As we approach the end of June, we are reminded of the stagnant Volatility during the month of May and of dismal FX trading volumes reported by leading Forex brokerages (particularly in Japan). This month has started rather promisingly, with the European Central Bank (ECB) releasing a very dovish message to the markets, cutting deposit rates into negative territory and pledging more on the line. There has been a huge spike in expectations for trading activity to pick up.

After the initial message by the ECB was heard and digested, the EUR/USD has settled into a new, lower range of about 140 pips - trading between 1.3510 and 1.3650. While we have seen vibrant activity for a couple of days after the monetary policy decision was taken, short-term volatility has entered a new phase of consolidation. With no signs of the Federal Reserve (FED) taking action to end its bond purchasing program quicker than markets are currently expected and with the release of the FED's new economic projections, more stagnant volatility is warranted.

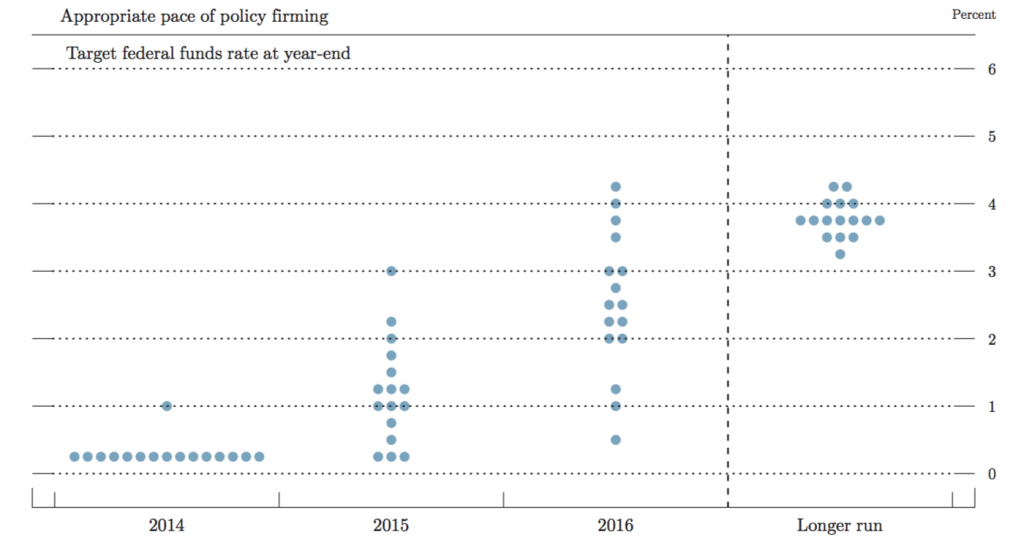

Looking at the Federal Reserve's economic outlook, we will turn the attention of our readers to the central economic projections and the projected path for interest rate moves going forward. As we can see from the chart named "Appropriate pace of policy firming," the pace of rate hikes by the US central bank is likely to be particularly slow during this cycle. The vast majority of policy makers are expressing a view that the Federal Reserve's FED funds rate will finish 2015 at 1.25%, while half of the Monetary Policy Committees' members are expressing a view that by the end of next year we will only see 1% fed funds rates at most.

Appropriate Pace of Policy Firming, Source: Federal Reserve Staff Macroeconomic Projections

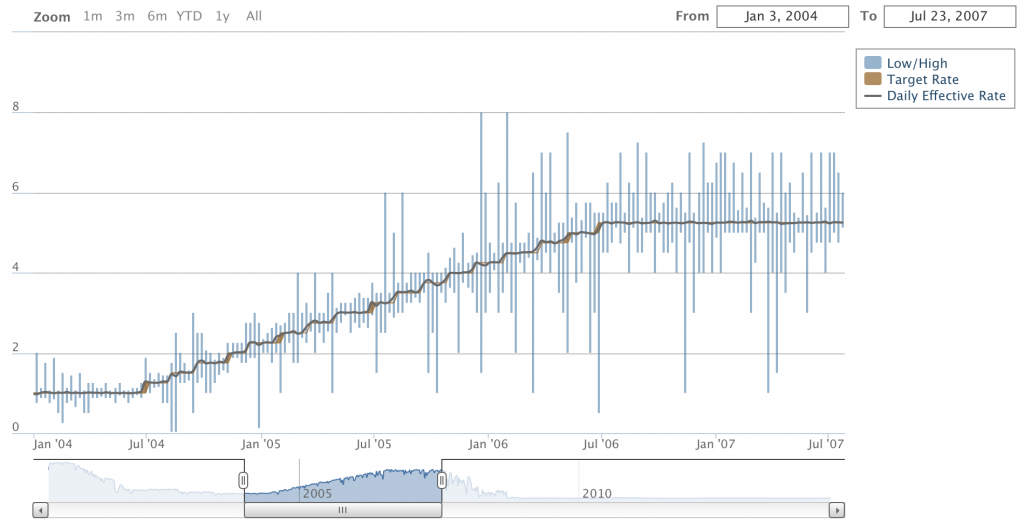

While when compared to the FED, the ECB's key interest rate is very likely to remain even lower, the Euro Zone's central bank doesn't have the vast weight of the Federal Reserve's balance sheet on its shoulders. Continuing to 2016, the vast majority of the FED's MPC considers somewhere between 2 and 3% to be the appropriate fed funds target rate. So if we go back to mid 2004 when the previous Federal Reserve tightening cycle started, we observe that the pace, this time around, is highly likely to be even slower than the protracted move from 1 to 5.25% between 2004 and 2006.

Previous FED Tightening Cycle, Source: New York Fed

At that point in time the Federal Reserve had been tightening policy by 25 basis points at every meeting. If we extrapolate a similar strategy today, that would mean at least 2% fed funds rate by the end of next year, assuming that the US central bank was to start moving its lever at the beginning of 2015.

So as the battle of the doves across the Atlantic unfolds, traders are very unlikely to see a clear "winner" between the two major central banks. According to the ECB's staff, macroeconomic projections released after their latest Monetary Policy meeting in the beginning of June has assumed a EURUSD exchange rate in 2015 and 2016 around 1.38. That said, the central banks have not been the best predictors of pretty much anything related to the economy, and their standard deviation models can be taken with a grain of salt.

Nevertheless we are not likely to see a big move in the EURUSD before a substantial turn in monetary policy at the FED, or much more drastic easing measures by the ECB. While the start of easier monetary policy and the use of unconventional monetary policy tools has been given, Mr. Draghi will have to stick to his guns if he wants to reinvigorate dwindling growth across the Euro Zone through a lower exchange rate, which could give a break to the peripheral economies across the Euro Area, with France rapidly becoming one of them.

Meanwhile the Bank of England has been the first major central bank, which signaled that it may start raising rates before the end of 2014. The hint in a speech by Marc Carney has triggered the biggest trading volumes in GBPUSD trading seen this year, however, since the effect of the news has started waning, the British currency has started giving some ground away. With the Bank of Japan staying pat for the foreseeable future, the monthly ECB press conference seems to be establishing itself as the most valuable economic event in terms of information, hence volatility and volumes.