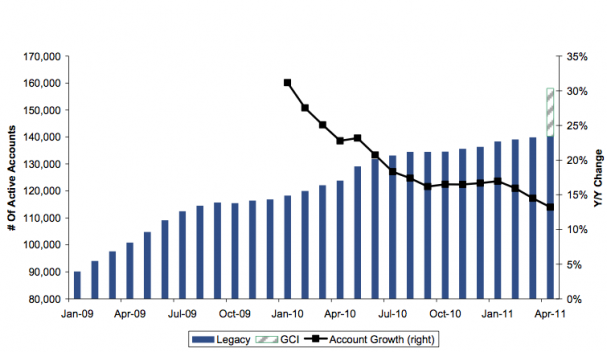

On the heels of the much hyped post aptly titled "That Currency Broker That's Plastered All Over CNBC Only Added 370 Organic Accounts In April" and which coincided with FXCM's 25% drop in value within 2 days from publishing its 2010 yearly and Q1 2011 quarterly reports I decided to do some more in-depth data mining of my own. All the noise around this focused on the following basic chart which showed slowing FXCM's growth in terms of accounts. However this chart, just like many charts out there, doesn't tell the whole story. For instance, it doesn't compare FXCM's numbers to other brokers (like Gain) and while it ignores the effect of GCI (because it's not organic) it doesn't ignore the effect of ODL (May 2010) which too wasn't organic - so in a way this chart compares apples to oranges.

In general I think that Wall Street still doesn't understand this industry and spends more time digging in month to month numbers than realizing the general trend - which is highly positive. This analysis also helped FXCM's owners make a killing - they bought for $9 what they sold for $14 only six months ago.

It's also interesting to compare this to another highly hyped IPO - last week Linkedin went public but on less revenue (and on forecast that it'll actually lose more money next year) it was valued at over $4 billion, rising 110% on first day of trading - simply because social networks is the new buzz word. Once again Wall Street proves that fundamentals and market value can be two very different things.

This chart speaks for itself and without any doubt the trend isn't a very positive one - FXCM's growth is indeed slowing down. However there are several important factors this chart fails to mention:

- FXCM's high growth is attributed mostly to its acquisitions and White Label deals

- in January 2009 FXCM has acquired US retail Forex businesses of ODL and Hotspot

- in May 2009 FXCM acquired US retail forex business of i-Trade FX

- high May 2010 growth is attributed to the acquisition of ODL Group

- in October 2010 CFTC introduced Leverage restrictions decreased available leverage to 1:50 on majors and 1:25 on minors

Bottom line is that FXCM is still growing in terms of accounts though in slower paces than earlier. This is probably both due to increased competition and leverage restrictions which impact global competitiveness with other brokers. On the other hand FXCM continues to grow thorough acquisitions and has grown over 75% in terms of accounts since January 2009. While total number of accounts is growing, FXCM's average retail trades and retail volume are dropping at a slow pace - figure 1.

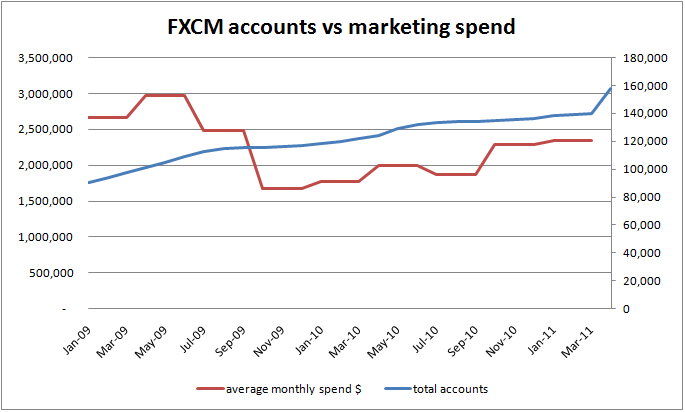

FXCM's Marketing and Advertising budget has been decreasing over the years and it is clearly affecting the new accounts growth. Data for marketing spend is available only on quarterly basis so I had to divide it by three to represent an average monthly spend for each quarter. It's interesting to note that when testing correlation between number of accounts and marketing budget the result is -0.5. This means that number of accounts and marketing budget are negatively correlated however while number of accounts is on the rise the marketing budget is dropping this means they are directly (but not perfectly) correlated. Which we all know makes a lot of sense.

Lastly, it's interesting to compare FXCM's numbers to Gain's. These are the only two public retail forex brokers and only they publish the data we need on a consistent basis. Though there's not much clarity whether definition of accounts is identical or not we can still see the overall trend. When testing correlaction between number of accounts for both brokers we get a positive 0.78 figure, which means almost a perfect correlation - when FXCM grows so does Gain and vice versa. Unfortunately data for Gain's funded retail accounts is only available since April 2010 - figure 3. This chart also shows all the events that affected the accounts growth (and drop) for both brokers.

The overall trend speaks for itself for both brokers. Or maybe it doesn't? Depends on what you are looking at.

- FXCM accounts growth spiked in May 2010 due to the acquisition of ODL Group. The growth was then flat until the year's end amid the CFTC leverage restrictions. GCI's acquisition rallied the growth once again in April.

- Gain's accounts growth was flat until the acquisition of CMS Forex in October 2010 which made similar impact to its growth as FXCM's GCI acquisition. Afterwards the trend was again flat until the loss of Tradestation and the acquisition of dbFX. dbFX contributed 1650 accounts while Tradestation cost Gain 4873 accounts. Thus Gain has suffered a considerable loss of accounts in April-May 2011.

- But if looking at total Gain's Client Assets then Gain is growing nicely, whether through acquisitions or organically - dbFX's accounts added much more than what was lost to Tradestation.

To sum this up, there's no chart that can show the whole picture which is quite complex. Investors and others should consider multiple factors and not just one (number of accounts) before making a decision to drop the stock.

Grab your latest copy of the Forex Magnates Retail Forex Industry Report for Q1 2011.