Financial highlights for the full year 2010 include:

- Record Net Revenue of $189.1 million; growth of 23.4% compared to 2009

- Net Income of $37.8 million (Diluted EPS of $1.00); net income growth of 35.0% compared to 2009

- Adjusted Net Income(1) of $33.9 million; growth of 28.9% compared to 2009

- Record Client Assets(2) of $256.7 million at December 31, 2010; growth of 28.4% compared to 2009

"2010 was a pivotal year for GAIN. We grew our business organically and also initiated our market consolidation strategy with the acquisitions of the retail Forex businesses of MG Financial and CMS Forex. We expanded our global footprint, opening offices in Hong Kong, Singapore and Sydney, and increased our product offering with the addition of new currency pairs, as well as equity index CFDs (contracts for difference) outside of the United States. We also launched GAIN GTX, our new ECN for institutional clients. In addition to our operational and strategic accomplishments, we reached a corporate milestone with our initial public offering and listing on the New York Stock Exchange in December 2010. We look forward to the opportunities ahead as we operate in the public markets," said Glenn Stevens, chief executive officer.

"We delivered a strong performance in 2010, growing revenue and adjusted net income at healthy rates while at the same time increasing client assets to an all-time high. We also continued to invest in our businesses to drive long term growth," said Henry Lyons, chief financial officer.

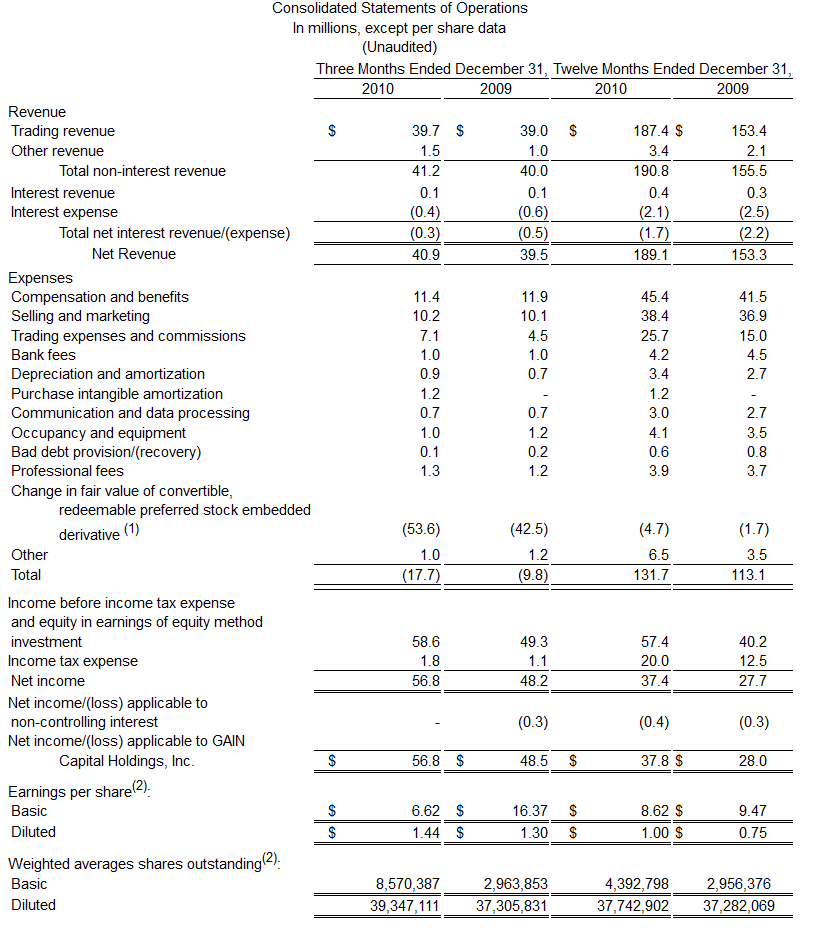

Financial Results:

(Note: Percentage changes are referenced to comparable period in fiscal year 2009.)

