GAIN Capital (NYSE: GCAP) has reported its trading metrics for the month ending March 2016, which saw a marginal decline across its trading volumes given the observance of the Easter holidays in Europe and the US, according to a GAIN statement.

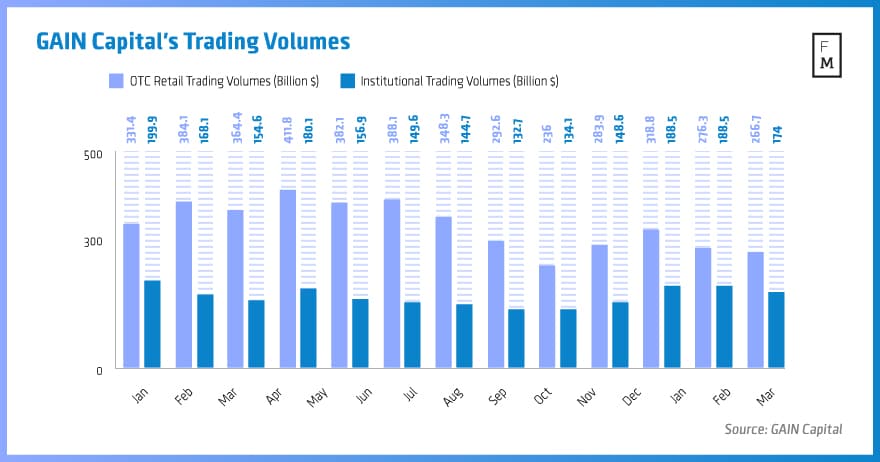

In March 2016, GAIN’s retail over-the-counter (OTC) average daily volume (ADV) came in at only $11.6 billion, retreating -12.1% MoM from $13.2 billion in February 2016. Moreover, total retail OTC volumes were disclosed at $266.7 billion in March 2016, down -3.5% MoM from $276.3 billion in February 2016.

While the ADV metrics declined materially, the nominal figures for the month are only marginally lower due to impact from thin volumes traded around the Easter holidays in Europe and the U.S. Across a yearly timeframe however, March 2015 showed a slightly less optimistic picture, incurring a YoY decline of -19.5% YoY growth from March 2016.

By extension, GAIN’s active retail OTC accounts were numbered at 136,559 in March 2016, having fallen by a factor of -4.9% MoM from 143,673 accounts in February 2016. GAIN also saw average daily contracts in its futures business standing at 35,561 for March 2016, down -3.9% MoM from 36,993 in February 2016. This downtrend was pared across its futures contracts however, which rose to 782,352 in March 2016, up 5.7% MoM from 739,859 contracts in February 2016.

Institutional Business Takes Step Back in March

In terms of its institutional metrics, GAIN’s ECN volume yielded $169.1 billion in March 2016, falling marginally by -2.8% MoM from $174.0 billion set in February 2016 – this figure was exacerbated by YoY decline of -19.5% YoY from March 2015.

In addition, the average daily ECN volume at GAIN came in at only $7.4 billion during March 2016, losing -10.8% MoM from $8.3 billion in February 2016, as well as orchestrating a decline of -19.1% YoY from March 2015. Lastly, GAIN’s Swap dealer ADV also was also reported at $2.8 billion in March 2016, falling -6.7% MoM from $3.0 billion in February 2016.