FXCM Inc. (NYSE:FXCM) has filed with the SEC a prospectus which is outlining the intentions of the company to issue up to $125 million worth of new securities. There is no specific mention of what type of securities those might be, with shares, preferred shares and bonds all on the table.

The official announcement highlights that the firm could issue “class A common stock, preferred stock, debt securities, depositary shares, purchase contracts, warrants or units.” According to the SEC filing, the sale can be executed in one or more offerings.

The financial conditions on global debt markets have materially improved in recent months. With the Federal Reserve remaining on the sidelines and with the market not expecting any move higher in interest rates in the near future, the debt markets have become very appealing to virtually all companies.

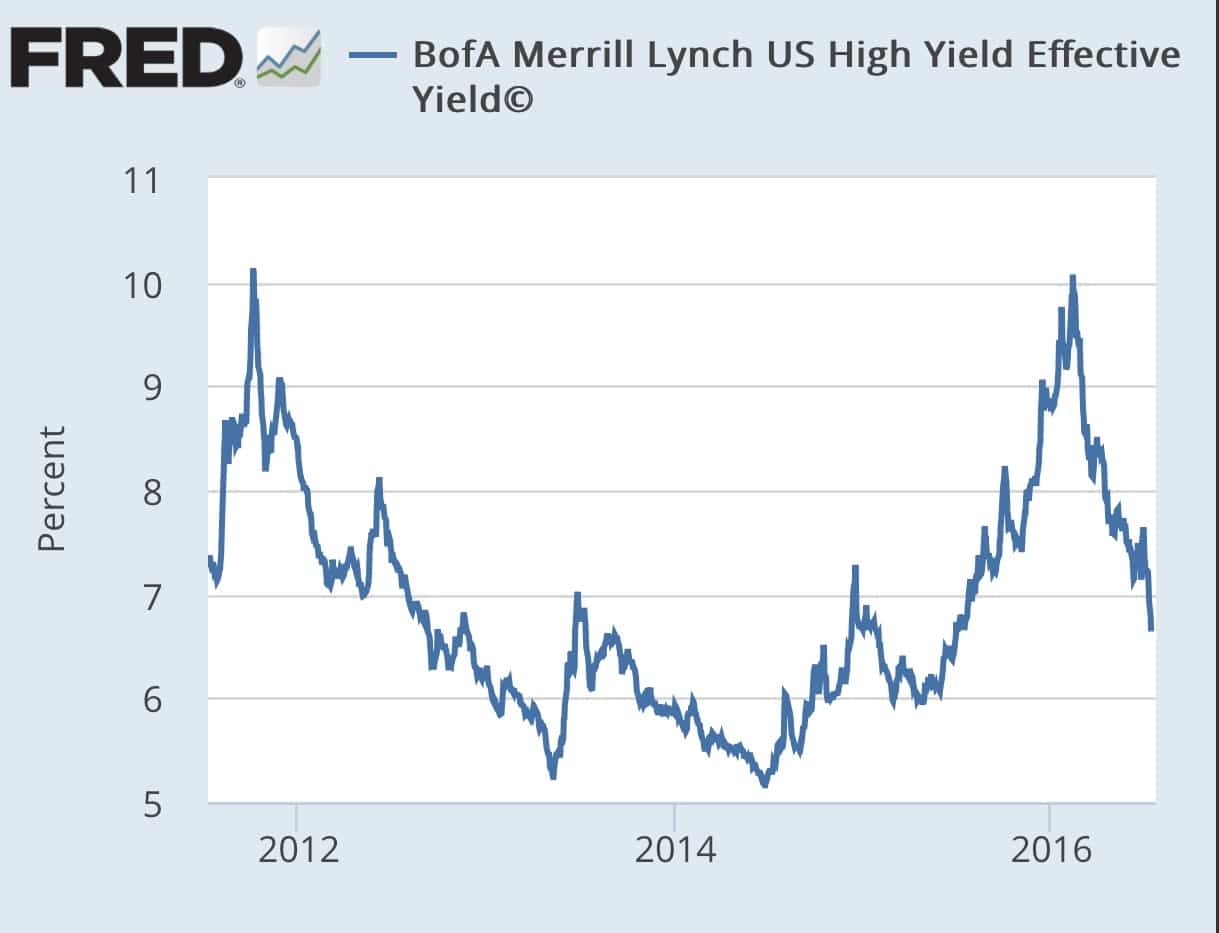

Regardless of the credit rating of a company, the current levels of yields on high yield debt as measured by the BofA Merrill Lynch US High Yield Effective Yield index have declined materially. The timing of the debt sale coincides with a substantial decline in bond yields globally, which makes for an attractive option for FXCM to refinance its obligations to Leucadia National.

High Yield Corporate Debt Chart, Source: Federal Reserve Economic Data

According to the official filing, FXCM may also use the proceeds to “repurchase certain outstanding securities, increase working capital, and for general corporate purposes”.

As of the date of the issuance of the prospectus, FXCM Inc (NYSE:FXCM) has not allocated the proceeds to these purposes. The company will issue a timely update when it intends to allocate the resources in a supplement.

Open SPX shorts FXCM 95%. 95% of traders hellbent on picking tops which is why success rate only 5%. Picking tops/bott high anxiety trading.

— Assad Tannous (@AsennaWealth) July 13, 2016

In the meantime the short interest on FXCM's stock has increased materially. Shares of the company have closed 1 per cent lower in yesterday's trade on the New York Stock Exchange , last changing hands at $9.19.