Set to post their Q4 and full-year 2014 financial results today, FXCM Inc. (NYSE: FXCM) has published a detailed summary of the events that followed January's Swiss franc flash crash. The Swiss National Bank (SNB) event caused their customers to sustain $225 million in negative balances and forced the broker to seek emergency financing of nearly $300 million to remain in business.

Some observations from their release:

1) FXCM is putting blame on the SNB, calling it a "Mishandling of the Swiss franc." Overall this has been somewhat of an agreed upon consensus for the FX market, primarily due to SNB members indicating in the days ahead of the event that they would be continuing support of the 1.2000 EURCHF peg

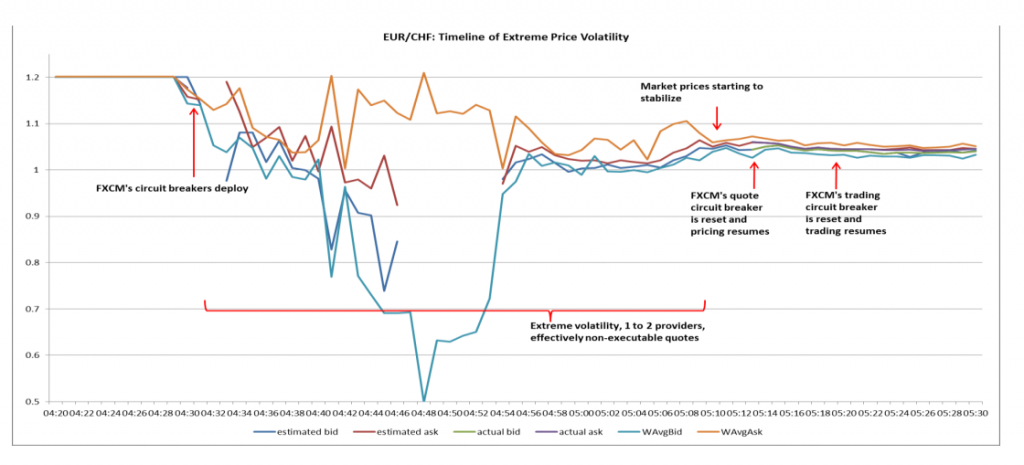

2) FXCM believes its systems performed correctly and its circuit breakers correctly halted customer executions when Liquidity dried

3) 200 million in orders were filled between 1.17 and 1.20 with the remained 1 billion taking place after liquidity was restored between 1.02 and 1.04

4) References to the event as a "Black Swan " and explanations as to why it is was worse than the 2010 flash crash which affected all markets

5) FXCM defended their circuit-breaker performance and believe that without them, customers would have lost much more with fills below the 1.00 parity line

6) With earnings set to be released, this release should be viewed in conjunction with the financial report as it is assumed that they will be referencing it to prove their actions were in-line with the moves in the market.

Full text below

The Swiss National Bank's Mishandling of the Swiss Franc:

On January 15, 2015, the Swiss National Bank (SNB) caused a flash crash that lead to historic dysfunction never seen before in the FX markets when it announced that it was completely (not gradually) removing the 1.2000 self-imposed floor on the EUR/CHF exchange rate. The SNB's shocking announcement was made without any prior warning or notice to the marketplace. As the market perceived the EUR/CHF rate to be real, the abrupt change triggered chaos and a complete FX market breakdown. In light of the reckless actions of the SNB, FXCM has since ceased offering any currencies which carry significant risk due to potential manipulation by their respective governments either by a floor, ceiling, peg, or band.

Timeline of Relevant Events on January 15 (Morning, Eastern Standard Time):

04:30 - Swiss National Bank announces the removal of the 1.2000 EUR/CHF floor.

04:30:47 - EUR/CHF drops below 1.2000 for the first time.

04:30:56 - 9 seconds later, the major international banks who provide liquidity to FXCM begin rapidly removing liquidity as quotes go as low as 1.1659.

04:30:57 - FXCM's system circuit breakers deploy to halt new quotes and trading. These circuit breakers are designed to protect clients against erroneous quotes and off-market trades.

04:31:08 - 21 seconds following the drop below the 1.2000 floor, only 1 liquidity provider is quoting FXCM at 1.1094 (1000 pips from the floor price).

04:31:43 - One major international bank is quoting a bid of 1.0037. Another major international bank is quoting a bid of 1.1556 (1500 pip range in bids between 2 liquidity providers at the same second). EBS quotes 1.0000 at this time.

04:32:41 - The first quote from FXCM liquidity providers below parity - 0.9831. The EBS quote at this time is 1.08115 - 1000 pips away.

04:33:32 - One major international bank quotes a bid of 0.6374. Another major international bank is still quoting 1.1220 at the same time (5000 pip range between 2 liquidity providers at the same second). There is no valid quote on EBS at this time.

