Ahead of the upcoming US presidential elections scheduled for November 8, 2016, many brokerage firms are raising their margin requirements, while others warn to do, amid fears that voting on the next leader of the ‘free world’ could trigger market mayhem.

Don’t miss your last chance to sign up for the FM London Summit. Register here!

The Brexit referendum in June proved that brokers are able to be ready for increased volatility, particularly with the UK and US votes not being events that will unfold within a few minutes, like the SNB Black Swan . The election's possible outcomes have been brewing for well over a year and the market impact may last just as long. But in the short term, volatility will kick into high gear as we approach the 58th U.S. presidential election.

In short, there is not an elephant in the room.

This article is designed to be an easy-to-understand guide that lists the margin and leverage changes across most of the key players in the trading industry.

You can find below a list of brokers that have updated their trading requirements or launched related initiatives, and more will be added as news comes in.

easyMarkets

CySEC-regulated forex broker easyMarkets has decided to go against the trend of limiting leverage being offered to trading clients. The broker has put out a note that it plans to maintain its 200:1 leverage plus offering free guaranteed stop loss and fixed spreads while negative balance protection will remain assured.

OANDA

Maximum leverage available on GBP pairs will be temporary lowered to 20:1 on Monday November 7th at 5:00 am EST.

- EUR/GBP: from 2% (50:1) to 5% (20:1)

- GBP/CAD: from 2% (50:1) to 5% (20:1)

- GBP/NZD: from 2% (50:1) to 5% (20:1)

- GBP/USD: from 2% (50:1) to 5% (20:1)

- GBP/JPY: from 3% (33:1) to 5% (20:1)

- GBP/AUD: from 3% (33:1) to 5% (20:1)

XM.COM

From 8:00 am (GMT+2) on Tuesday, 8th November 2016, the margin required for all positions will be temporarily increased for all instruments to:

- 1% (100:1 leverage) for all currency pairs, gold and silver and

- 4% (25:1 leverage) for all CFDs on equity indices and commodities.

This temporary measure will be waived and margin requirements will revert back to normal by Wednesday 9th November 2016.

ACM Group PLC (Alpha)

The London based FX and CFD institutional only, announced that it will be increasing margin requirements on select FX and CFD instruments. The new margin requirements will come into effect on the close of business Friday, November 4 and will remain in effect until at least Wednesday, November 9 at 22:00 GMT.

HotForex

The broker has informed its clients that it reserves the right to make a number of changes to the trading conditions without prior notice, which may include but is not limited to, increased margin requirements, Close only mode and volume restrictions.

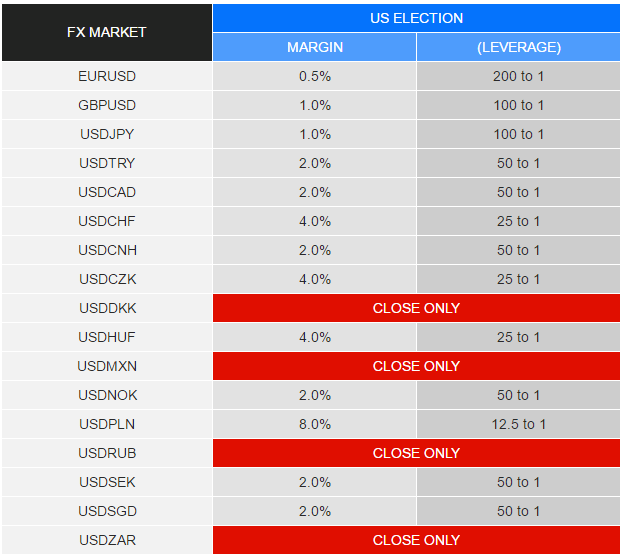

FXCM

FXCM has announced that it will temporarily increase margin requirements from 1 percent to 2 percent for selected currency pairs with effect from Friday 4th November from 5.00pm EDT (21.00 GMT).

The company will reduce margin requirements back to pre-election levels as soon as market conditions permit. The thirteen currency pairs that will see higher margins of 2 percent include euro/USD, USD/JPY, GBP/USD and USD/CAD.

The USD/Mexican peso's margin requirements will rise from 4.6 percent to 10 percent, the USD/Swedish krona margin will increase from 3 percent to 6 percent and the USD/Norwegian krona will move from 1.5 percent to 3 percent.

Z.com

The UK-arm of the leading Japanese broker GMO Click informed its clients that from the opening of trading on November 7th until the close on November 11th, the margin ratio of all Forex and Spot Metals products be adjusted temporarily to 2% (1:50), and all Stock Indices and Energies and Soft Commodities products will be adjusted temporarily to 4% (1:25).