- Net Revenue of $40.9 million for the fourth quarter and $189.1 million for the full year, representing growth of 3.5% and 23.4%, respectively

- Net Income of $56.8 million for the fourth quarter and $37.8 million for the full year, representing growth of 17.1% and 35.0%, respectively

- Adjusted net income(1) of $4.0 million for the fourth quarter and $33.9 million for the full year, representing a decline of 33.3% and growth of 28.9%, respectively

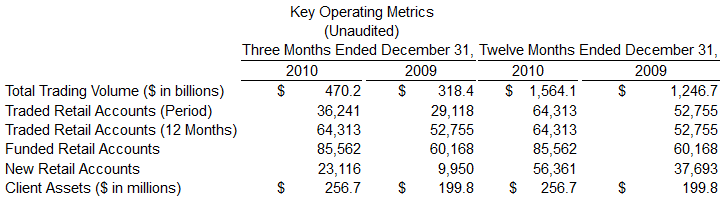

Business Metrics:

(Note: Percentage changes are referenced to comparable period in fiscal year 2009.)

- Total Trading Volume was $470.2 billion for the fourth quarter and $1.6 trillion for the full year, representing growth of 47.7% and 25.5%, respectively

- Traded Retail Accounts were 36,241 for the fourth quarter and 64,313 for the full year, representing growth of 24.5% and 21.9%, respectively

- Funded Retail Accounts were 85,562 at December 31, 2010, representing growth of 42.2%

- Client Assets were $256.7 million at December 31, 2010, representing year over year growth of 28.4%

Initial Public Offering:

On December 15, 2010, GAIN Capital successfully priced its initial public offering ("IPO") of 9.0 million shares of its common stock at a price of $9.00 per share. Of the 9.0 million shares, 0.4 million were offered and sold by GAIN Capital and 8.6 million were offered and sold by certain selling stockholders. The proceeds to GAIN Capital from the IPO, which were $3.4 million after underwriting discounts and commissions, were used to pay for the Company's expenses relating to the offering. GAIN Capital did not receive any of the proceeds from the shares of common stock sold by the selling stockholders. On January 19, 2011 the underwriters of the IPO exercised the over-allotment option to purchase approximately 0.1 million additional shares of common stock from certain selling stockholders at the public offering price of $9.00 per share, less the underwriting discount. As of December 31, 2010, there were approximately 31.2 million shares of common stock issued and outstanding and approximately 41.07 million shares of common stock on a fully diluted basis.

About GAIN Capital

GAIN Capital Holdings, Inc. (NYSE: GCAP) is a global provider of online trading services. GAIN Capital's innovative trading technology provides market access and highly automated trade execution services across multiple asset classes, including foreign exchange (forex or FX), contracts-for-difference (CFDs) and exchange-based products, to a diverse client base of retail and institutional investors.

A pioneer in online Forex Trading , GAIN Capital operates FOREX.com®, one of the largest and best-known brands in the retail forex industry. GAIN's other businesses include GAIN GTX, a fully independent ECN for hedge funds and institutions, and GAIN Securities, Inc. (member FINRA/SIPC) a licensed U.S. broker-dealer.

With offices in New York City; Bedminster, New Jersey; London; Sydney; Hong Kong; Tokyo and Seoul, GAIN Capital and its affiliates are regulated by the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) in the United States, the Financial Services Authority (FSA) in the United Kingdom, the Financial Services Agency (FSA) in Japan, the Securities and Futures Commission (SFC) in Hong Kong, and the Australian Securities and Investments Commission (ASIC) in Australia. More information is available at www.gaincapital.com.

(1) For each of the periods indicated, in accordance with Financial Accounting Standards Board Accounting Standards Codification 815, Derivatives and Hedging, we accounted for an embedded derivative liability attributable to the redemption feature of our previously outstanding preferred stock. This redemption feature and the associated embedded derivative liability is no longer required to be recognized following the conversion of all of our preferred stock in connection with our IPO, which closed in December 2010.

(2) Immediately prior to consummation of our IPO, all convertible, redeemable preferred stock converted to common stock and we effected a 2.29-for-1 stock split. In addition, we issued 407,692 shares of common stock to cover all of our estimated costs for the IPO. The new shares we issued, the common stock split and conversions of the convertible, redeemable preferred stock resulted in 31,148,058 common shares issued and outstanding after the IPO. We have conformed the weighted average outstanding shares in all periods to reflect all of the foregoing adjustments.

