The Japanese retail Forex subsidiary of Rakuten Securities, today announced new margin requirements that will take effect on June 20th 2016 ahead of the UK referendum next week, according to an official corporate announcement.

The company noted that on June 20th at 6am (Tokyo) there could be a forced settlement or close-out of client’s positions if they fall short of the new margin requirements that the company outlined in its announcement ahead aimed to reduce leverage ahead of expected market volatility surrounded the Brexit vote.

Change at start of Brexit week

The time of 6am Monday in Tokyo corresponds to 5pm Sunday in New York - which is considered the start of the trading week for most brokers globally (plus or minus 30 minutes) as markets first open in Asia.

Finance Magnates has covered a number of brokers in recent days who have joined in preparing to help reduce client's exposure - and in some cases their own - by hiking margin requirements, and imposing various trading restrictions during the entire Brexit week and/or days preceding and following it.

GBP-related pairs affected

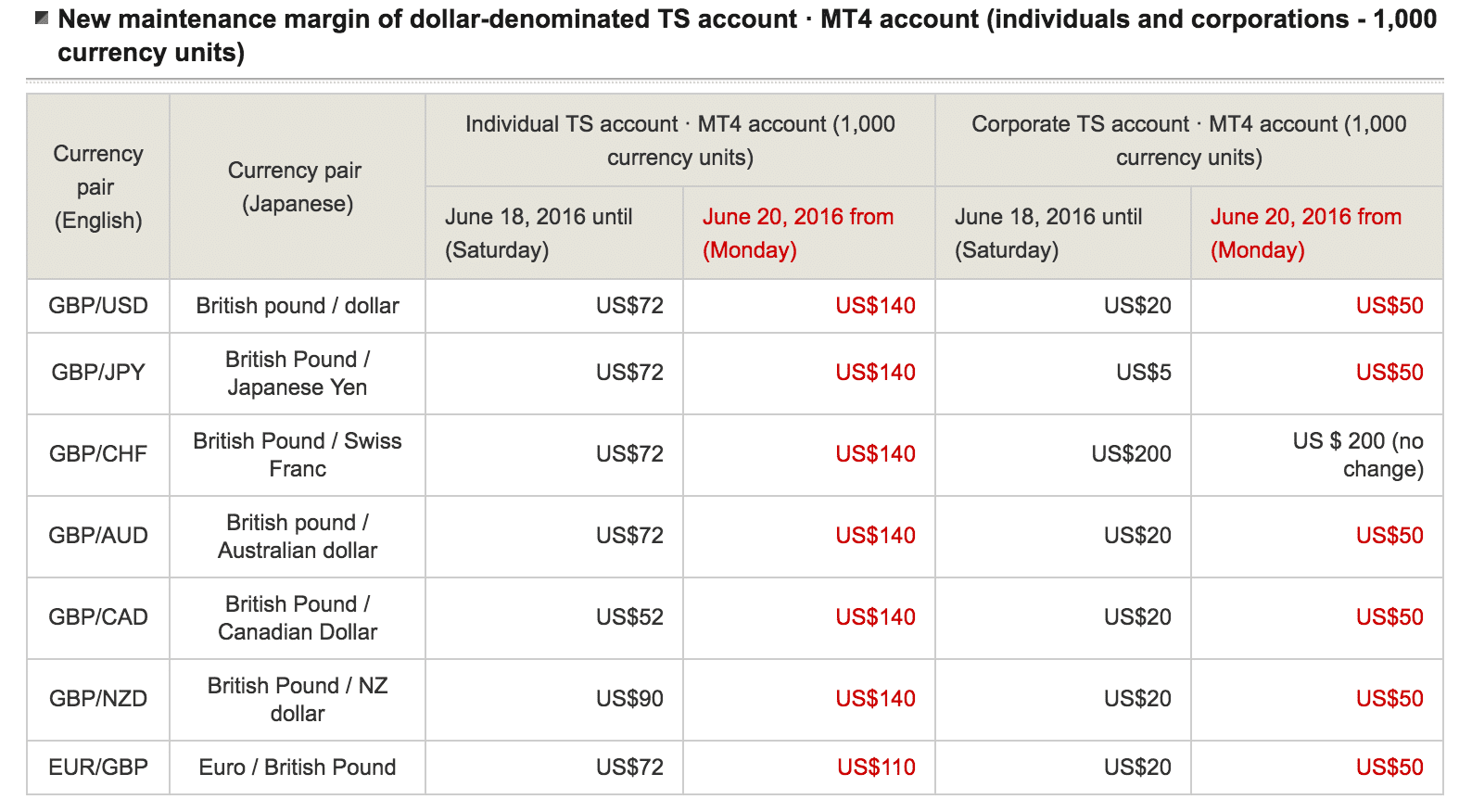

For clients of Rakuten Securities, the margin rates on corporate and individual accounts, have their margin rates set to nearly double once the margin changes go into effect across all GBP-related pairs including GBP/USD, GBP/JPY, GBP/CHF, GBP/AUD, GBP/CAD,GBP/NZD, and EUR/GBP. The changes are expected across both USD-denominated accounts and accounts based in JPY.

FXCM Japan noted in the announcement that in anticipation of the vote on June 23rd, and immediately after the exit poll of the referendum, there may be sudden market changes including to stop-loss order fill rates as a gap could occur.

Accordingly, the company emphasized that losses could exceed the amounts on deposit in client accounts, including in GBP-related pairs, as it appears that any trades held during this time could be subject to such conditions and should be adjusted accordingly.

An excerpt of one of the tables provided in the announcement for USD-based accounts can be seen below, translated from Japanese:

Source: Rakuten Securities