04:35:16 - While there are still no valid quotes on EBS, 3 bid quotes from FXCM liquidity provider bounce within a 6000 pip range in 2 seconds: 1.1078, 0.5696, 0.9769

*0.5696 is the lowest quote received by FXCM from all its liquidity providers

04:42:28 - EBS shows a bid quote of 0.9550 one second, then a bid quote of 0.5000 the next second (a difference of 4500 pips). The next new price shown is 0.9600, five seconds later.

04:55:40 - The market finally trades somewhat consistently above parity, but volatility is still extreme. The range of bid quotes between major FX industry ECNs is 0.87 to 1.0001 (1300 pips).

05:10:00 - The market begins to stabilize around 1.0400 level. Spreads and consecutive price ticks are still above 100 pips. The range of bid quotes on major FX industry ECNs is 1.0120 to 1.0600 (480 pips).

05:17:00 - FXCM's quoting circuit breakers are removed and prices begin updating again. Execution is still halted.

05:23:00 - FXCM's trading circuit breakers are removed and execution of trades begins again. Liquidity levels are as little as 5% of normal levels, and only 3 or 4 liquidity providers are quoting consistently.

January 15 Was A Market Flash Crash - The Institutional FX Market Failed And Did Not Function:

As the above timeline demonstrates, the SNB's surprise announcement caused a complete institutional FX market breakdown impacting liquidity, volatility, spreads, and execution. Unlike other recent major market events where FXCM's liquidity providers continued quoting and providing consistent levels of liquidity, January 15 saw an extreme lack of liquidity and pricing.

No Liquidity - There was almost no available liquidity for approximately 40 minutes

Dramatically Low Pricing - External ECN prices went as low as 0.2000 and 0.5000

Extreme Spreads - The average spreads of EUR/CHF were more than 2000-3000 pips

Extreme Range - The average range of EUR/CHF was 6000 pips.

The January 15 flash crash saw the EUR/CHF drop 40% in seconds whereas the 2010 flash crash in the equities market saw about 9% drop in the Dow Jones Industrial Average over the course of a few minutes.

Prices were extremely volatile and liquidity deteriorated rapidly. Accordingly, quality of execution deteriorated rapidly across all FXCM's liquidity providers.

In the first 5 seconds after the EUR/CHF price moved below 1.2000, FXCM's providers accepted orders and executed more than their average quoted volume.

04:30:47 to 04:30:51

Average Sell Amount Executed Per Second: 25.3 Million

Average Bid Size Available Per Second: 22.3 Million

% of Average Bid Size Executed: 113.5%

In the next 5 seconds, FXCM's providers rejected heavily, filling less than 1/5th of the average quoted volume.

04:30:52 to 04:30:56

Average Sell Amount Executed Per Second: 2.66 Million

Average Bid Size Available: 14.72 Million

% of Average Bid Size Executed: 18.0%

FXCM systems allowed most clients to exit trades between 1.02 & 1.04 and avoid the extreme lows of the extraordinary market event. In normal market conditions, there are more than a dozen active liquidity providers and quotes good for sixty million on each side (both Bid and Ask) that refresh every few seconds. FXCM saw executable liquidity drop to nearly zero two minutes into the event. EUR/CHF was dropping from 1.20 and FXCM had little ability to execute client stop orders or margin calls because there were almost zero effectively executable quotes. FXCM executed approximately 200 million in total volume before 4:30:56 in the 1.17 to 1.20 range. At 4:30:57, FXCM's circuit breakers engaged and would not execute the remaining approximately 1 Billion until the market began to function with stable pricing. FXCM's system circuit breakers deploy to halt new quotes and trading, and are designed to protect clients against erroneous quotes and off-market trades.

The majority of FXCM liquidity providers had stopped quoting prices during this time. Had FXCM's circuit breaks not engaged, the weighted average price of the same orders would have been much lower than the execution price of 1.05, at 0.9760. With no liquidity for approximately 45 minutes, the market began to stabilize around 5:10 am at a price of 1.0400.

Observations:

The market data from January 15 shows that while it appears many of the FX ECN's have few or even no circuit breakers to halt trade execution in the case of extreme pricing, FXCM's circuit breakers aided its clients in this extreme market movement. The market could have been functional if circuit breakers had existed at every level.

The market data also shows that the losses on January 15 were not the result of FXCM technology or FXCM margin requirements, but rather due to the extreme market dysfunction resulting from the SNB's irresponsible and unforeseen announcement to completely remove the 1.2000 CHF floor. FXCM has long run a No Dealing Desk or Agency Execution model on its FX business. For FXCM's execution system to function efficiently and effectively, the Institutional Market must provide prices and executable liquidity. As FXCM is given prices and liquidity from liquidity providers, the firm executes every client's FX trade back to back with the liquidity providers. However, the SNB's actions on January 15 caused the firm's liquidity providers to cease providing pricing during the event, which ultimately resulted in some clients having negative balances with FXCM.