Globally oriented online foreign Exchange and CFDs brokerage FXCM Inc (NYSE:FXCM) has issued an announcement highlighting that the company is preparing to transfer its listing on the NASDAQ. The firm became listed on the New York Stock Exchange (NYSE) back in December 2010, raising $211 million.

The official announcement made by FXCM Inc (NYSE:FXCM) states that the last day of trading on the NYSE will be the 23rd of September. The next trading day for global markets is Monday the 26th of September, which will see the listing of the company’s shares on NASDAQ.

Commenting on the announcement, the CEO of FXCM, Drew Niv, stated: “At this time we feel moving our shares to NASDAQ is the right decision for our business. We recognize all that the New York Stock Exchange has done for us over the last few years, and we look forward to our shares trading on NASDAQ.”

The move comes in the aftermath of a difficult period for FXCM after the company's market cap has dropped to just over $50 million in light of the bailout agreement which the brokerage had to sign with Leucadia National in the aftermath of the Swiss National Bank-induced crisis on the foreign exchange market in January 2015.

Reasoning for the Move

While FXCM Inc has not elaborated on the main reasons for the listing of the company’s shares on NASDAQ, there are several benefits for the company in doing so. First and foremost, the costs associated with the company’s trading on the NYSE are substantially higher when compared to NASDAQ.

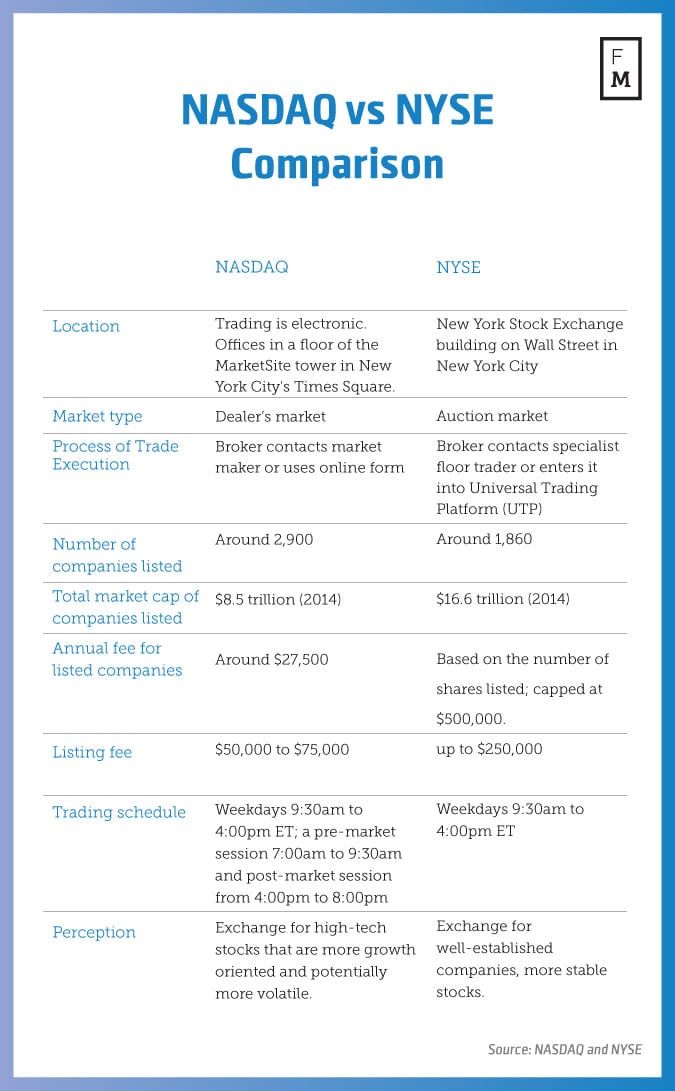

The annual fee for companies listed on NASDAQ is about $27,500, which contrasts with the NYSE. The main reasons for the decreased costs associated with NASDAQ is due to the electronic exchange structure of the most popular market for technology companies.

NASDAQ listed companies are usually closely associated with the high-tech sector and are typically growth oriented and more volatile. In contrast, the NYSE is typically associated with more established companies whose market value on a daily basis fluctuates less.

There are also substantial differences in the ways that NASDAQ and NYSE listed securities are traded. NASDAQ is a dealer’s market where different counterparts to a trade are connected via a market maker. The NYSE is an auction market, where traders are usually transacting with one another looking to match their orders via an auction process.

NASDAQ vs NYSE comparison, Sources: NASDAQ and NYSE