GKFX

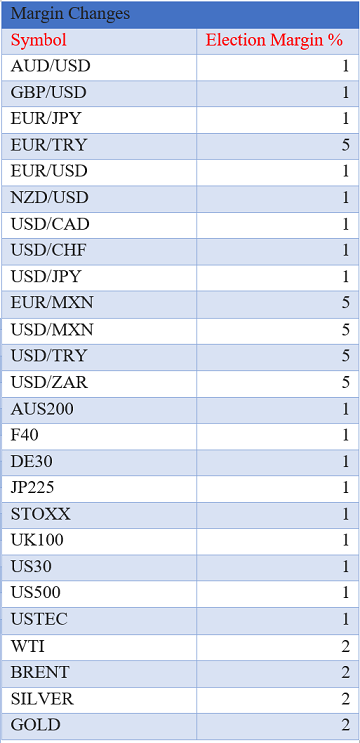

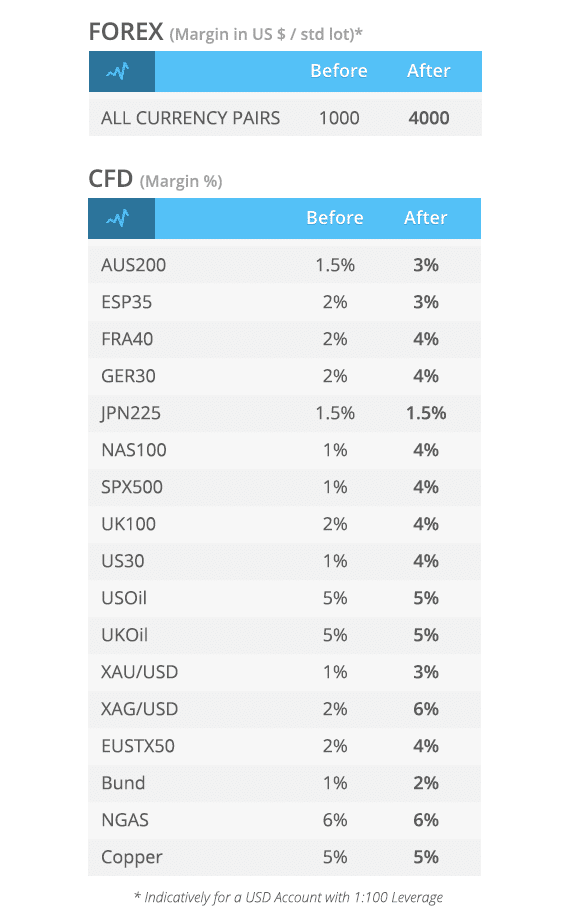

Effective Friday close, November 4th, margin requirements will be increasing on all instruments, as outlined in the table below.

Hantec Markets

Effective Sunday 6th November 2016, the Margin Requirement on ALL FX PAIRS will treble, whilst the margin requirement for all Indices and Commodities will double.

Capital Index

At 2pm (UK time) on Thursday 3rd November, the margin rates on all products will be raised to 2% with the exception of the below:

China50 5%

US Coffee 3%

Natural Gas 3%

Palladium 3%

There will be a further increase at 2pm (UK time) on Monday 7th November to 4% for all products with the exception of the below:

China50 5%

Dukascopy

Leverage on all CFD Indexes will be reduced to 1:10 on Monday 7 November, 14:00 GMT and will remain in place until further notice.

On Sunday 6 November, 22:00 GMT, the leverage on USD/MXN will be lowered to 1:10. On Tuesday 8 November at 10:00 GMT, the trading leverage on all currency pairs will be decreased till the level of the over-the-weekend leverage conditions on all trading accounts that have the balance over 30,000 USD or equivalent at the end of previous trading day (account balance on 7 November).

All other accounts (under USD 30,000 or equivalent) that experience a significant increase of equity due to profit or deposit on Tuesday 8 November will be treated on a case-by-case basis.

The leverage reduction is planned to be cancelled on Wednesday 9 November, 05:00 GMT. However, Dukascopy reserves the right to prolong it if found necessary.

AAAFx

The company will temporarily increase the margin requirements in all of the following instruments before market opening on 6th November 2016.

Alpari

From 7th to 11th November, 2016, the following margin requirements will take place:

The maximum floating leverage will be set to; 1:100 for standard.mt4 and pamm.standard.mt4 accounts; 1:50 for ecn.mt4, pamm.ecn.mt4, pro.ecn.mt4, pamm.pro.ecn.mt4, ecn.mt5, and pamm.ecn.mt5 accounts.

For nano.mt4 accounts - the maximum order size will be 10 lots and the maximum leverage will be 1:100. For standard.mt4 and nano.mt4 accounts – the Limit & Stop Levels will be stablished equal to two spreads.

In case of high volatility and low Liquidity , the broker could set instruments to Close Only mode. For binary options, between 7th and 8th November, 2016, the strategies "Touch" and "Spread" may be unavailable.

Vantage FX

Effective Thursday open, November 3rd, margin requirements will be set to 3% for Forex pairs and 4% for Commodities and Indices. Under some liquidity circumstances the broker may move instruments to close only.

AxiTrader

Effective market close on the Thursday, 3rd November, the company will be increasing the margin requirements for all products. It will adjust the margin requirement, as a multiple of the client’s current margin requirement. For example, if your current leverage is 100:1 as an example, your new effective leverage would be:

| Margin Multiple | Effective Leverage |

| 2 | 50:1 |

| 3 | 33:1 |

| 5 | 20:1 |

OctaFX

From October 31 till November 14, leverage for US30, NAS100, SPX500 indices will be lowered from 1:50 to 1:10 on Metatrader 5 trading platform.

Saxo Bank

Margin on most major FX pairs up to 2%-3% with RUB and MXN going to 10% and 15% respectively, while the minimum margin requirement on CFD Indices will be 4% based on market volatility and liquidity leading up to and through the election.

FXOpen

The company may increase margin requirements up to 5 times their normal level starting from November 3rd without prior notice.

FOREX.com also warned temporary changes to the clients’ accounts which may include, but are not limited to, updates to margin requirements in the days leading up to and after the vote.

ETX Capital has launched a new US Election News Sentiment Index to help better predict what the final electoral result will be on November 8, 2016.

Swissquote Bank launches a new Fintech solution to allow clients invest in a selection of stocks or currency portfolios which are most likely to be impacted by a victory from either candidate.

CFI Markets has announced that volatility in the markets is expected to spike during the voting and after announcing the next US President and has decided to raise its margin requirements accordingly. The new margin requirements are listed on the company's website and will apply from Friday 4th November 2016, at 7pm CET until further notice. CFI Markets will further raise the margins if deemed necessary.