerage that was differentiated as being the simplest place to trade for beginners, your strategy may be visualised as shown below.

This hypothetical brokerage doesn’t tout a range of platforms, 1,000+ instruments to trade, or low spreads. They simply offer the best education, support, and ease of use.

When your strategy canvas looks vastly different from the industry norm, you can be sure that your brokerage is positioned differently to the competition.

3) Adopt a Growth Hacker Mindset

Most marketers believe that acquiring more customers costs more money. This is clearly false, given that companies such as Instagram, Snapchat and AirBnB have acquired millions of customer with virtually no marketing budget.

How did they do it? Growth hacking.

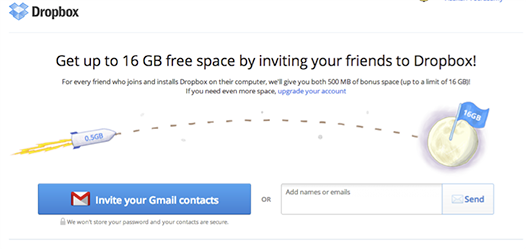

Growth hacking is the art of baking marketing into your product in a way that incentivises your existing customers to promote your product in the places where potential customers might be looking for it. DropBox did this by giving their existing users 500mb of free storage for every friend they invited.

AirBnB did it by automatically posting listing on Craigslist. Hotmail did it by including the line, “PS: I Love You. Get Your Free Email at Hotmail” at the bottom of every email.

So, how do you do this as a broker?

Offering social trading is one of the most effective ways I’ve come across as, unlike normal trading, social trading improves the trading experience as traders invite more of their friends.

There are countless ways to growth hack your brokerage. From prompting traders to share their wins on social networks, to incentivising them to increase the size of their bonus by inviting friends, this is a largely untapped area of opportunity for FX brokers.

4) Turn Your Traders into Your Marketing Team

If each of your traders recommended two friends, and each of those new friends recommended two of their friends, you would achieve exponential growth… for free.

Obviously, this is easier said than done. So, how do you do it? First, you need to understand what motivate people to invite their friends.

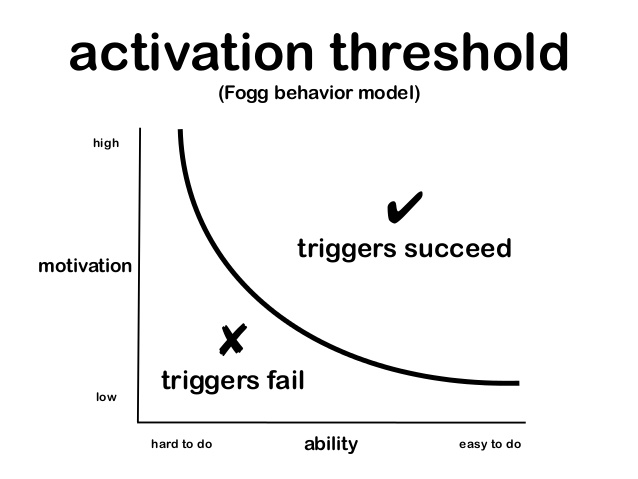

According to the Fogg Behaviour Model, three things are required to make someone do something:

- Motivation

- Ability

- A trigger

If one of these is not present, the action will not take place.

In the context of getting traders to invite their friends, this means that 1) traders must benefit from inviting their friends, 2) it must be easy to do so, and 3) there must be a ‘trigger’ or prompt asking them to do so.

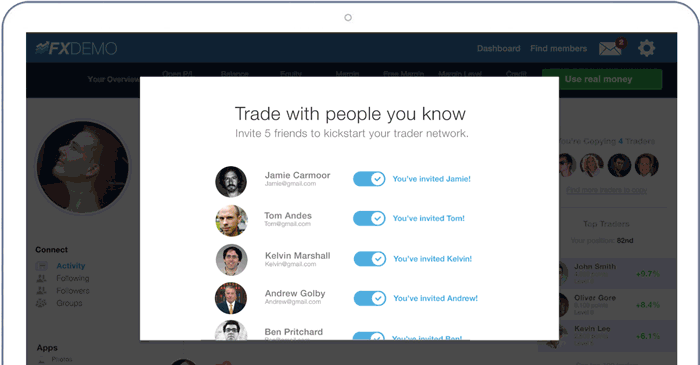

Here’s an example of this in action. Throughout TradeSocio’s platform there are various triggers inviting traders to invite their friends. The user interface has a one-click invite system, making it extremely easy for traders to invite their friends.

To create motivation, two things are done: Firstly, when a trader invites his friends it helps to build his profile - and there’s a chance that his friends might copy him (allowing him to earn commissions on copy trades).

By considering all three points: ability, motivation, and triggers, you can effectively incentivise your users to market your brokerage for you.

5) Stop Targeting the Same Pool of Traders

One of the reasons why marketing to traders is expensive is because everyone is competing over the same pool of traders.

One of the reasons why platforms like Etoro have become so successful in recent years is because they haven't targeted

the existing pool of traders - they created a new market and generated new demand.

From ethically-conscious traders, to wealthy Japanese housewives, and privacy-conscious cryptocurrency traders, there are thousands of latent trader groups with no brokerage directly speaking to them. By tapping into new markets and customer groups you’re able to target and acquire traders in places where no other brokers are marketing their services.

Conclusion: Avoid the Forex Red Ocean

In their book, Blue Ocean Strategy, W. Chan Kim and Renée Mauborgne coined the term ‘blue ocean strategy’ to refer to generating demand in uncontested market space to make competitors irrelevant.

Uber, AirBnB, and Cirque de Soleil did this. Instead of fighting within the existing boundaries of the taxi, hotel, or circus industry, they reinvented those boundaries and generated new demand.

Conversely a red ocean is defined as an existing market where companies try to beat the competition within the accepted industry boundaries.

Forex is a bloody-red ocean.

I hope the tips above provide a useful foundation for steering clear of this over-saturated red ocean and pursue more ambitious blue ocean opportunities.