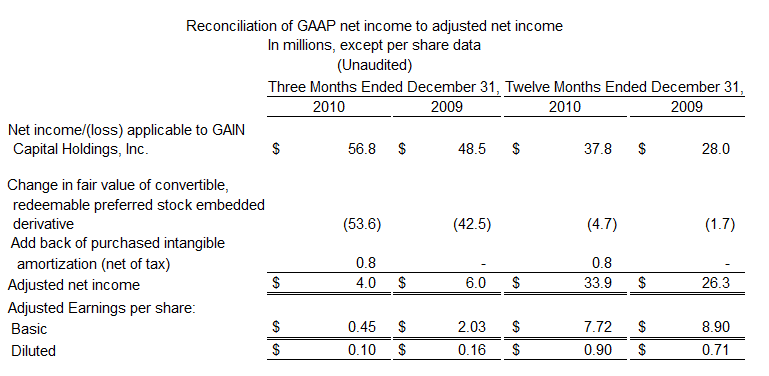

Reconciliation of Net Income to Adjusted Net Income:

Gain Capital's Convertible, Redeemable Preferred Stock Series A, Series B, Series C, Series D, and Series E contained a redemption feature which allowed the holders of our preferred stock at any time on or after March 31, 2011 to require us to repurchase such securities. We had determined that this redemption feature effectively provided such holders with an embedded option derivative meeting the definition of an "embedded derivative" pursuant to FASB ASC 815, Derivatives and Hedging. Consequently, the embedded derivative was required to be bifurcated and accounted for separately. This redemption feature and related accounting treatment is no longer required to be recognized following conversion of our preferred stock in connection with our IPO. Historically, in accordance with FASB ASC 815, we adjusted the carrying value of the embedded derivative to the fair value of our Company at each reporting date, based upon the Black-Scholes options pricing model, and reported the preferred stock embedded derivative liability on the Consolidated Statements of Financial Condition with changes in fair value recorded in our Consolidated Statements of Operations and Comprehensive Income. Historically, this impacted our net income, but did not affect our cash flow generation or operating performance. This accounting treatment caused our net income to fluctuate, but in our view was not indicative of our historical or expected future operating performance.

Adjusted net income is a non-GAAP financial measure and, for periods prior to 2011, represented our net income/(loss) excluding (i) the change in fair value of the embedded derivative in our preferred stock and (ii) the after-tax impact of purchased intangible amortization. As noted above, the embedded derivative in our preferred stock was extinguished at the time of our IPO. Accordingly, beginning in 2011, we will no longer include an adjustment for changes in fair value of the embedded derivative and adjusted net income will represent our net income excluding only the after-tax impact of purchased intangible amortization. This non-GAAP financial measure has certain limitations, including that it does not have a standardized meaning and, therefore, our definition may be different from similar non-GAAP financial measures used by other companies and/or analysts. Therefore, it may be more difficult to compare our financial performance to that of other companies.

Forward Looking Statement:

In addition to historical information, this earnings release contains "forward-looking" statements that reflect management's expectations for the future. A variety of important factors could cause results to differ materially from such statements. These factors are noted throughout GAIN Capital's registration statement on Form S-1, as amended, as declared effective by the Securities and Exchange Commission on December 14, 2010, and include, but are not limited to, the actions of both current and potential new competitors, fluctuations in market trading volumes, financial market volatility, evolving industry regulations, errors or malfunctions in our systems or technology, rapid changes in technology, effects of inflation, customer trading patterns, the success of our products and service offerings, our ability to continue to innovate and meet the demands of our customers for new or enhanced products, our ability to successfully integrate companies we have acquired, changes in tax policy or accounting rules, fluctuations in foreign exchange rates, adverse changes or volatility in interest rates, as well as general economic, business, credit and financial market conditions, internationally or nationally. The forward-looking statements included herein represent GAIN Capital's views as of the date of this release. GAIN Capital undertakes no obligation to revise or update publicly any forward-looking statement for any reason unless required by law.

(1) Adjusted net income is a non-GAAP financial measure. For a reconciliation of adjusted net income to net income, a financial measure calculated in accordance with GAAP, please see "Reconciliation of Net Income to Adjusted Net Income" below.

(2) For definitions of the operating metrics discussed in this earnings release, see the appendix to the presentation entitled "4th Quarter and Full Year 2010 Financial and Operating Results" filed as an exhibit to our Form 8-K on February 15, 2011.