New York-based Forex Capital Markets (FXCM) has released a comprehensive Spreads Report for the first quarter of 2017, detailing average spreads throughout the first three months of the year on its trading accounts featuring 'No Dealing Desk Execution'.

The London Summit 2017 is coming, get involved!

[gptAdvertisement]

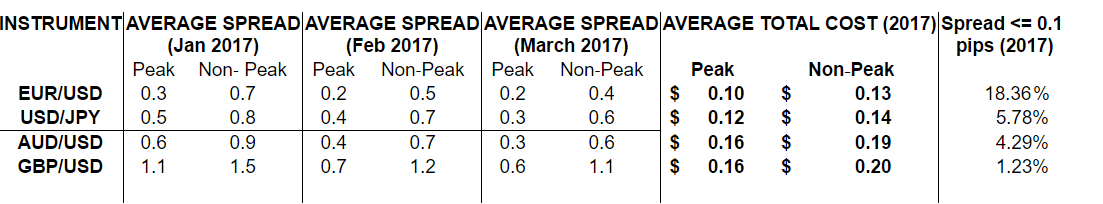

According to figures stated in the report, the average spreads on the EUR/USD, USD/JPY and AUD/USD currency pairs were 0.2, 0.4 and 0.4 pips respectively at peak trading hours. The company noted that 70% of EUR/USD and 61% of USD/JPY volume occurred during peak hours which FXCM defines as the period from 0600 - 1800 GMT from 1 January 2017 to 31 March 2017, excluding weekends.

The report also showed the average total cost to open a 1k position on each pair through the Q1 2017:

During non-peak hours, average spreads on the three major pairs were doubled as shown below:

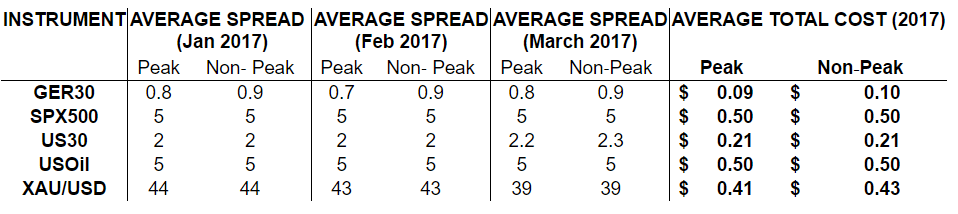

CFD Spreads Highlights

For the GER30, one of the most widely traded instruments in Europe, the company averaged 0.78 during the most active trading hours. The average cost to trade GER30, assuming a 1K trade, was $0.09 during peak trading hours.

FXCM has also advertised its price improvements/Slippage statics which showed the following highlights.

• 58.84% of all orders had NO SLIPPAGE.

• 30.37% of all orders received positive slippage.

• 10.79% of all orders received negative slippage.

• 63.77% of all limit and limit entry orders received positive slippage.

• 39.61% of all stop and stop entry orders received positive slippage.

Execution Study

Additionally, the brokerage disclosed information from its own studies looking into the quality of execution of the retail orders of its clients. Based on the data, FXCM claims that its retail order execution is better than if the same orders were executed on the futures market or the interbank forex market, hence it offers better prices for its clients.

FXCM defined the quality of execution advantage as “the difference between the actual price at which the FXCM client’s order was executed versus the quoted price at which the same order could have been executed on the Futures or Interbank market.”

The more detailed information reveals that “FXCM LTD was equal to or better than the quoted futures price 81.34% of the time compared to the spot equivalent quoted futures prices on the CME.” The better or equivalent prices offered by FXCM led to potential savings of $42,529,156 for FXCM LTD clients.

FXCM's prices scored even better in comparison to the interbank forex market. The study data shows that it offered to its clients a better or equal price 94.84% of the time compared to the spot equivalent quoted Interbank market price. Thus, the broker's clients potentially saved $114,588,455.