In the last post we touched on the advantages and disadvantages of exchanges vs. LPs for brokerages. As such, it is becoming abundantly clear that forex brokers must add Cryptocurrencies to their offering. However, the best and fastest way to accomplish this feat is to get Liquidity from a crypto broker-liquidity provider (LP).

IS THIS RELEVANT FOR YOUR BUSINESS? GET LIQUIDITY HERE

[gptAdvertisement]

Crypto broker LP’s either make markets on cryptocurrencies like a CFD or STP all incoming trades to crypto exchanges. Forex Brokers can either go to an STP crypto broker-LP or a market maker. In this article we will compare STP and market marker crypto broker-LP’s. Here is a breakdown of how each method works.

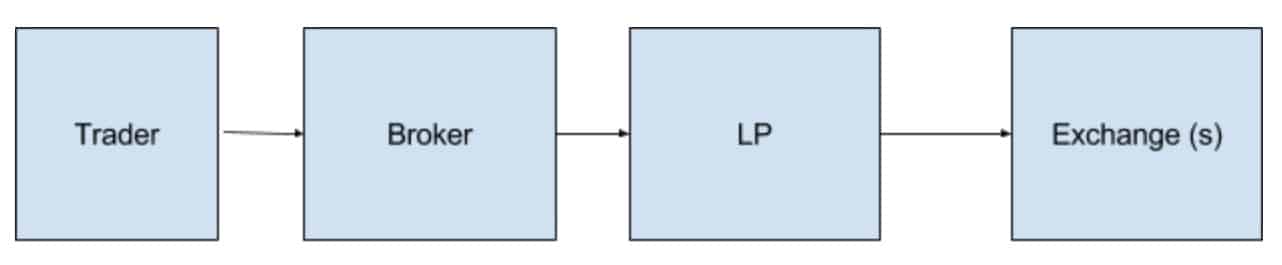

STP’ing

An STP liquidity provider will route orders from their broker clients to the exchanges. They typically automate the order flow to one or more of their exchange partners with little human interaction.

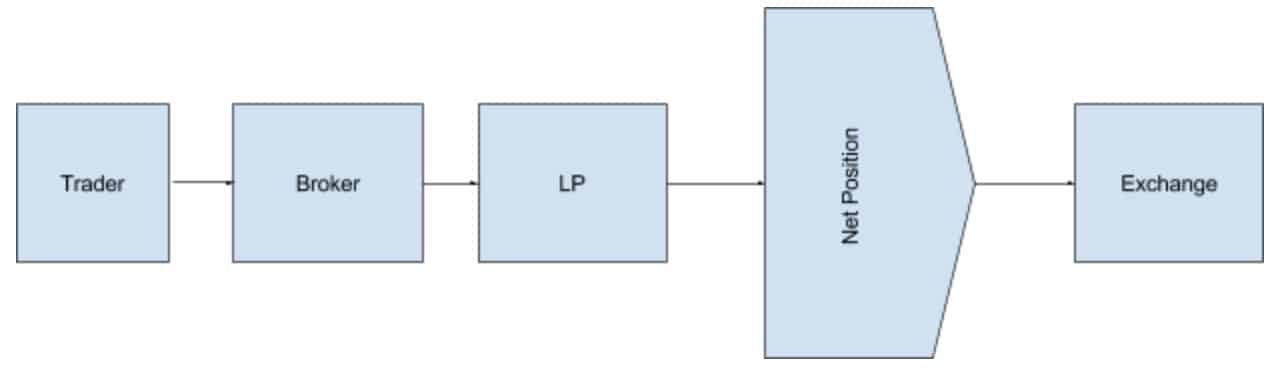

Market Maker Crypto LP

While a market making LP will quote their broker clients on what the market displays and trades are either booked internally or sent out to the market. And just like in FX, the market making (MM) can be the counterparty to a cryptocurrency transaction.

