According to filings made with the Securities and Exchange Commission (SEC), and after reported metrics filed yesterday, Gain Capital Holding Inc. (NYSE: GCAP) today filed a Form 12b-25 which is a notification of late filing, as it doesn't anticipate that it will be able to complete its 10-K for the period ending December 31st 2015 in time.

The company concluded that because of accounting errors in the manner that it accounted for certain taxes in recent years, its 2013, 2014 and the first three-quarters of 2015 will need to be restated, and as it detailed in yesterday's filing.

It said that the way inter-company payables and receivables were handled among domestic and overseas subsidiaries of the company, in terms of how they were treated for tax purposes during the impacted periods, were to blame for the misstated numbers.

In addition, Gain said that the firm's management has already started implementing preventive and detective controls requiring the enhanced review of the accounting processes related to the transactions in question which included between domestic and overseas subsidiaries.

Because of this, the company was unable to file the 10-K form in time, and the filing it made today provides for an additional 15-day extension.

The company's stock is already down 6% since yesterday, yet the filing today said that the company didn't expect the results reported in the Form 10-K to be materially different from the results announced yesterday, filed with the SEC in the Company's Current Report on Form 8-K dated March 15, 2016.

Finance Magnates reported yesterday after the company's 8K filings revealed a slump and mixed results for last quarter. It's not clear as to whether the error could bring about any action from the SEC, which could be adding to downside pressure on the company's stock price recently.

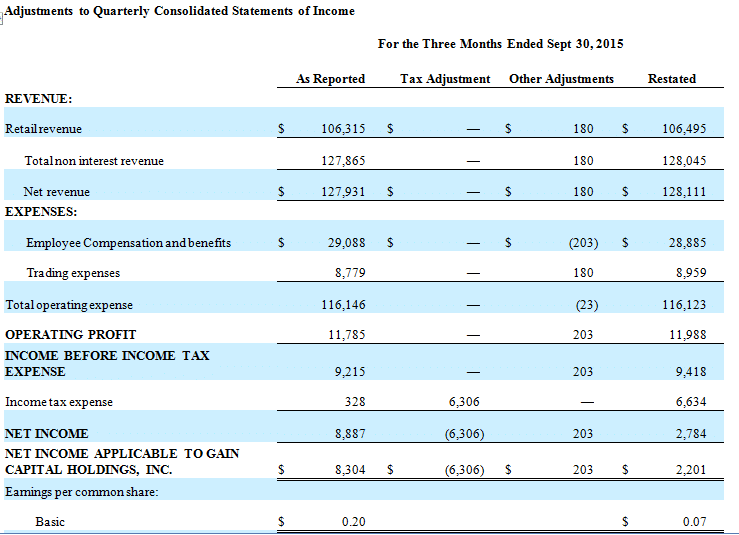

An excerpt of their 8-K filing from yesterday for Q2 last year shows a small difference in the restated amount, which brought the diluted earnings per share from .20 to .07 during the affected period.

Source: Gain Capital 8-K report

Shortly after publication, a company spokesperson stated that this is due to technical tax matter, and it has not materially impacted the underlying strength of the business of the brokerage. In terms of any prospective involvement by the SEC, the company does not expect any enforcement action related to this matter.