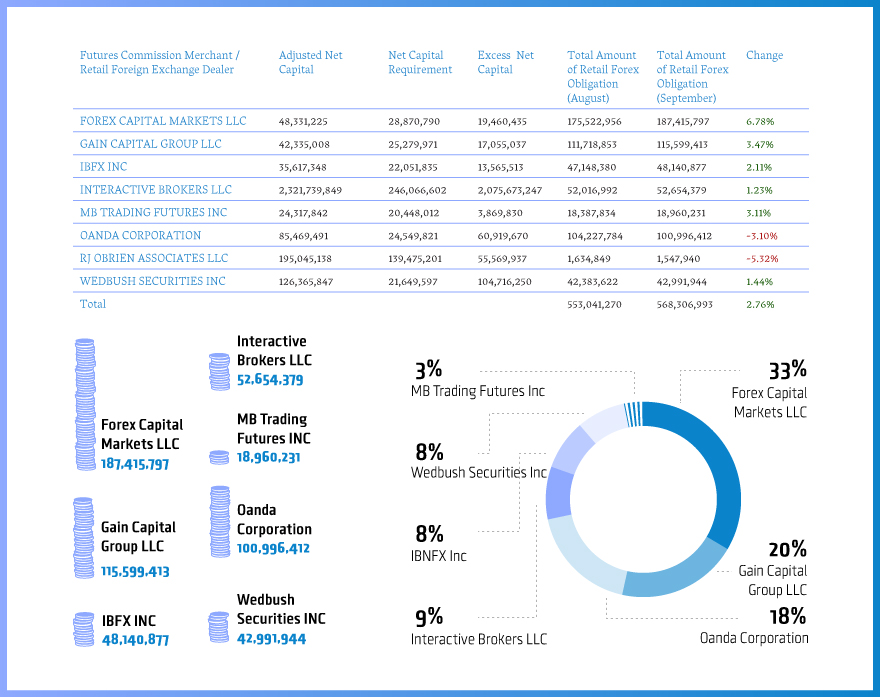

The U.S. Commodity Futures Trading Commission (CFTC ) has published the latest data gathered from futures commission merchants (FCMs) and retail foreign Exchange dealers (RFEDs). The companies are obligated to file monthly financial reports with the CFTC's Division of Swap Dealer and Intermediary Oversight (DSIO).

Several months after the Swiss National Bank disaster affected the market share of FXCM Inc (NYSE:FXCM), the company continues to rebound. With the total deposits of retail traders rebounding somewhat to $568.3 million, the main take away from the numbers is that the biggest retail brokerage by client assets in the U.S. is on the right track.

After July's slump across the industry, the total amount of deposits held at FXCM Inc (NYSE:FXCM) fully recovered in August, posting an increase of 6.8 percent. The figures of GAIN Capital (NYSE:GAIN) have also been positively impacted with the company coming back very close to levels seen after last month’s 3.6 percent decline.

The total figure for all retail brokers operating in the U.S. rebounded by 3 percent, lower in nominal terms than the decline registered after the August figures. Back then the total amount of client funds decreased by 7.4 percent.

While the publicly listed counterparts in the retail foreign exchange industry have rebounded, OANDA was the top loser when it came to September data. The deposits held by the brokerage's clients decreased by another 3 percent after a 4.3 percent decline in August.

This has also resulted in the company losing some market share to FXCM Inc (NYSE:FXCM) and GAIN Capital (NYSE:GAIN). FXCM has gained the most with about 33 percent of the deposit holdings, with GAIN Capital remaining in second place with 20 percent, and OANDA trailing close in third spot with 18 percent.

Looking at the smaller participants, Interactive Brokers, IBFX and Wedbush Securities are trailing with less than 10 percent of the market each.