Update: more details of the ODL acquisition have surfaced, read about it here.

FXCM, arguably the largest broker in the world in terms of volume, has just announced plans to go public in the US. It would be interesting to see FXCM actually complete the IPO unlike Gain, one of FXCM's largest US competitors (FXCM's announcement comes exactly 12 months after Gain's, how ironic). These news come amid FxPro's potential IPO on London's AIM. After August draught, the forex news market is back with a bang!

Calculating FXCM's deal with ODL (3.5% of FXCM's shares in exchange for 100% of ODL's shares valued at $23.6m) it seems that FXCM is valued at about $676 million (much lower than the rumored $1.5 billion figure). FXCM's 2010 income is going to be about $95-100 (ODL's is losing money, a lot of it actually) which gives only a x6-7 multiple to this deal. Pretty low if you ask me although FxPro is priced using exactly same multiples so this must mean something.

In a recently submitted forms FXCM says is looking to raise $200m (value and use of proceeds still unavailable) and disclosed the following facts, amongst many others:

Income:

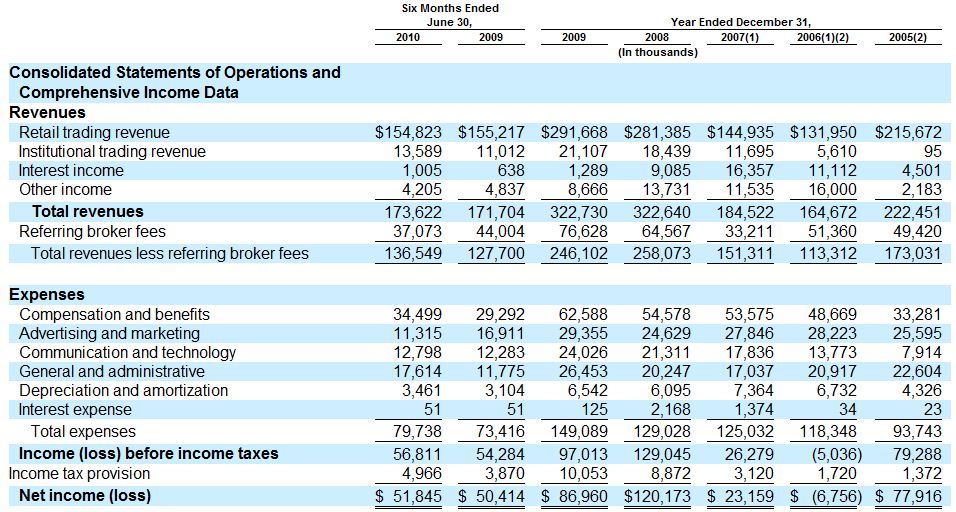

- revenues 2010- ~$350 million (first half of 2010, income was $173 million)

- revenues 2009 - $322 million

"Our income before income taxes has grown from $5.4 million in 2001 to $97.0 million in 2009, a CAGR of 43.5%. Our revenues less referring broker fees were $136.5 million and our income before income taxes were $56.8 million in the six months ended June 30, 2010, as compared to $127.7 million and $54.3 million, respectively, in the six months ended June 30, 2009."

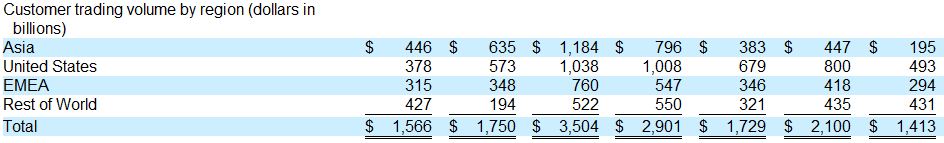

Volume:

- $261 Billion/monthly, far from the self reported volume of $365 Billion/monthly. For the first 6 months of 2010 total traded volume was $1,566 billions.

Agency Model:

- "Our agency model is fundamental to our core business philosophy because we believe that it aligns our interests with those of our customers, reduces our risks and provides distinct advantages over the principal model used by the majority of retail FX brokers. In the principal model, the retail FX broker sets the price it presents to the customer and may maintain its trading position if it believes the price may move in its favor and against the customer. We believe this creates an inherent conflict between the interests of the customer and those of the principal model broker. Principal model brokers’ revenues typically consist primarily of trading gains or losses, and are more affected by market volatility than those of brokers utilizing the agency model. We also believe that regulators in certain jurisdictions have been implementing requirements in a manner that may be more favorable to FX brokers utilizing the agency model as compared to those utilizing the principal model."

