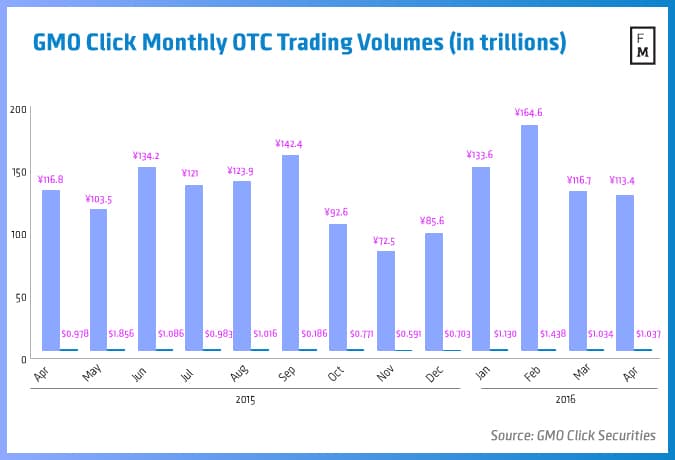

GMO Click Securities has released April trading metrics today, revealing that volumes for its OTC and exchange-traded FX business totaled ¥113.4 trillion ($1.033 trillion), down 2.8% from ¥116.7 trillion ($1.037 trillion) reported in March 2016, adding to March's downtrend.

Last month GMO Click Securities released its preliminary Q1 financials which had shown an upbeat performance. Finance Magnates had written about GMO Click's January results which had slingshotted higher, as well as about February's totals when volumes spiked towards a record high, and then the March pullback when volumes dipped and helped wrapped-up its Q1 totals.

Shares of GMO Click Securities traded around 740.00 JPY per share, and were up by almost 1% after the close of today's trading on the Tokyo Stock Exchange 's JASDAQ market. The company's share price performance has been about flat since the start of 2016, with the value of the stock trading about 2.25 per cent lower than at the beginning of the year.

The trading volumes numbers of GMO Click are highly correlated to the Volatility of the Japanese yen. According to a Reuters poll released last week, analysts from major banks are expecting the yen to weaken about 8 per cent within the next 12 months to 115 against the U.S dollar. The number is lower than last month's poll, when the expectations were centered around 118 Japanese yen. A chart below using data volume data compiled over the last twelve months including April can be seen including the USD equivalent (represented in the trillions) alongside the Japanese Yen (JPY) totals for each month. It's noteworthy to point out that GMO Click surpassed the $1 trillion mark in seven of the last twelve months as seen in the chart below.

Source: GMO Click