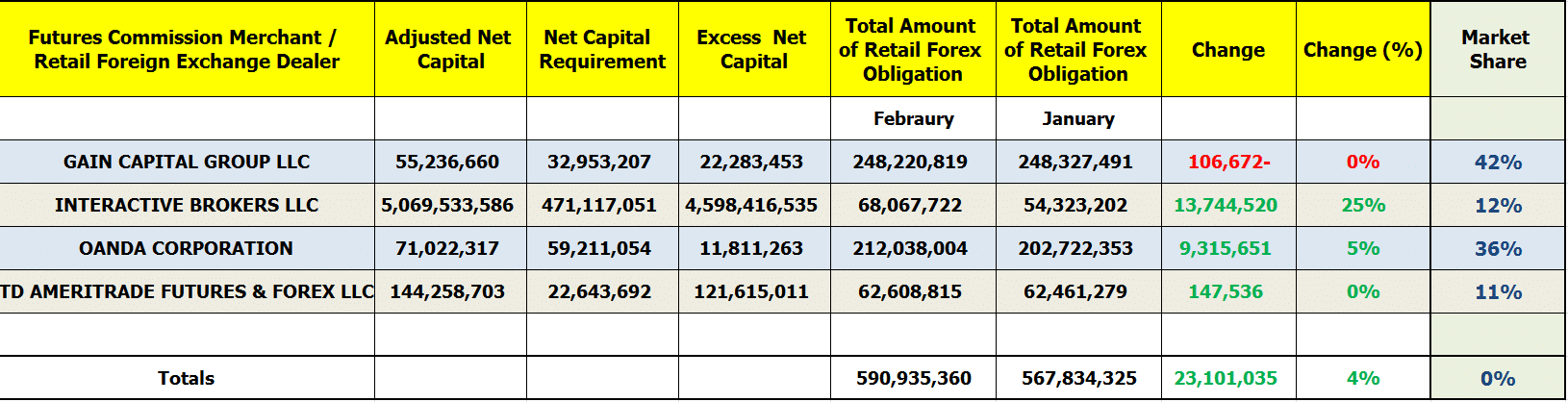

Retail FX deposits at US brokerages, including FCMs that are registered as Retail Foreign Exchange Dealers (RFEDs) and broker dealers, rose in February by over $23 million, data from the Commodity Futures Trading Commission (CFTC) showed today.

Specifically, the FX funds held at the US-based brokers came in at $590 million in February 2019, up four percent compared with $568 million reported in the prior month.

Except for GAIN Capital, which reported a minor decline in its clients’ assets, three of the four FX firms listed notched increases in Retail Forex Obligations including Interactive Brokers, OANDA Corporation and TD AMERITRADE.

After consecutive drops in its market share, the best performer for the month was Interactive Brokers which saw an overall rise of $13.7 million to $68 million, compared to only $54 million at the end of January, or an increase by 25 percent month-over-month.

Interactive Brokers overtakes

Meanwhile, GAIN Capital’s client assets fell slightly by $106,000, to $248.2 million, almost unchanged over a monthly basis. The largest FX broker in the United States, however, remained the leader in terms of market share, commanding a 42 percent share.

Relative to January 2019, it appears that Interactive Brokers has moved past TD Ameritrade in the rankings as the company managed to score a rebound, paring all losses incurred over the past few months. The largest U.S. electronic brokerage firm, as measured by DARTs, overtook TD Ameritrade as the US third largest holder of retail FX funds —something that happens a number of times over recent months as both companies duke it out for dominance.

OANDA also solidified its stance as the second largest in the US with 36 percent.

The chart listed below outlines the full list of all FCMs that held Retail Forex Obligations in the month ending on February 28, 2019 – for purposes of comparison, the figures have been included against their January 2019 counterparts to illustrate disparities.

cftc data