Foreign exchange and CFDs (contracts for difference) brokerage GAIN Capital has today reported its operating metrics for the month of January. The company is updating its investors on both retail and institutional trading every calendar month.

GAIN Capital registered average daily volumes on the retail side rising to $15.9 billion, which is an increase of 23.5 per cent when compared to the month of December. The figure is also higher by 4.9 per cent when compared to January 2015.

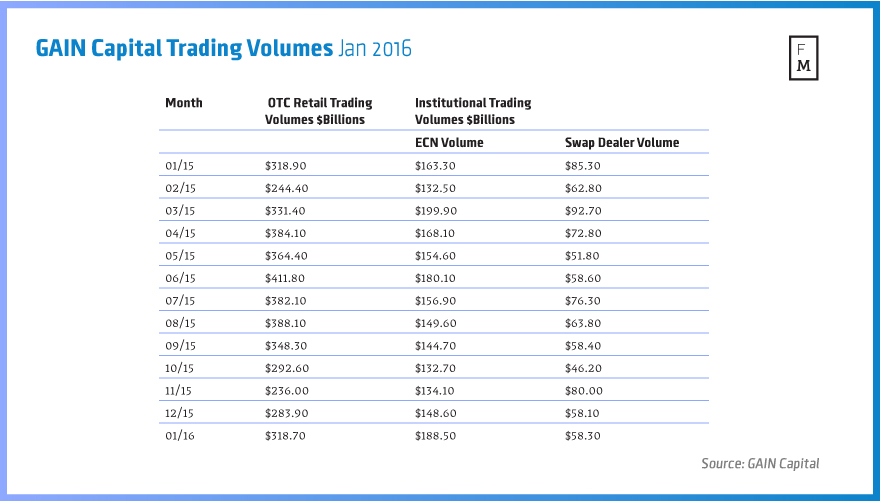

Total volumes at GAIN Capital increased at a more moderate pace of 13.3 per cent to $318.7 billion. The figure is flat when compared to January 2015, when we saw record volumes across the industry due to the Swiss National Bank (SNB) induced Volatility .

The number of active accounts totaled about 143,766, which is lower by 2.2 per cent from December 2015. The figure is higher by a whopping 49.5 per cent when compared to January 2015, however this is due to the fact that the company completed the acquisition of U.K. based City Index later during the year.

Due to the deal with City Index, the year-on-year comparison is not the most accurate measure of assessing the performance of GAIN Capital. The number of average daily contracts of futures traded through GAIN Capital’s platform totaled 40,605, which is higher by 22.4 per cent when compared to December 2015 and by 9.3 per cent when compared to January 2015.

Looking at the total number of futures contracts, the figure was 812,097, which is an increase of 11.2 per cent when compared to the previous month, and an increase of 9.3 per cent when compared to the same period of last year.

Institutional Business Metrics

Starting from the release of the January 2016 metrics, GAIN Capital is reporting its institutional trading metrics with a new methodology. Volumes on the company’s institutional foreign exchange Electronic Communications Network (ECN) ) platform GTX, are divided into two categories - ECN volume and Swap Dealer.

The ECN volume presents the amount of spot FX and non-deliverable forwards (NDFs) trading executed through GTX. GAIN Capital is executing the NDF trades through its Swap Execution Facility.

Another component of the institutional trading volumes is the Swap Dealer volume, which includes spot, forwards, swaps, options and non-deliverable forwards executed by GAIN Capital’s registered swap dealer.

On previous occasions, GAIN was reporting its total institutional volumes on a double-count basis, while the company’s Swap Dealer trading volumes were represented in a single count.

Starting from January 2016, GAIN Capital starts reporting its ECN volumes on a single-count basis.

Looking at the numbers, the ECN average daily volume totaled $9.4 billion, which is higher by 39.5 per cent when compared to last month and by 21.2 per cent when compared to January 2015.

The total volume transacted through the ECN totaled $188.5 billion, which is higher by 26.8 per cent when compared to the last month of 2015, and by 15.4 percent when compared to the same month of last year.

Swap Dealer average daily volume was $2.9 billion, or higher by 10.3 per cent and lower by 28.3 per cent from January 2015. The total Swap Dealer volume was $58.3 billion, or higher by 0.3 per cent, then compared to December 2015 and lower by 31.7 per cent from January 2015.

A Strong January for FX and CFDs Brokers

The month of January has proven to be very strong across the whole industry. With significant headwinds in financial markets, brokerages fared rather well as trading activity amongst retail traders increased in tandem with volatility.

GAIN Capital's figures are reaffirming expectations that the foreign exchange and CFDs brokerage industry is setting up for a good first quarter of 2016. Revenues for foreign exchange and CFDs brokers typicially move in tandem with market volatility.