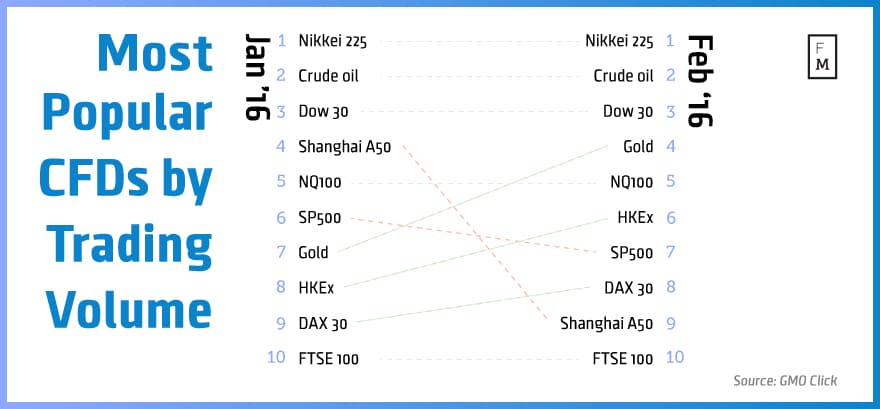

The Japan-based online brokerage GMO Click announced today its final February trading volumes rankings for contract-for-differences (CFDs). Since the start of the list in December 2014, Japanese stock market index Nikkei 225 continues to be an uninterrupted leader 15 months in a row.

Compared to January 2016, GMO click also observed changes in the second and the third position. Due to increased Volatility , crude oil still enjoys great investors’ interest, while the US DOW 30 index has been traded in anticipation of Wednesday’s interest rates decision.

On a month-over-month (MoM) basis, gold spot volumes jumped strongly – mainly due to the widening trend of negative rates monetary policy in Japan and Europe. Traders are looking for a market safe haven, which gold ore can become to some extent.

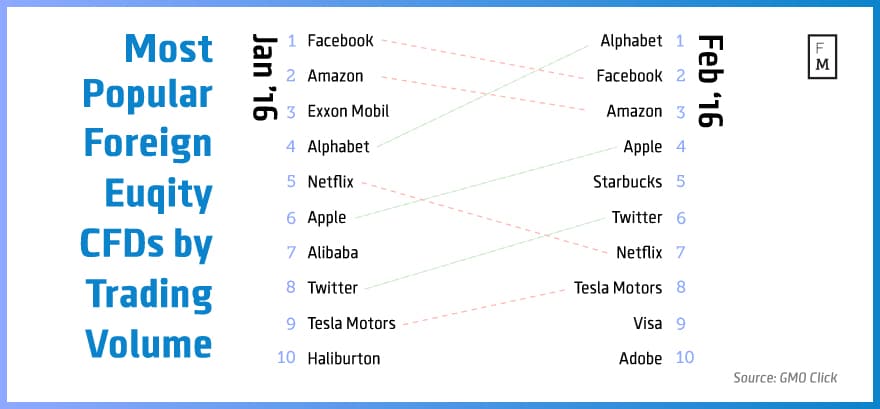

In the case of foreign equity CFDs the situation was much more volatile than in the overall trading volume rankings. In February, Alphabet (formerly Google) jumped to first place - rebounding from fourth position a month before. This was all thanks to record quarterly highs, both in terms of sales, profits and market capitalization.

The strongest MoM growth has been seen with Starbucks CFD trading. From 21st position in January, the popular coffee chain gained broadly and closed in February in 5th place. In the case of foreign equity CFDs however, the trading volumes depend strongly on the financial reports issued by the respective companies.

Increased market volatility clearly supports one of the largest retail brokerage's total trading volume increase. As reported by Finance Magnates, in February GMO Click’s volumes reached $1.45 trillion, ranking 23.2% higher than in January 2015 ($1.18 trillion).

In addition, it is worth recalling that GMO Click extended recently its CFDs offering adding Euro Stoxx 50 and natural gas contracts. The assets are becoming more attractive among Japanese traders, but their trading volumes are still way lower than in the case of the above mentioned, most popular instruments.