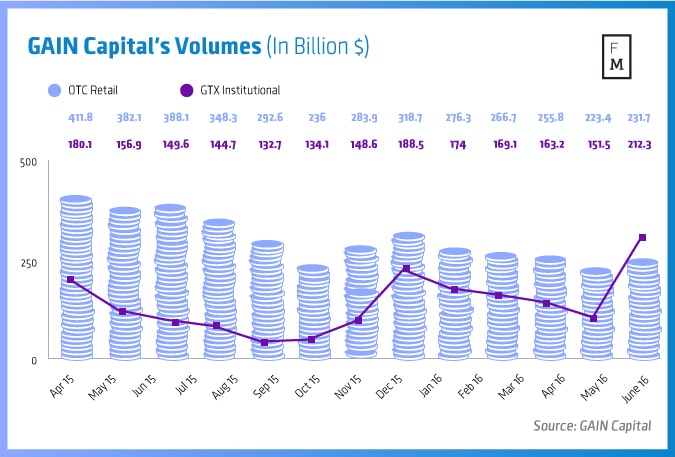

GAIN Capital Holdings, Inc. (NYSE: GCAP) has published its monthly metrics for June 2016. Both the retail and institutional trading volumes were up from the month of May 2016, as per an official statement.

Delving into the figures, retail OTC trading volume reached $231.7 billion, an increase of 3.7% from May 2016 and a decrease of 43.7% from June 2015. Average daily retail OTC trading reached a volume of $10.5 billion, an increase of 3.7% from May 2016 and a decrease of 43.7% from June 2015. Active retail OTC accounts were marginally higher from May 2016, coming in at 139,022, up 0.1% from last month, but saw a strong drop of 6.5% YoY from June 2015.

The institutional side of the business continued to perform strongly, with a healthy 40.1% MoM increase in ECN trading volumes, which came in at $212.3 billion for the month of June 2016, netting average daily volume (ADV) of $9.6 billion, an increase of 17.9% from June 2015. The ECN volume presents the amount of spot FX and non-deliverable forwards (NDFs) trading executed through GTX platform.

Meanwhile, swap dealer average daily volume came at $2.4 billion, a decrease of 15.5% from May 2016 and 8.9% from June 2015. The total swap dealer volumes, which includes spot, forwards, swaps, options and non-deliverable forwards executed by GAIN Capital’s registered swap dealer, was $53.4 billion.

Futures Metrics

In terms of GAIN’s futures contracts, the figure came in at 727,633 in June 2016, incurring a marginal decline of 0.3% from the prior month. Across a yearly timeframe though, June 2016 showed a more upbeat picture, mounting an increase of 4.6% from June 2015. Furthermore, futures average daily contracts were numbered at 33,074, a decrease of 4.8% from May 2016 and an increase of 4.6% from June 2015. Finally, active futures accounts were reported at 8,822, a decrease of 0.6% from May 2016 and an increase of 0.3% from June 2015.

Commenting on the recent metrics, Glenn Stevens, CEO of GAIN Capital, said: "The lead-up to and market reaction following mid-June's Brexit referendum led to an increase in Volatility which resulted in GAIN's Q2 2016 retail revenue per million tracking roughly 10% above our Q1 2016 levels."

"In addition, retail volume generated from the indirect business represented 48% of total retail OTC trading volume in the quarter," Mr. Stevens concluded.