Global Brokerage Inc, the new name for the public company that accommodates FXCM’s assets outside of the US, has reported its financial results for the fourth quarter of 2016. The firm’s bottom line during the period increased when compared to the previous year, as a result of higher Volatility in the aftermath of the election of President Trump in November.

The company reports that for the fourth quarter of 2016 that ended on December 31st, trading revenues from continuing operations amounted to $79.5 million. The figure is materially higher than the $65.4 million reported in Q4 2015.

[gptAdvertisement]

Net income from continuing operations totaled $10.7 million, a number that includes a $6.4 million gain on derivative liabilities related to the post-SNB bailout agreement with Leucadia National. The net loss attributable to Global Brokerage from continuing operations totaled $85.7 million, again after a $99.9 million loss on the aforementioned derivative liabilities.

For the twelve months that ended on December 31st, 2016, US GAAP trading revenues amounted to $276.0 million, a figure that is higher by 10 percent year-on-year.

Discontinued Operations and US Business

Global Brokerage’s trading revenues from discontinued operations in the US for the fourth quarter totaled $8.5 million, compared to $11.3 million for the quarter that ended on December 31st, 2015.

The net loss attributable to Global Brokerage from discontinued operations was $11.1 million, compared to $19.3 million in Q4 2015. For the full year revenues were $31.1 million, compared to $71.5 million in 2015.

The net loss from the discontinued operations was $26.0 million, compared to $40.3 million in the previous year.

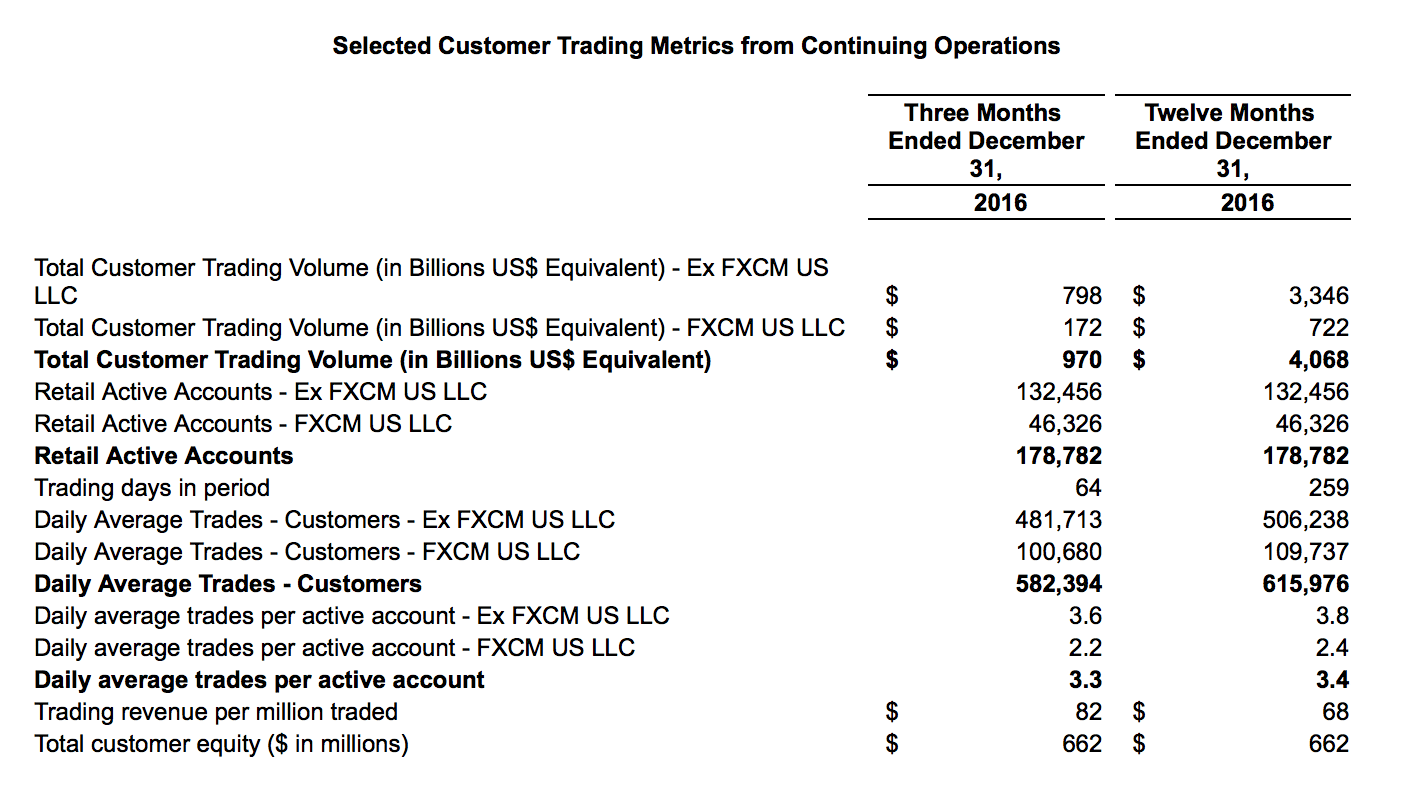

Client trading metrics including and excluding US operations. Source: Global Brokerage Inc

During the final quarter of 2016 FXCM US trading volumes totaled $172 billion, for the full year, the figure was $722 billion. Average daily volumes from the US business totaled 2.2 billion per day in the final quarter of last year and 2.4 billion for the full year. The number of average daily trades in the same segment in Q4 totaled 100,680 and 109,737 for the full year.