James Brown, Presiding Independent Director of FXCM, has filed a notice to the Securities and Exchange Commission (SEC) a notice of change of beneficial ownership or acquisition, a procedure which, under the Securities Exchange Act of 1934 is a legal requirement for any individual or organization holding more than 5% of company securities, and wishes to purchase or sell such equity.

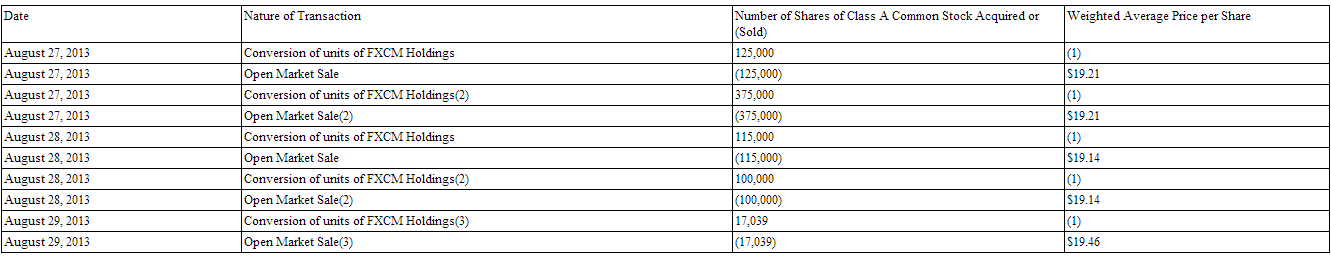

Mr. Brown’s filing to the SEC, details that he has disposed of 732,039 of Class A Common Stock, representing a significant proportion of the 1,273,075 shares of Class A Common Stock of which Mr. Brown was the custodian.

The stock was sold at an average price of $19.19, for a total value of $13,720,850, subsequent to which the director now directly owns 100,000 shares of the company’s stock.

The firm announced its quarterly results on August 7, in which it was disclosed that it had achieved $140.1 million in revenues, an all-time high and 53% above the same period last year.

US GAAP net income during the quarter was posted at $10.1 million, or $0.32/share. The income gains, compare to a loss that was announced in 2012. In addition, FXCM announced that revenues per million dollars traded was at $90, as the figure climbed back into the broker’s expected range of $90-100. The revenue figure compares to $88 last quarter.

On Friday, September 6th, investors are expected to be paid a dividend of $0.06 per share. This represents a $0.24 annualized dividend and a dividend yield of 1.21%. The ex-dividend date is Wednesday, September 4th.

The stock now held by Mr. Brown is composed of the following: 100,000 shares of Class A Common Stock, 219,865 units of FXCM Holdings LLC (FXCM Holdings), which are exchangeable for shares of Class A Common Stock on a one-for-one basis pursuant to the Exchange Agreement, and 32,563 currently exercisable options to purchase Class A Common Stock, all of which are held directly, 477,821 units of FXCM Holdings, which are exchangeable for shares of Class A Common Stock on a one-for-one basis pursuant to the Exchange Agreement held by a trust for the benefit of Mr. Brown’s family, for which Mr. Brown’s wife is trustee (Brown Family Trust).

The portfolio also includes 222,961 shares of Class A Common Stock held by the limited liability company of which Mr. Brown serves as manager (Brown LLC), and 219,865 units of FXCM Holdings, which are exchangeable for shares of Class A Common Stock on a one-for-one basis pursuant to the Exchange Agreement held by the Brown LLC.

Aside from his independent directorship at FXCM, Mr. Brown is a founder and managing partner of Long Ridge Equity Partners, since 2007.

Long Ridge Equity Partners is a private equity fund specializing in financial services investments. He has been a managing director of TH Lee Putnam Ventures since 1999, a $1.1 billion private equity fund affiliated with Thomas H. Lee Partners and Putnam Investments.

Before joining TH Lee Putnam Ventures, Mr. Brown served as a Senior Vice President at GE Equity, where he was responsible for strategic and financial investments in technology and financial services companies. He has been an investor in financial services companies for over a decade.

As a result of the disposal of his FXCM assets, as of August 27, 2013, Mr. Brown ceased to be the beneficial owner of more than five percent of the shares of Class A Common Stock.

Full Details of James Brown's Sale of FXCM Assets