Offices and Regulation:

- "Our operating subsidiaries are regulated in a number of jurisdictions, including the United States, the United Kingdom (where regulatory passport rights have been exercised to operate in a number of European Economic Area jurisdictions), Hong Kong, Australia and Dubai. Upon the completion of our acquisition of ODL Group Limited, or ODL, a U.K.-based FX broker, which is expected to close in September 2010, we will also be regulated in Japan." (What about FXCM Japan then? - MG).

- "For the six months ended June 30, 2010, approximately 76% of our customer trading volume was derived from customers residing outside the United States."

- "Trading volume for 2009 with customers resident in jurisdictions in which we are not licensed or authorized by governmental bodies and/or self-regulatory organizations was in the aggregate about 55% of our total customer trading volume. " (would China be one of those regulations? - MG).

- "The Canadian regulatory environment with respect to FX products is complex and evolving and subject to provincial and territorial differences. Although we are not currently subject to regulatory proceedings, our FX trading services may not be compliant with the regulations of all provinces and territories in Canada. We may be required to register our business in one or more provinces or territories, or to restructure our Canadian activities to be in compliance. Any such restructuring could negatively impact our profitability because, among other things, we may be required to share a portion of our revenue."

- Dodd-Frank: "The impact on us of these new regulations, which will become effective on October 18, 2010, is uncertain. However, the inability to offer customers who are U.S. residents leverage in excess of 50-to-1 (as compared to 100-to-1 previously) may diminish the trading volume of these customers which may affect our revenue and profitability."

Branding and Marketing:

- "We believe that the FXCM brand is one of the most well-known, global brands in the retail FX industry, built through over $146 million in brand advertising expenditure since 2005.

- "In 2009, our web properties attracted over 2.2 million unique visitors and 19 million page views per month, as measured by Omniture, a web Analytics application service. Among our most popular web properties is DailyFX.com, our research and news site that is staffed by a team of nine full time analysts who produce over 30 articles a day in three languages which are syndicated on over 80 sites globally, including Thomson Reuters and Yahoo!® Finance. "

The new structure:

- "FXCM Inc. was incorporated on 10th August 2010 and its sole asset will be a controlling equity interest in FXCM Holdings, LLC. FXCM Inc. will operate and control all of the business and affairs and consolidate the financial results of FXCM Holdings, LLC and its subsidiaries. "

Refco impact and other IBs/WLs:

- "In 2005, a shareholder and white label (presumably Refco - MG) (a firm that offers FX trading services to their customers on our platform under their own brand in exchange for a revenue sharing arrangement with us) of FXCM declared bankruptcy, at the time representing approximately 40% of total revenues, resulting in a significant disruption in the business that led in large part to the reduction in revenues and the loss recorded in 2006. "

- FXCM's largest IB accounts for 4% of its total volume, I wonder who that is?

- "For the six months ended June 30, 2010, revenue generated through our white labels represented 2.7% of our total revenue, and our largest white label relationship represented 2.5% of our total revenue." (that's probably dbFX - MG).

- South Korea: Retail trading revenue decreased $0.4 million or 0.3% to $154.8 million for the six months ended June 30, 2010 compared to the six months ended June 30, 2009. Retail trading volume decreased by 11%, 90% of the decline was due to lower trading activity from our South Korean referring brokers. In April 2009, new regulations were introduced that required South Korean referring brokers to trade with at least two FX brokers or market makers resulting in less trading activity from referring brokers with which we had previously an exclusive relationship. In September 2009 margin requirements were increased, which also had a negative impact on volume. As a percentage of total volume traded, South Korean customers, which had accounted for 18% of our volume for the six months ended June 30, 2009, declined to 11% for the six months ended June 30, 2010.

Deposit methods:

- Over 81% of FXCM's customers deposited funds using credit cards. (that's pretty high, but probably because FXCM doesn't work with various e-wallets - MG).

Competition:

- We face significant competition. Many of our competitors and potential competitors have larger customer bases, more established brand recognition and greater financial, marketing, technological and personnel resources than we do which could put us at a competitive disadvantage. Additionally, some of our competitors and many potential competitors are better capitalized than we are and able to obtain capital more easily which could put us at a competitive disadvantage.

- U.S. based retail FX brokers: In the U.S. market, our primary competitors are Gain Capital Holding LLC, Global Futures & FX, LLC and OANDA Corporation. They are well capitalized, have their own technology platforms and are recognizable brands. All of these firms operate using the principal model. We also compete with smaller retail FX brokers such as Capital Markets Services, LLC, FXDirectDealer, LLC and InterbankFX, LLC. These firms, to date, have not been our core competitors due to their smaller size, technology and marketing limitations. With the exception of InterbankFX, all of these firms operate using the principal model.

