GAIN Capital announced that during the second quarter of 2014 it lost $5.2 million or $(0.13) per diluted share, compared to $17.2 million or $0.44 a share a year ago. The company has reported net revenues totaling $69.7 million, which is lower by 5% from a year ago and a touch less than 13% when compared to revised revenues for the first quarter of 2014.

While key operating metrics were reported as higher, with the company's Retail OTC volume totaling $522.2 billion, or higher by 13%, and institutional trading topping 2013's figures by 27% coming in at $1.3 trillion during the quarter, the most stark difference emerges when we compare the total retail client assets figures which total $840 million, higher by 76% when compared to a year ago.

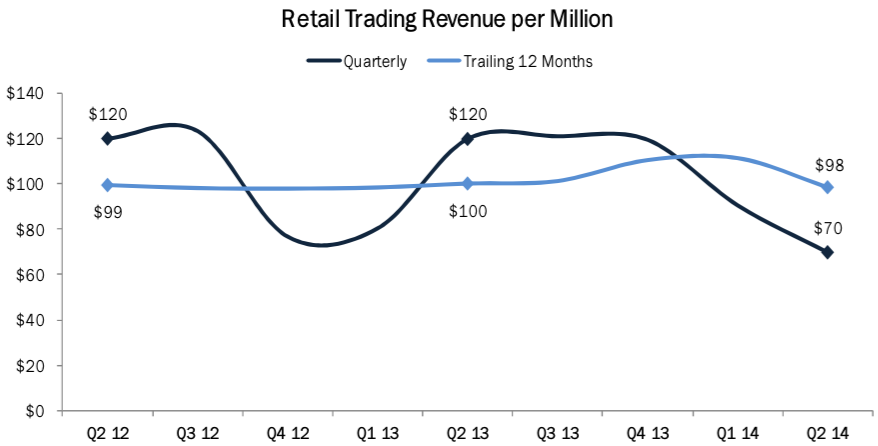

The company's retail revenues per $ million dropped below the low range of profitability targets, as stated by the company's CEO Glenn Stevens in previous conference calls, between $80 and $120 and currently at $70.

Retail Trading Revenue per Million, Source GAIN Capital Q2 Earnings Report

Retail OTC Business

Revenues generated from the company's retail OTC business totaled $36.4 million in the second quarter, which is lower by almost 37% when compared to the second quarter of 2013, primarily due to the significant difference in FX Volatility last year. The number of retail OTC funded accounts has grown by 37% and 95% from the year ago quarter to 120,236 and $671 million respectively.

Institutional Sales and Trading

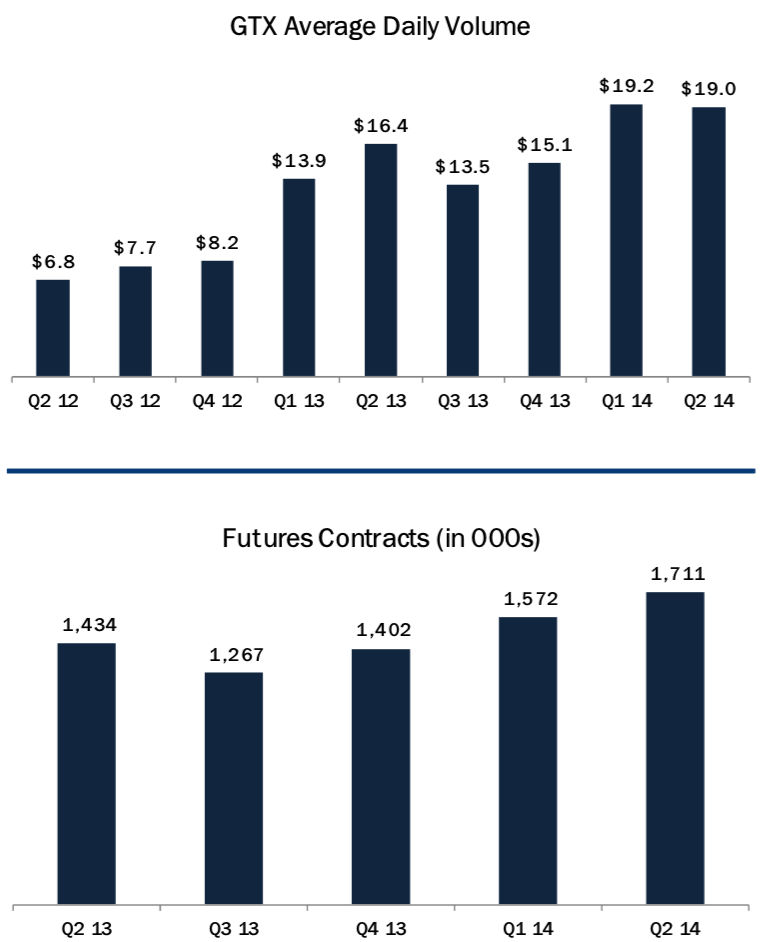

GTX and Futures Metrics, Source GAIN Capital Q2 Earnings Presentation

GAIN Capital's institutional sales and trading businesses, namely GTX and sales trader, generated a total revenue of $23.5 million in the second quarter which compares to $7.8 million for the same period in 2013. The company has outlined the purchase of all the intellectual property powering the GTX ECN technology, which was completed in the second quarter. According to the earnings release, the company expects the move to result in an increase of its institutional ECN business over the long-term. According to the results, the sales trader business recorded strong results in the second quarter, boosted by strong trading volumes across a mix of asset classes, including European equities.

The Exchange traded futures business of GAIN Capital has generated revenue totaling $8.9 million in the second quarter of 2014, compared to $6.4 million during the same period in 2013. Average daily futures contracts reached 26,322 in the second quarter, which is higher by 19% when compared to last year and 5% lower than throughout the first quarter of 2014.

Restated First Quarter Results

In the run-up to its second quarter earnings results on August 8, 2014, the Audit Committee of the Board of Directors of GAIN Capital Holdings, Inc. concluded that the financial statements contained in the Company's Quarterly Report on Form 10-Q for the quarter ended March 31, 2014, should no longer be relied upon. The company has understated its trading revenue for Q1 of 2014 by $4.2 million to $79.9 million, while net income was revised to $3.8 million, which is an adjustment higher by $2.1 million. The cause was pointed out as an isolated error and has been identified and fixed.

M&A Pipeline Still Remaining Robust?

The company announced that it had almost doubled its commissions businesses, and that its focus on expense management continues, a statement which sounded a bit controversial as at the same time “the M&A pipeline remains robust with several transactions in various stages of negotiations."

The company’s CEO, Glenn Stevens, has outlined that there is enough room to cut expenses to reach the firm’s target without hammering the efforts of expanding the company’s business at a relatively good time for M&A. He stated that the current environment is not a result of secular changes, but cyclical changes and “ultimately currency ranges do break out."

According to Mr. Stevens, the firm is “positioned from benefitting from a correction back to normal volatility levels," however, he highlighted that a broader product mix is incoming as the company relies more on multitude products and less on pure currency play. Non-FX products volumes levels have been rising, with diversification with CFDs and single stock CFDs permitting to look for ways to deliver desired products to multiple geographies.

The ratio between direct and non-direct revenues at GAIN Capital has been stated at around 50:50, meaning that half of the company’s revenues now come from white label partners.

Shares of GAIN Capital traded lower by 9.8% in after-market hours as investors seem to be materially worried about the expense side of the company's business.