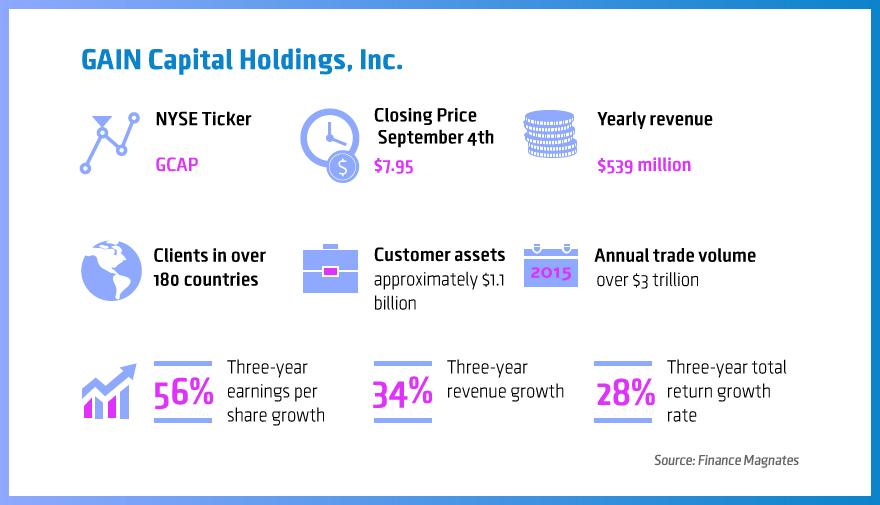

Fortune magazine has added GAIN Capital (NYSE: GCAP) to its 100 Fastest Growing Companies list for the first time. The brokerage is ranked at number 44 on the 2015 list, the 19th annual such ranking of public companies.

To qualify for a ranking, a company must be trading on a major U.S. Stock Exchange , have a minimum market capitalization of $250 million and a stock price of at least $5 on June 30, 2015, and have been trading continuously since June 30, 2012.

Companies that meet these criteria are ranked by revenue growth rate, earnings per share (EPS) growth rate, and three-year annualized total return for the period ending June 30, 2015. The overall rank is based on the sum of these three ranks. GAIN was represented well across these categories, with a three-year EPS growth rate of 56%, revenue growth of 34% and total return growth rate of 28%.

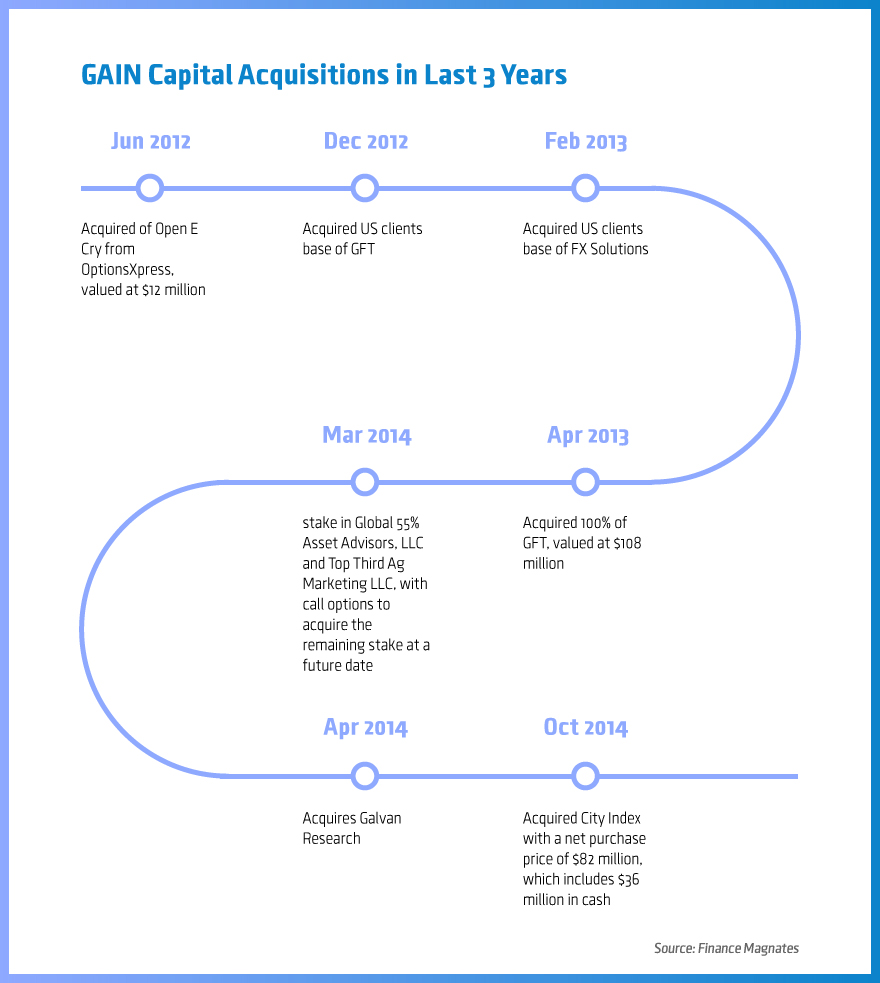

One of the main drivers of growth for the company over this period was its focus on acquiring businesses that would complement its revenue streams. Among the more interesting deals in the last three years was the acquisition of GFT. In 2013 GAIN Capital paid $40 million in cash for GFT, in addition to approximately 3.6 million shares of GAIN Capital stock and a $33 million 5-year seller note.

Earlier this year GAIN completed its latest acquisition, the 2014 purchase of the UK-based City Index, creating a combined balance sheet with a pro forma revenue of $539 million. Following this acquisition, GAIN has retail and institutional customers in over 180 countries with assets totaling approximately $1.1 billion, and it handles in excess of $3 trillion in trade volume annually.

"GAIN's strategy over the past few years has been to achieve the scale necessary to allow us to establish a clear leadership position and more successfully compete in our increasingly competitive global industry," commented Glenn Stevens, CEO of GAIN Capital.

"This goal has driven both our organic growth efforts and our M&A strategy. Our acquisitions of City Index, GFT, Open eCry, GAA/Daniels Trading and Galvan Research in the past three years, along with organic growth across our retail, institutional and futures segments, have all contributed to increasing the scale in our business and growing our financial results. We are pleased that our success is being recognized."