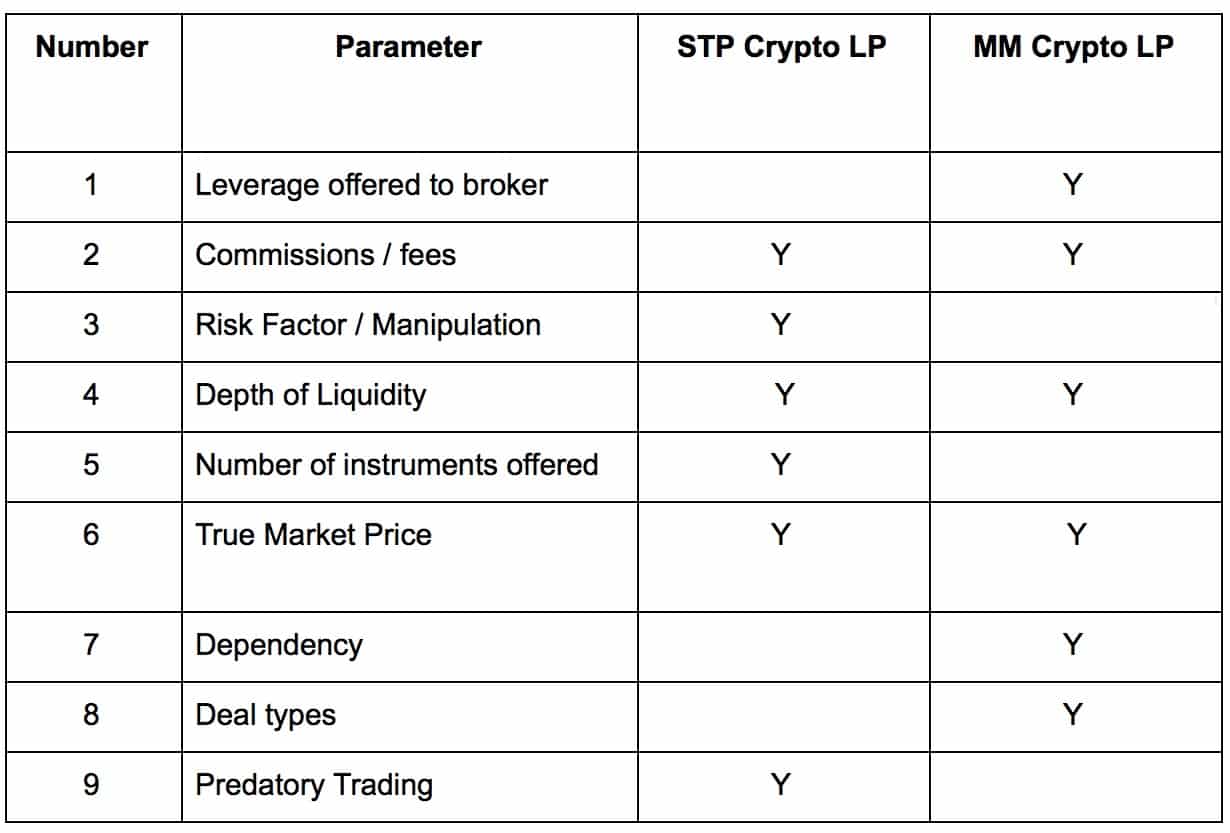

Comparison of STP and Market Maker LPs

The following table lists the important parameters that brokers should be thinking about when choosing the broker LP type they want to work with:

Leverage

In most cases, the market maker will likely offer higher leverage. An STP crypto LP is bound to the leverage offered by their exchange partners. The leverage offered is typically capped at 3:1. The MM crypto LP can go as high as 20:1 in some instances.

Commissions

STP crypto LPs are charged commissions by the exchanges and have to recoup those fees from their broker clients. While market makers make money from their market making activities and don't always need to charge commission. That being said STP LPs may be aggregating multiple exchanges and get a tighter spread than market makers.

Risk

Because cryptocurrencies are a brand new asset class, market maker LPs may have a tough time managing risk due to unexpected events and predatory trading. STP LPs simply pass that risk off to the exchanges.

Depth of market

With STP crypto LPs market depth is decided by the number and size of the exchanges they aggregate. The more exchanges a crypto LP aggregates the more market depth. With market maker crypto LPs you need to pay attention to capitalization and find out what is the maximum trading size they can handle. Bottom line is that you have to get into the specifics with each particular LP that you are planning to use to find out which one will have the best market depth.

