The Commodity Futures Trading Commission (CFTC) has published its monthly report for February 2018. The report covers data for all FCMs registered as Retail Foreign Exchange Dealers (RFEDs), which includes broker-dealers that hold retail Forex obligations in the US. Overall, domestic deposits rose month-over-month in February 2018 as markets remained more active.

February proved to be the most active period in 2018 thus far, with FX markets benefitting from short-term Volatility and healthy trading ranges. Ongoing political scandals in the US continued to help kindle movement in the USD as well, a recurring trend in 2018. FX activity in the US has notably been improved in February, especially when weighed against last month.

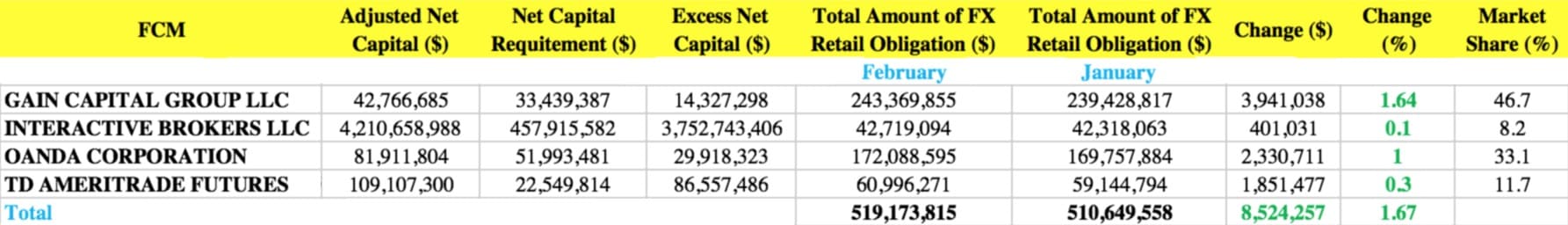

Relative to January 2018, FX funds managed to score a rebound, paring all losses incurred last month. In particular, FX funds held at registered brokerages operating in the US came in at $519.2 million in February 2018, which is $8.5 million higher, or 1.6 percent more than $510.6 million reported in January 2018. This includes data for GAIN Capital, Interactive Brokers, OANDA Corporation, and TD Ameritrade.

The chart listed below outlines the full list of each of the four FCMs that held US retail forex obligations in the month ending on February 28, 2018 – for the purposes of comparison, the figures have been included against their January 2018 counterparts.

According to the CFTC dataset, each of the four FX firms listed saw their respective retail forex obligations grow in February 2017. The best performer for the month, GAIN Capital, saw an overall rise of $3.9 million to $243.4 million at the end of February 2018. This compared to $239.4 million at the end of January or an increase by 1.6 percent month-over-month.

Looking at the market share, the overall distribution of brokers was largely unchanged in February 2018 relative to the month prior. GAIN Capital remains the paramount player in the US market, commanding a 46.7 percent share. This is followed by OANDA Corporation (33.1 percent), TD Ameritrade (11.7 percent), and lastly Interactive Brokers (8.2 percent) respectively.