Yesterday GAIN Capital reported its quarterly results, showing that the company’s revenues were slashed in half on a year-on-year basis. The main cause for the decline was market condition deterioration throughout the quarter, exacerbated by increased political uncertainty about the ability of the new US president to deliver on his promises.

The FX markets have stalled with expectations running high and the real-life results achieved by the new administration minor. As a result volatility has materially declined and squeezed brokers as an expected rise in volatility did not materialize.

[gptAdvertisement]

While the fourth quarter of last year proved to be one of the best in a while for the retail foreign exchange and CFDs industry, the first quarter of 2017 paints a different picture. The currency volatility index declined from 21 in the fourth quarter of 2016 to 12 in Q1 2017.

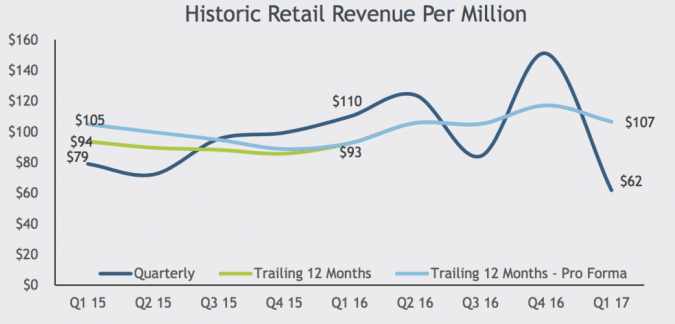

GAIN Capital revenues per million over time

The key metric for retail flow profitability, revenue per million traded (RPM), dropped materially in the first quarter of 2017 at GAIN Capital. The company reported that it earned $62 per million, a figure that is materially lower than the broker’s long running average of about $107.

Taken together with the increased revenue capture in the final quarter of 2016, on average the six months that ended on March 31st 2017 fall in line with the long-running averages. According to GAIN Capital CEO Glenn Stevens, an RPM number between 75 and 80 is the break-even point for the company.

There is little indication that other brokers from the industry would be marking a different trend in the first quarter of this year. Sources to which Finance Magnates has spoken suggest that RPM dropped broadly and the current low volatility environment coupled with regulatory uncertainty is challenging brokers that have little flexibility.

Acquisition Achievements and Opportunities

Glenn Stevens stated in the earnings call after the publication of the results that the current environment could provide the brokerage with more acquisition opportunities. He shared that the brokerage has about $135 million of Liquidity and is looking for more acquisitions.

The company so far paid $6.5 million for 13,000 accounts in the deal with FXCM. The new clients for GAIN Capital generated about $1.1 billion in average daily trading volumes.

Commenting on the acquisition of the US clients of FXCM, Glenn Stevens said: “We remain confident in the estimated incremental revenue from the FXCM deal, which is roughly $15-20 million for 2017 at a minimum cost to GAIN.

Impending regulatory changes will likely produce industry volatility during this year and beyond, primary impacting second and third tier providers and presenting heavy implementation challenges.”

Stevens proceeded to say that the current environment is presenting an opportunity for well capitalized companies.

Mobile Trading on the Rise

During the earnings call, Mr Stevens also highlighted that retail trading volumes at GAIN Capital transacted via mobile surpassed 50% of the total. The CEO expressed the view that the broker’s client demographics are playing a key role and the number could increase further over the coming quarters.

GAIN Capital is currently working on a new mobile app redesign to be released in June and has recently launched its new web-based Trading Platform in the US. The upgrade for international clients is set to be rolled out in the current quarter.