Over the past several weeks, shares of publicly traded retail broker GAIN Capital (NYSE:GCAP) have faced a pummelling on the NYSE. The company’s buyback program which was announced in October last year provided $50 million worth of Liquidity , effectively putting a floor under the shares between $6 and $7 for some months.

While the industry was facing a challenging market environment in the first quarter of the year, the conclusion of the buy-back was the trigger point when shares of GAIN Capital (NYSE:GCAP) started falling materially.

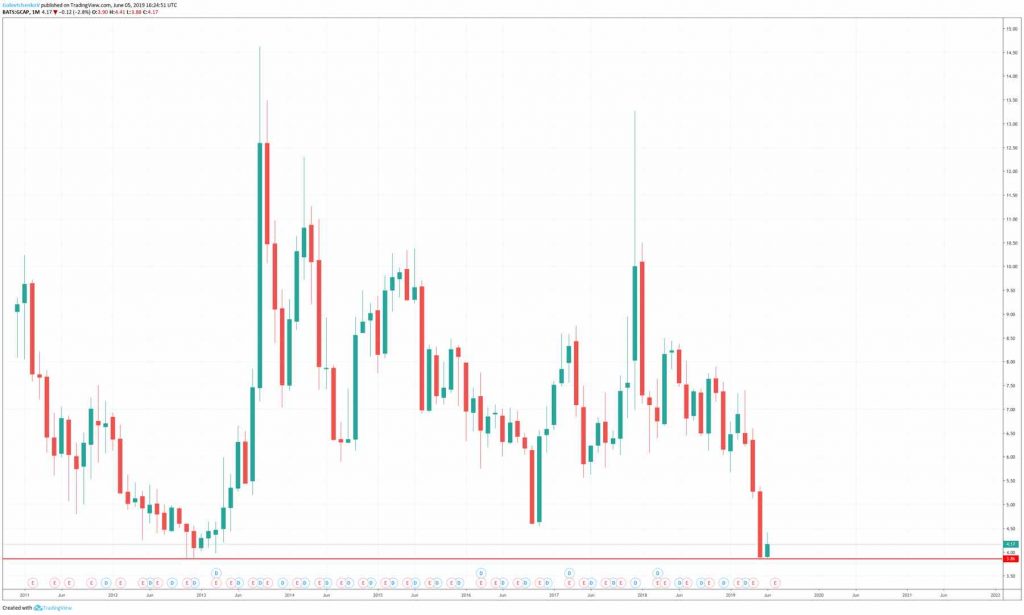

Trending lower alongside with the rest of the industry’s publicly listed heavyweights like IG Group, CMC Markets, and Plus500, last month the stock printed a new all-time low at $3.83 per share. After stabilizing above $4 per share, the stock is facing increased pressure today as the company released its trading volumes for the month of May.

GAIN Capital Shares

Rising RPM Levels

Revenues Per Million traded or RPM is a key metric for the brokerage industry, and today Glenn Stevens underscored that the number has been rising, to return closer to its 12-month average. While the metric has been historically just above $100, during the first quarter of this year, it dropped to as low as $50.

“While customer trading activity has remained subdued and volatility remains lower than normal, we are encouraged by indications that market conditions appear to be returning to more normalized levels in the second quarter,” commented Glenn Stevens today speaking at the Sandler O’Neill Global Exchange and Brokerage Conference.

The CEO of GAIN Capital highlighted that during the first two months of the second quarter of 2019, the company saw a return to “more normal RPM levels.” Stevens was also upbeat on the firm’s marketing spend as average monthly new accounts for the first two months of Q2 2019 went up 8 percent versus Q1 and by 37 percent when compared to Q4 2018.

The brokerage also appears to have reigned in its costs, lowering its estimates for overhead costs for the full year to $180 – 190 million. Adding up the firm’s strong balance sheet, Steven sees the company’s shares trading at price levels that are well below the actual value of the firm.

Despite these comments, shares of GAIN Capital are trading 2.8 percent lower at $4.17, just above all-time lows. Shares of the firm were trading at similar levels all the way back in the final quarter of 2012.

Challenging Markets and Beyond

While the company is aiming to restructure its operations in order to further cut costs, it is also planning to launch a new premium brand for its high-end customers. While the firm is currently using Forex .com and Citi Index for all its clients, back in the first quarter of the year, the brokerage announced the impending launch of the new GAIN Capital brand.

The size of the company is making the transition more difficult, and increasing marketing spending has weighed on the cost base over the past quarters. That said, as the CEO of the firm highlighted, the number of new clients attracted to the brand should pay off in the long run, as volatility ramps up and traders get more engaged in the market.