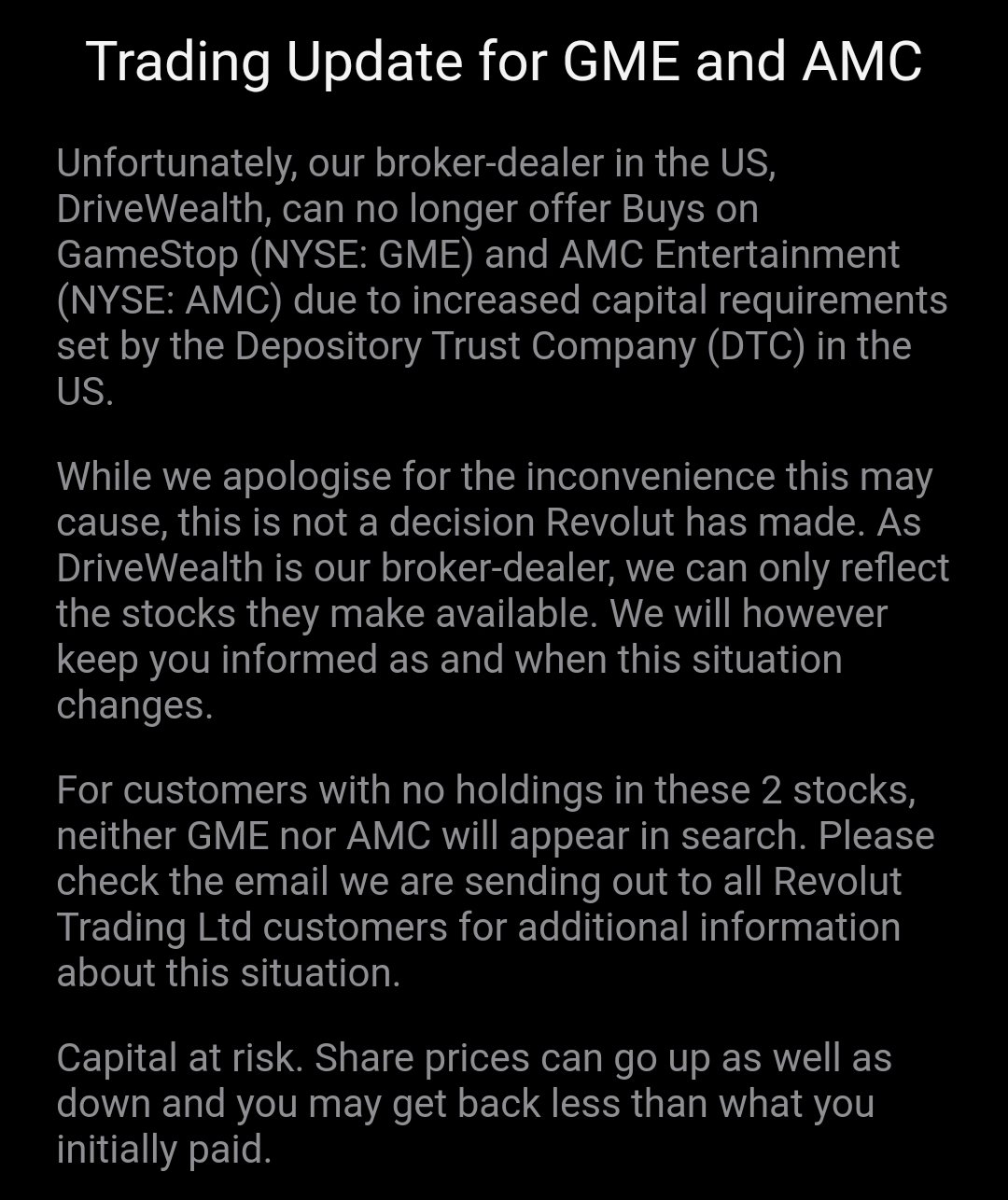

British financial technology startup, Revolut stopped users from investing any further in Texas-based video game retailer GameStop and movie theatre chain AMC. The challenger app attributed the move to new restrictions imposed by their Technology Provider , the US broker-dealer, DriveWealth, LLC.

New Jersey-based DriveWealth is a major partner to many retail trading apps and challenger banks across the globe, including Revolut, MoneyLion and Unifimoney, among others. The firm helps these platforms navigate the complexities of the brokerage business and provides them with popular investment products, such as no-commission trades and fractional shares.

However, it is not clear if DriveWealth has also banned Nokia, Blackberry and other stocks that benefited from an extraordinary rise in their value, spurred by social media users on Reddit in what began as a move against hedge fund managers.

Almost all major retail apps have placed restrictions on trading in these shares, which sparked allegations involving conspiracy theories, political intervention and that the hedge funds influenced trading platforms to stop the rout.

GameStop started January trading at around $20 per share and is now sitting at around $85 per share. It traded as high as $469 last week. The meteoric rise in the share price of the game retailer forced Wall Street institutions and other short betters to buy back the stocks at a higher price, effectively sitting on billions of dollars in losses.

But, with more trading platforms banning traders from buying these stocks, Reddit users who congregated on WallStreetBets to buy into the stock are now losing out too.

The US Securities and Exchange Commission said last week it is probing recent dramatic price run-ups in heavily shorted stocks, promoted by retail investors’ groups on Reddit’s boards.

The SEC is parsing the activity to uncover market instability and see if there is deliberate manipulation or fraudulent intent more broadly on stock markets.

Additionally, the agency is investigating restrictions introduced by stock apps and online platforms, which banned retail investors from buying shares in red-hot GameStop and several other troubled companies.