Number of instruments

Adding more instruments for a market maker to monitor is always a daunting task. The overhead cost for adding an instrument for a MM LP is quite significant. So most MM LPs keep it simple with offering Bitcoin and Ethereum as their ‘majors’. With an STP LP, they will almost always have more crypto pairs because it’s less a strain on them compared to a MM.

Prices and spreads

The price and spread at an STP crypto LP comes directly from the exchanges they aggregate. A market making LP does not use a true price but can use an index or an average of exchanges. For example the CME now has a Bitcoin index that some market maker LPs use to determine the price they show. When it comes to price and spread you have to compare LPs individually rather than concentrate on their type.

Bitcoin breaks $5,000 in latest price frenzy https://t.co/PVgW1KnHc7 pic.twitter.com/jMs5mw2v4M

— Fortune (@FortuneMagazine) September 4, 2017

STP brokers are typically taking their price from exchanges. Having this dependency can be a negative for the broker clients because exchanges can experience downtime. A MM LP is less likely to have these issues because they are not as dependent on the exchanges for order execution. If one exchange goes down, the market making LP will derive a quote from other sources.

Deal type

Cryptocurrencies can be very volatile. This causes retail traders to lose. Brokers may want to profit from these losses. A market maker LP would be more willing to work with a broker on a revenue sharing basis. This can create opportunities for more lucrative deals depending on your client type.

Predatory Trading

Because cryptocurrencies are a new instrument prices for the same instrument vary from broker to broker and exchange to exchange. For example, Bitcoin can be priced at 3494 at one exchange and 3500 at another. Predatory traders will try to take advantage of these price differences. If you have fast connectivity technology and use an STP crypto LP you will be less likely to be in harm’s way. Whereas with a market maker it can lose to predatory traders because it is trading against them.

Nekstream Recommendation

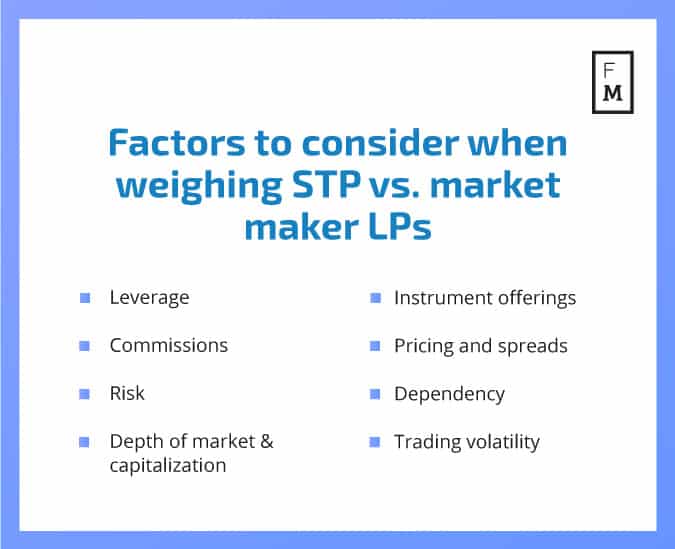

Both STP and market making crypto broker-LPs have their advantages and disadvantages. In a perfect world, we suggest that you aggregate multiple crypto broker-LPs into your connectivity solution (aggregator) and offer your clients an aggregated feed of STP and MM LPs. This way you hedge yourself from the risks of each LP type.

If you are planning to go with just one LP you want to look at its specific parameters. Here is the breakdown of the questions you want to ask to each LP type when making your decision.

For market makers you really want to focus on their size and capitalization, pricing and deal type and how they plan to deal with predatory traders. For STP broker LPs you want to focus on the number and the quality of the exchanges that they aggregate and the speed of their technology.

Alex Nekritin is the Managing Director of Nekstream Global, a liquidity and technology consulting company helping brokers, HFT traders and money managers to find proper liquidity and tools for their ventures. Alex has over 10 years of experience in the financial space. Contact Alex at info@nekstream.com.