GMO Click Holdings Inc (TYO:7177) has announced the latest set of revenues data for the final month of the Japanese fiscal second quarter of 2016, which ended on the 30th of September. The figures which the brokerage revealed are not a big surprise considering the trading volumes figures which the company publishes every month.

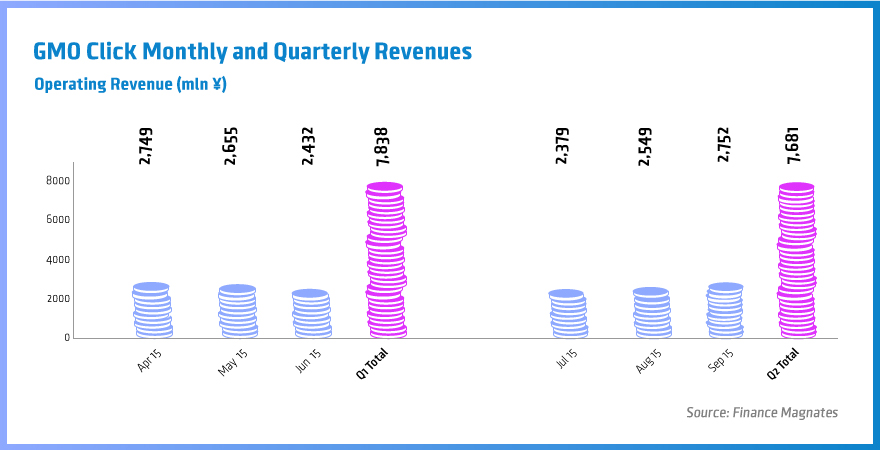

Revenues were reported higher by 8 per cent in September, which totaled ¥2.75 billion rounding up the quarter ending on the 30th on a positive note. Looking at the quarterly figures the numbers seem rather upbeat considering that on a seasonal basis this quarter is usually the slowest for pretty much all brokers, regardless whether they are on the retail or institutional side of business.

Monthly and quarterly revenues of GMO Click

For the second quarter of fiscal 2016, GMO Click Holdings Inc (TYO:7177) reported ¥7.68 billion ($64.1 million) of revenues which is only 2 percent lower than in the first fiscal quarter that ended on June 30th (¥7.83 billion or $65.4 million).

Looking beyond the obvious, we expect the next quarter to maintain the momentum for GMO Click Holdings Inc (TYO:7177) into the next calendar year.

Share prices of the company have been trending lower for the most part of the summer after a record dividend disbursement in the month of May. Looking at the performance metrics, there hasn’t been a material reason for this move which is directly related to GMO Click Holdings Inc (TYO:7177) itself.

The company’s share performance has been suffering due to the broadly declining confidence in the Japanese stock market as the effects of the Quantitative and Qualitative Easing (QQE) conducted by the Bank of Japan (BoJ) have been subsiding.

Since peaking out in May, the broad index Nikkei 225 has lost almost 19 percent, albeit since October started the index and the shares of GMO Click have been rallying. Shares of the company are still trading at a discount when compared to the start of the year - down by almost 12 per cent.