- International multi-product trading firms: Outside the United States we compete with firms such as Saxo Bank, CMC Group, IG Group Holdings plc and City Index Limited. Other than Saxo Bank, the international firms tend to focus on CFDs and spread betting and derive less than 50% of their revenues from retail FX.

ODL Acquisition (lots of interesting details here):

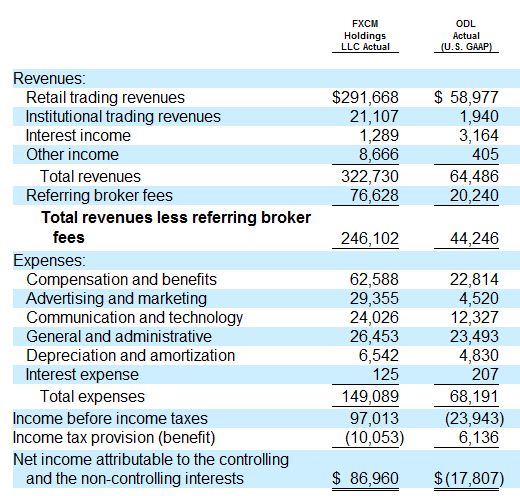

- "On May 1, 2010, we signed a purchase agreement to acquire a 100% voting and equity interest in ODL subject to certain conditions precedent, with the acquisition expected to close September 2010. The purchase price shall be a 3.5% equity interest in FXCM Holdings, LLC (“Initial Consideration”) and an additional equity interest in FXCM Holdings, LLC if ODL earns greater than $20.0 million up to a maximum of a 3.5% additional equity interest in FXCM Holdings, if ODL earns $40.0 million in the twelve month period ending June 30, 2011 (“Contingent Consideration”)."

- Basically FXCM gave 3.5% of its shares for the projected ODL's value of $23,682,000 and further, conditional 3.5%, for $24,361,000. This values FXCM at $676 million at the time of ODL's acquisition. I do not expect the IPO value to be much different as any increase in value within short time period would be difficult to explain to investors.

- ODL turns out to be a losing business (very much explains this deal), it had lost over $17 million in 2009 alone.

Converting demo to live:

- "In 2009, 713,048 demo accounts were opened, a growth rate of 89% over 377,150 demo accounts opened in 2008. Of these demo accounts, 107,648 or 15% were converted into tradeable accounts."

Employees:

- "As of June 30, 2010, we had a total of 678 full-time employees and 57 full-time contractors, 515 of which were based in the United States and 220 of which were based outside the United States."

- Key employees:

| Name | Age | Position |

| Drew Niv | 37 | Director and Chief Executive Officer |

| David Sakhai | 37 | Director and Chief Operating Officer |

| William Ahdout | 44 | Director |

| Kenneth Grossman | 38 | Director |

| Eduard Yusupov | 39 | Director |

| Brendan Callan | 31 | Managing Director of Sales and Client Services |

| Robert Lande | 47 | Chief Financial Officer |

| Ornit Niv | 34 | President — International Operations |

| Andreas Putz | 50 | Managing Director and Global Head of FXCM Pro |

| James Sanders | 49 | Chief Compliance Officer |

| David S. Sassoon | 39 | General Counsel |

- "Drew Niv, a director and our chief executive officer, and Ornit Niv, our president of international operations, are siblings. David Sakhai, a director and our chief operating officer, and William Ahdout, a director, are cousins. There are no other family relationships among any of our directors or executive officers."

- "Niv and Sakhai receives guaranteed cash Payments of $1,020,000 per year. These payments have served the same function as the base salaries that we pay to our other named executive officers."

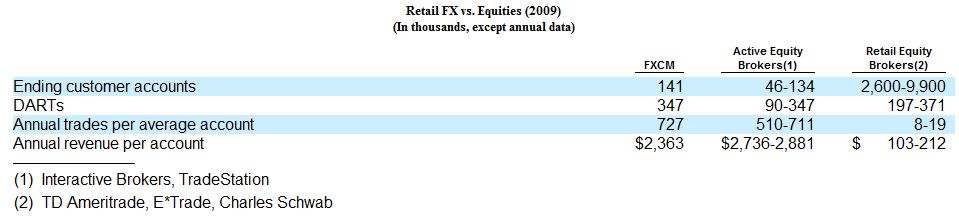

Relative profitability:

- It seems that FXCM (and probably most forex brokers) are no less profitable than other equity/futures brokers. In fact, FXCM makes $2,363 a year out of an average client.