FXCM Group has released a comprehensive execution quality report for the one-month period ending on September 30, 2018. The company also published execution statics detailing average spreads throughout the eight months to August on its trading accounts.

Slippage is the difference between the quoted prices and those at which the client’s orders have been executed by the broker. The less slippage the trader gets, the better his trading results will be.

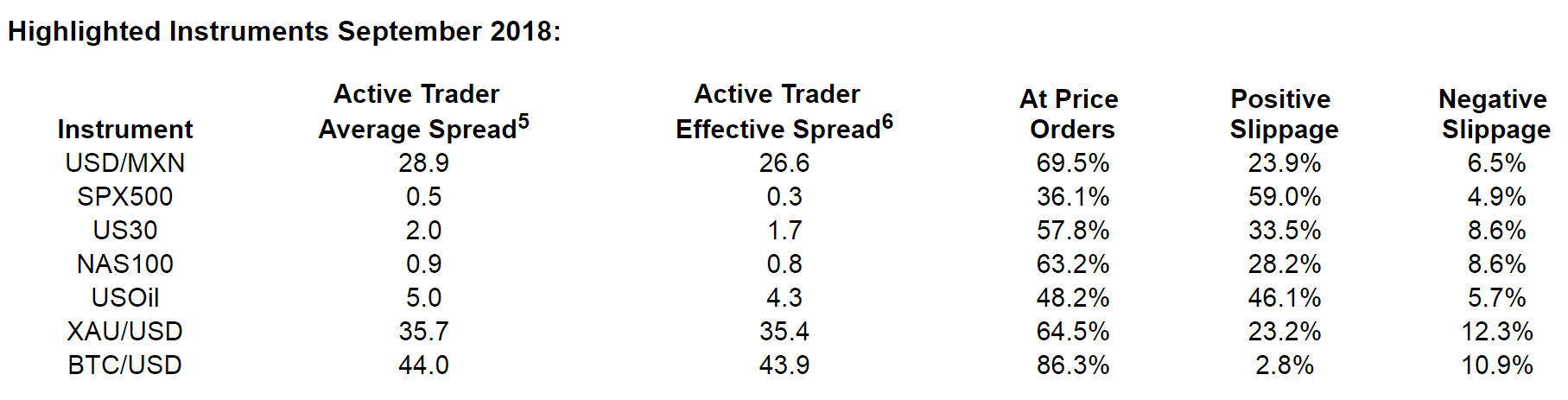

According to figures stated in the report, the average spreads on the USD/MXN, XAU/USD and BTC/USD pairs were 28.9, 35.7 and 44.0 pips respectively. For the SPX500, one of the most widely traded CFDs on indices, the company averaged 0.5 pip.

Of note, FXCM published spreads metrics for its bitcoin instrument for the first time after it became the latest retail trading venue to launch access to Bitcoin trading. The move comes a bit late but follows an ongoing trend by brokerages and service providers to adopt cryptocurrencies.

FXCM report states that the average execution speed for all instruments was 25 milliseconds. And while 66.8 percent of orders executed at price, nearly 22.1 percent of orders executed with positive slippage and 11.1 percent with negative slippage.

FXCM has also advertised its price improvements/slippage statics during the first eight months of 2018 which showed the following highlights.

- 51 percent of all stop, limit, 'at market,' and entry orders received positive slippage

- 25 percent of all stop, limit, 'at market,' and entry orders received negative slippage

- 77 percent of all limit and limit entry orders received positive slippage

- 90 percent of all stop and stop entry orders received negative slippage

Additionally, the online brokerage has disclosed its Effective Spread statics, which displays its quoted spread for its top FX pairs, and compares the figures with actual spreads, at which trades were already filled, with the difference being displayed in a table key.

The following table shows the exact figures in September 2018:

Commenting on the findings, Brendan Callan, CEO of FXCM Group, said: “With the recent expansion of our Bitcoin CFD to almost all retail clients we are excited to see our current execution stats on the instrument but we are continuing to work on improvements to bring spreads in even further with the addition of more Liquidity providers. While FXCM has traditionally been known more for its FX offering, we have come a long way with improving our CFD offering especially on some of the major indices and metals.”