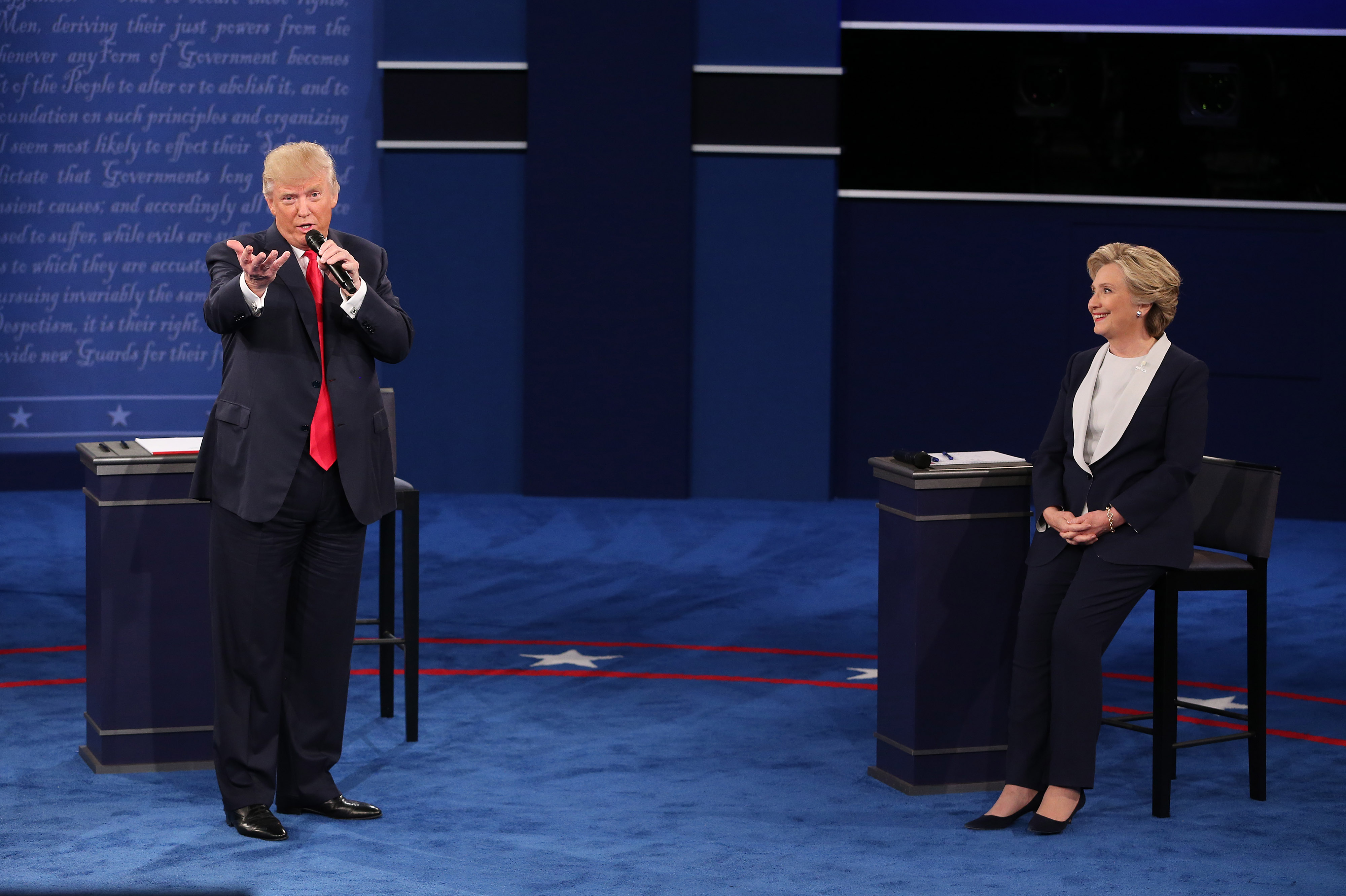

Foreign exchange brokerages, along with the broader financial industry, are eyeing the US election next week on November 8, 2016 in what could be one of the most volatile trading events of the year. As recently as last week many pollsters were predicting an electoral landslide for Hillary Clinton, however the dynamic of the race has changed dramatically.

Don't miss your last chance to sign up for the FM London Summit. Register here!

Presently there exists the potential for an upset win, namely a Donald Trump victory, which could instigate a wide range of volatility. As a result, brokers are implementing margin changes ahead of the US election, which will last from Monday November 7, 2016 to Friday, November 11.

Alpari is the latest such broker, adopting several margin changes as of November 7th. All standard.mt4 and pamm.standard.mt4 accounts will see a maximum floating leverage will be 1:100. In addition, all ecn.mt4, pamm.ecn.mt4, pro.ecn.mt4, pamm.pro.ecn.mt4, ecn.mt5, and pamm.ecn.mt5 accounts will utilize a maximum floating leverage of 1:50.

For Alpari nano.mt4 accounts, market participants will be governed by a maximum order size of 10 lots and the maximum leverage will be 1:100. Additionally, for standard.mt4 and nano.mt4 accounts – the limit and stop levels will be equal to two spreads. However, in the case of extreme high volatility and Liquidity constraints, instruments may only be set to close only.

With regard to binary options, between November 7th and 8th, the strategies 'Touch' and 'Spread' may also potentially be unavailable in alpari.binary accounts. This compares with many other measures and offerings established by other brokers, which are displayed below:

OctaFX: From October 31 till November 14, leverage for US30, NAS100, SPX500 indices will be lowered from 1:50 to 1:10 on the Metatrader 5 Trading Platform .

Saxo Bank: Margins on most major FX pairs up to 2%-3% with RUB and MXN going to 10% and 15% respectively, while the minimum margin requirement on CFD indices at 4% based on market volatility and liquidity leading up to and through the election.

FXOpen: The company may increase margin requirements up to 5 times their normal level starting from November 3rd without prior notice.

FOREX.com also warned temporary changes to the clients’ accounts which may include, but are not limited to, updates to margin requirements in the days leading up to and after the vote.

ETX Capital has launched a new US Election News Sentiment Index to help better predict what the final electoral result will be on November 8, 2016.

Swissquote Bank launches a new fintech solution to allow clients invest in a selection of stocks or currency portfolios which are most likely to be impacted by a victory from either candidate.